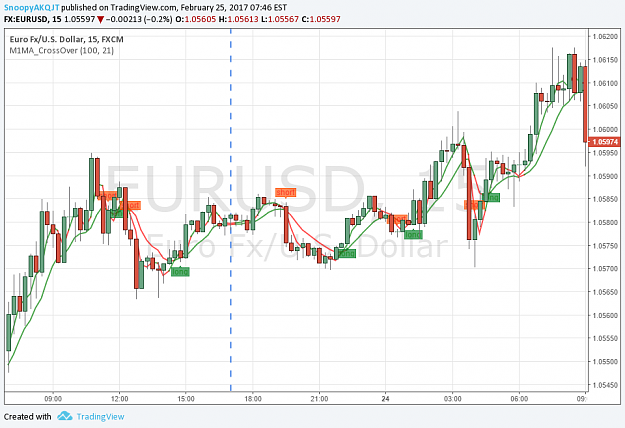

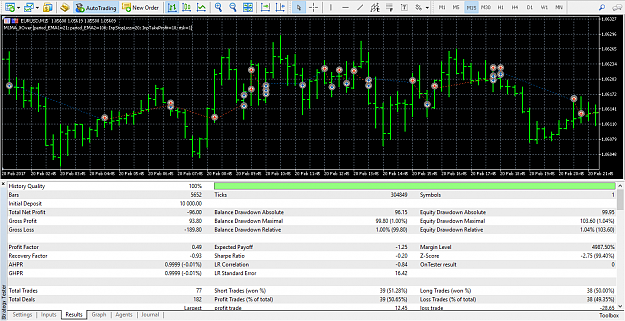

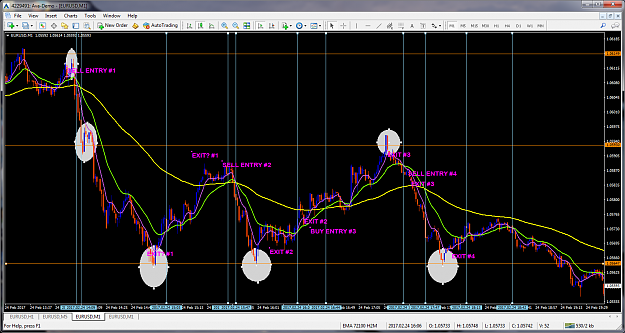

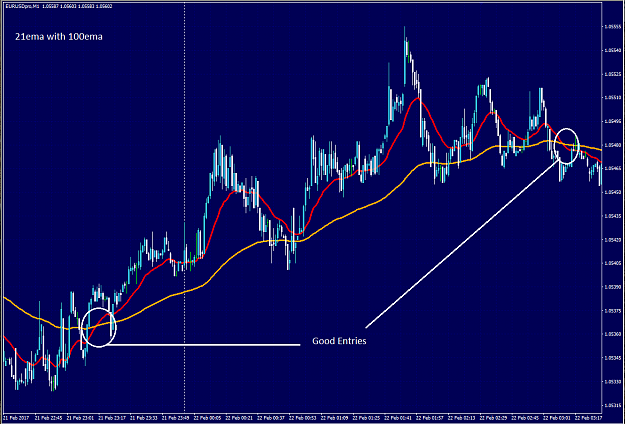

This is a "SEMI Automatic / Manual System" to reduce stress of going in a trade or not....and just two indicators to make it less complicated.

Trust me i have been in situations like most traders trading live account, when you are sitting infront of your computer praying for the market to go in your favour LOL, also when the market goes opposite your heart start beating faster.

I have also been in a situation in a higher time frame in the past where i went negative 50 pips and was hopeful market will come back to me... it never did...went more against me 100 and eventually i had a margin call.

With this little strategy, you do not have to "Guess" or be "hopefull" or "predict"

Just stay in the crosses, be smart collect little pips here and there and make money.

Be stress free. Also, never leave open positions over the weekend.

Also, please understand that i am not a professional .... i am just a small trader like you trying to make it happen. I am sharing this because it works for me. Thanks

Good luck all.

Trust me i have been in situations like most traders trading live account, when you are sitting infront of your computer praying for the market to go in your favour LOL, also when the market goes opposite your heart start beating faster.

I have also been in a situation in a higher time frame in the past where i went negative 50 pips and was hopeful market will come back to me... it never did...went more against me 100 and eventually i had a margin call.

With this little strategy, you do not have to "Guess" or be "hopefull" or "predict"

Just stay in the crosses, be smart collect little pips here and there and make money.

Be stress free. Also, never leave open positions over the weekend.

Also, please understand that i am not a professional .... i am just a small trader like you trying to make it happen. I am sharing this because it works for me. Thanks

Good luck all.

Love Cars & Money !

1