We're all here to generate pips. Fresh edit 1 March 2019.

This is not my creation. This will likely be my KWAN !!

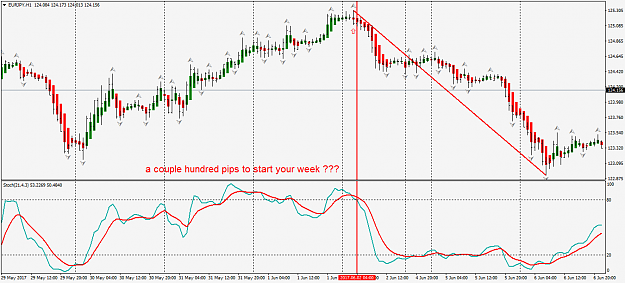

I trade the 1h, 4h, and Daily due to work obligations. This will work on all TF.

I trade many pairs. Beware the spread (it's the cost or running a business). This strategy is designed to catch not only reversals, but trend continuations as well.

Max risk is your quarrel, not mine! (we're all here for max pips) My personal max is 3% daily, 1% on any 1 trade... .5% on regular divergence trades.

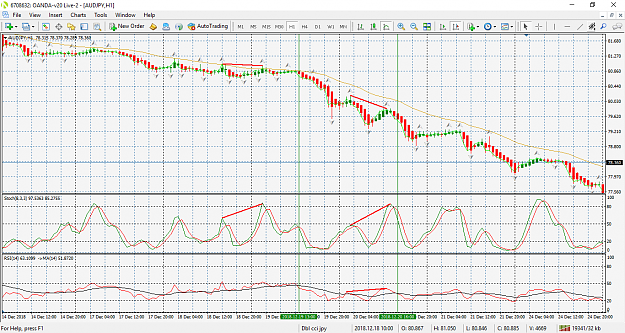

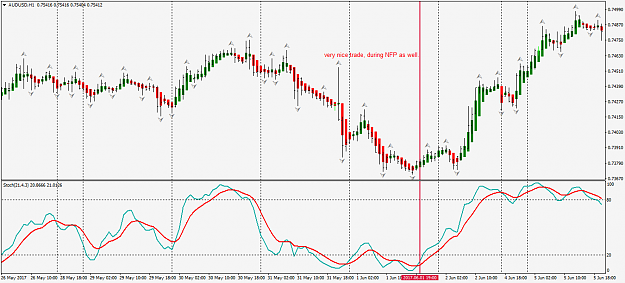

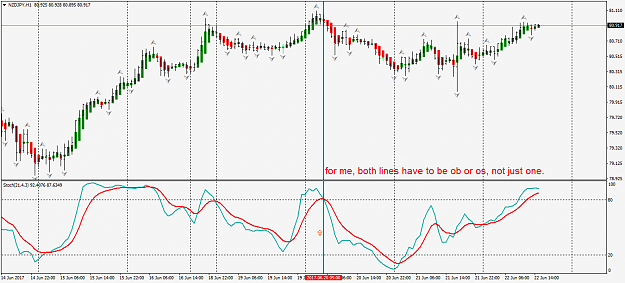

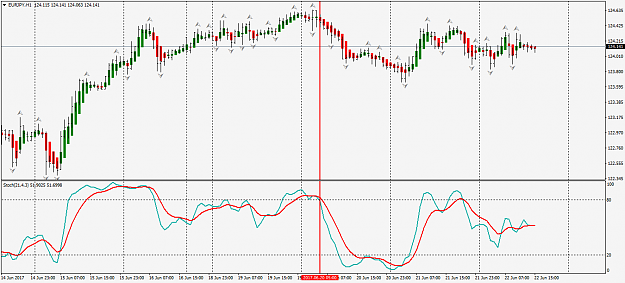

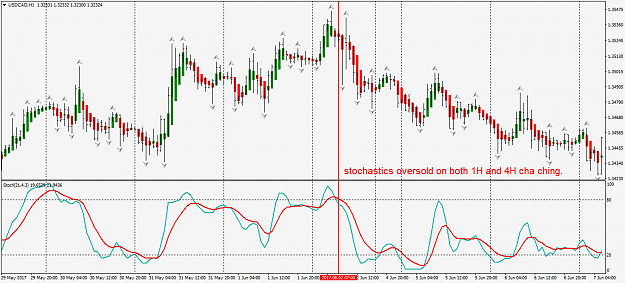

I use Heiken Ashi candles combined with stochastics (settings of 8,3,3), overbought is 80, oversold is 20. (close/close) (exp.). Humans are visual creatures, hence the HA candles. HA are much easier on the eyes. Do not forget when plotting your candles to switch from candlesticks to line charts.

I have recently added a 5 EMA (3 shift) to show trend direction and momentum.

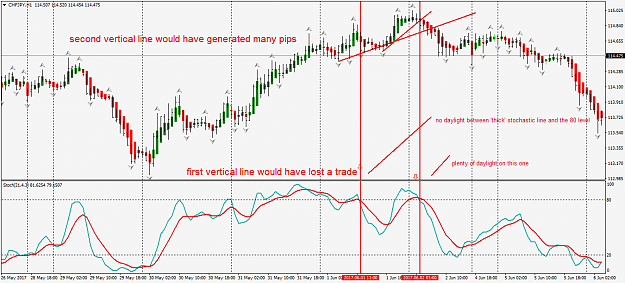

The winners far outweigh the losers.

