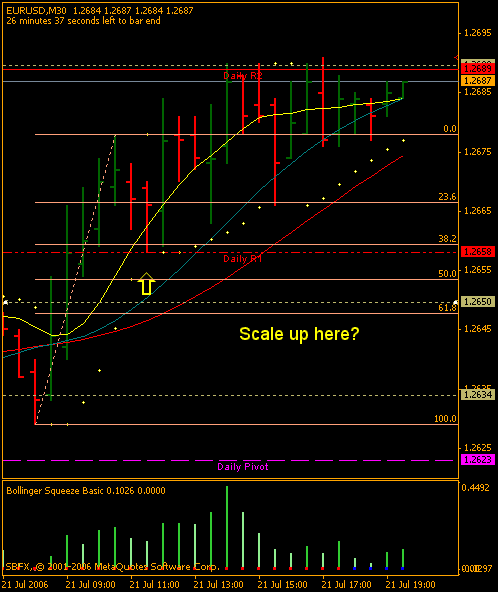

Does any of you increase lot size if have a winning position? Such as:

1) Enter a limit, limit hits, open a new position for larger lot size.

2) Same as "1", but decrease limit amount?

3) Or other?

1) Enter a limit, limit hits, open a new position for larger lot size.

2) Same as "1", but decrease limit amount?

3) Or other?