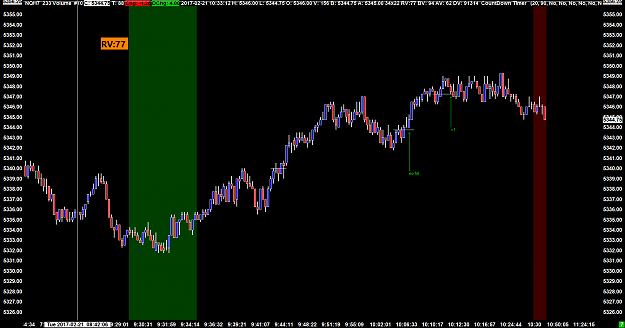

Dislikedfirst candle made low the next candle took out high that's 2 candles the third candle took out the second candles high that's 3 candles the next 2 candles made LLIgnored

Edit: Follow up query please. Based on trading method, we would've put a sell limit order around the encircled area as price pulls back to it. Perhaps I am not seeing something or maybe I have a wrong understanding of how the method is traded?

Thoughts?

Thank you very much!

David