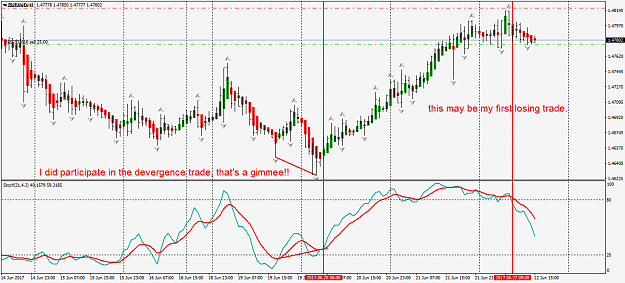

I like the way the TDI reacts to PA. I will consider reversals when courting the 32 and 68 levels. TC are also considered depending upon where the price is within a wave. If I'm trading using the TDI, I wait for a complete cross of thick lines.

My biggest success has been using indicators to spot HD.

This journey began with 'trading made simple' post. It's a very popular thread. I've tried to replace the TDI with a stochastics. In so many of these trades, a simple trend line break could've had most traders making nice pips. Alas, EDIT... my replacement for the TDI indicator is the RSI (14)/14 EMA in the same window. Most of my trades are now HD. Same thing as a TC, or trend continuation trade. I now wait for a complete cross of the stochastic.

I will say if you get good at Hidden Divergence, you will have pips coming out of your ears.

Stochastics 8, 3, 3 for divergence and trend direction.

With a RSI/EMA (14) combined in it's own window.

Please be aware, when the stochastics extend to either 80 or 20, that does not mean the price WILL reverse, it may continue without a reverse.

This post has been edited on 8/13/17

Manage-- one can set a take profit for 1:1, I often use fractals for my trail stops. In addition, a trader can take half of their risk (R) out of the market at 1:1 and let the rest run, trailing the 'runner' with stops at or near fractals (highs and lows).

This will help. This can be used on any TF. I cannot recall nor I have been shown back to back losses. I do not frequent the way low TF.

I have added a price chart with trend lines. The green vertical lines are entries. Very important, the chart shows Hidden Divergence (HD), not a reversal trade.

Always always use a SL. If you're new to trading, head to Babypips and test yourself through each and every year. Study pyramiding and divergences while you're there. Study MTF while you're there. I've done it and most of the traders reading have done it.

I begin with a daily chart, then 4H. When I get bored, it's the 1H. You can trade any TF.

I look for a change in color of the current candle for a reversal. This post has more than enough marked charts to know what I'm looking at and looking for. If you want lots of daytime action in your trading, you may find it in this strategy. For best results, trade 1H and higher.

Rarely do I strive for a 1:1 trade. Rarely do I use a TP. I believe in letting all trades run.

Good questions to begin a checklist include. What is my balance? What max $ amount am I willing to risk today? Have I plotted at least 4 areas of SR? I am ____ pips away from parity. With experience comes incredible decisions that should ultimately lead you to better trades.

Enjoy, Renofaith

This is not my creation. This will likely be my KWAN !!

I trade the 1h, 4h, and Daily due to work obligations. This will work on all TF.

I trade many pairs. Beware the spread (it's the cost or running a business). This strategy is designed to catch not only reversals, but trend continuations as well.

Max risk is your quarrel, not mine! (we're all here for max pips) My personal max is 3% daily, 1% on any 1 trade... .5% on regular divergence trades.

I use Heiken Ashi candles combined with stochastics (settings of 8,3,3), overbought is 80, oversold is 20. (close/close) (exp.). Humans are visual creatures, hence the HA candles. HA are much easier on the eyes. Do not forget when plotting your candles to switch from candlesticks to line charts.

I have recently added a 5 EMA (3 shift) to show trend direction and momentum.

The winners far outweigh the losers.

I like the way the TDI reacts to PA. I will consider reversals when courting the 32 and 68 levels. TC are also considered depending upon where the price is within a wave. If I'm trading using the TDI, I wait for a complete cross of thick lines.

My biggest success has been using indicators to spot HD.

This journey began with 'trading made simple' post. It's a very popular thread. I've tried to replace the TDI with a stochastics. In so many of these trades, a simple trend line break could've had most traders making nice pips. Alas, EDIT... my replacement for the TDI indicator is the RSI (14)/14 EMA in the same window. Most of my trades are now HD. Same thing as a TC, or trend continuation trade. I now wait for a complete cross of the stochastic.

I will say if you get good at Hidden Divergence, you will have pips coming out of your ears.

Stochastics 8, 3, 3 for divergence and trend direction.

With a RSI/EMA (14) combined in it's own window.

Please be aware, when the stochastics extend to either 80 or 20, that does not mean the price WILL reverse, it may continue without a reverse.

This post has been edited on 8/13/17

Manage-- one can set a take profit for 1:1, I often use fractals for my trail stops. In addition, a trader can take half of their risk (R) out of the market at 1:1 and let the rest run, trailing the 'runner' with stops at or near fractals (highs and lows).

This will help. This can be used on any TF. I cannot recall nor I have been shown back to back losses. I do not frequent the way low TF.

I have added a price chart with trend lines. The green vertical lines are entries. Very important, the chart shows Hidden Divergence (HD), not a reversal trade.

Always always use a SL. If you're new to trading, head to Babypips and test yourself through each and every year. Study pyramiding and divergences while you're there. Study MTF while you're there. I've done it and most of the traders reading have done it.

I begin with a daily chart, then 4H. When I get bored, it's the 1H. You can trade any TF.

I look for a change in color of the current candle for a reversal. This post has more than enough marked charts to know what I'm looking at and looking for. If you want lots of daytime action in your trading, you may find it in this strategy. For best results, trade 1H and higher.

Rarely do I strive for a 1:1 trade. Rarely do I use a TP. I believe in letting all trades run.

Good questions to begin a checklist include. What is my balance? What max $ amount am I willing to risk today? Have I plotted at least 4 areas of SR? I am ____ pips away from parity. With experience comes incredible decisions that should ultimately lead you to better trades.

Enjoy, Renofaith