I am starting this thread to explore the Carry Trade Potential with the Pair NZDCHF.

NZDCHF is currently the most profitable carry trade of the 8 major currencies typically traded. Using a rough example in an account of 400:1 leverage, and a $50,000 USD investment, a trader could stand to make substantial profits, using only 25% of the available leverage:

50,000 x 100:1 = 5 Million

NZD central bank rate = 1.75%

CHF central bank rate = -.75%

Combined Carry Trade Interest = 2.50%

5,000,000 x 2.5% = $125,000 Interest Annually or $10,400 monthly.

Amount gained per pip change in exchange rate = 5 Million/10,000 = $500/pip

If the Pair increased by 1 cent over a month, the trader would profit 100 pips x $500 = $50,000 plus $10,400 in interest earned.

At that point, trader takes his initial investment out of the account and continues trading with only his profits, which would be $60,400. resulting in a nice interest income of 604/500 x $10,400 = $12,500 per month.

AT THIS POINT THERE WOULD BE ZERO RISK.

And it would only rise from there, with trader doing no trades except the initial purchase of 50 lots at the broker.

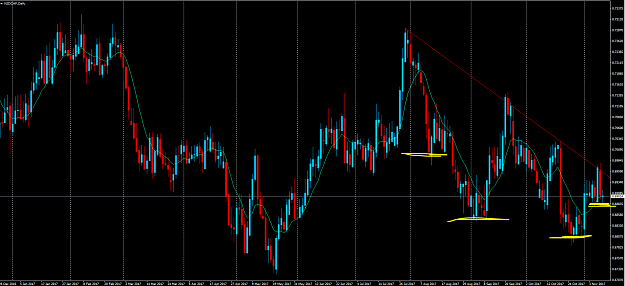

All you have to ascertain is low risk in purchase price level that the Pair won't fall any further or by much. Here is the current Daily Chart:

NZDCHF is currently the most profitable carry trade of the 8 major currencies typically traded. Using a rough example in an account of 400:1 leverage, and a $50,000 USD investment, a trader could stand to make substantial profits, using only 25% of the available leverage:

50,000 x 100:1 = 5 Million

NZD central bank rate = 1.75%

CHF central bank rate = -.75%

Combined Carry Trade Interest = 2.50%

5,000,000 x 2.5% = $125,000 Interest Annually or $10,400 monthly.

Amount gained per pip change in exchange rate = 5 Million/10,000 = $500/pip

If the Pair increased by 1 cent over a month, the trader would profit 100 pips x $500 = $50,000 plus $10,400 in interest earned.

At that point, trader takes his initial investment out of the account and continues trading with only his profits, which would be $60,400. resulting in a nice interest income of 604/500 x $10,400 = $12,500 per month.

AT THIS POINT THERE WOULD BE ZERO RISK.

And it would only rise from there, with trader doing no trades except the initial purchase of 50 lots at the broker.

All you have to ascertain is low risk in purchase price level that the Pair won't fall any further or by much. Here is the current Daily Chart:

Let the Market come to you