everyone knows "DONT Trade if you bored"

well, i did it anyway and blow away ALOT of $$ in the process.

if you are like me and can't control yourself .. better stop trading

or do this below:

it's basically a way to let you "chase trades"

based on Beauty rather than difficult analytics ... (yes I meant Beauty, because the strategy works best and only on a clear structure)

perfect for quiet markets (personally I make the best results in the Asian session as there are less news and levels are better respected)

look at this screen below and tell me if you would have taken this trade off the 1H chart:

I would not

so the first part of this strategy is to zoom in/out so far until the chart does look "nice"

where "nice"means where you can clearly see the steps a typical trend does "HH-HL-HH" or "LH-LL-LH"

like this (same time as above, just on M3)

Indicators needed: None

Tools Needed: Fibonacci extension tool with the values: 0, -5, 38, 83

find the trend-sequence appearing "CLEARLY"(this is VERY VERY important!!! .. if there is consolidation in the way .. drop it .. wait for next setup.)

Long Setup:

3 things can happen:

Quick example about re-evaluating via larger timeframes: http://www.forexfactory.com/showthre...08#post9301208

well, i did it anyway and blow away ALOT of $$ in the process.

if you are like me and can't control yourself .. better stop trading

or do this below:

it's basically a way to let you "chase trades"

based on Beauty rather than difficult analytics ... (yes I meant Beauty, because the strategy works best and only on a clear structure)

perfect for quiet markets (personally I make the best results in the Asian session as there are less news and levels are better respected)

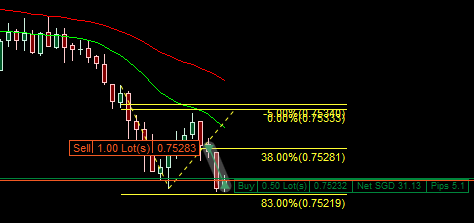

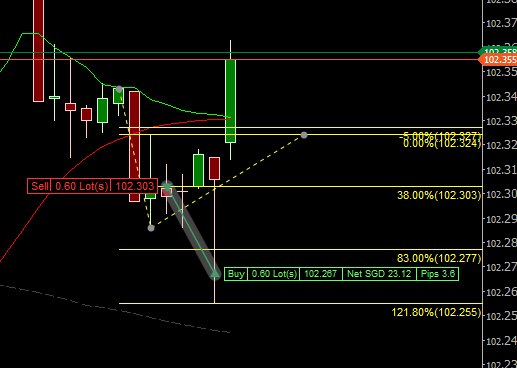

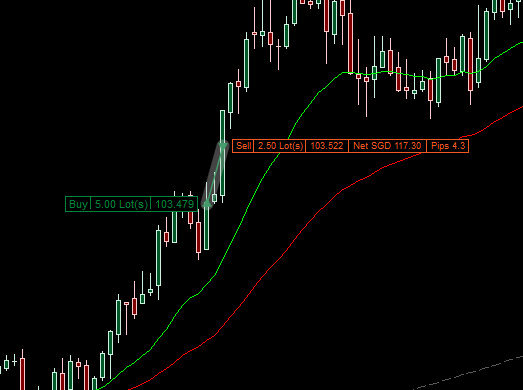

look at this screen below and tell me if you would have taken this trade off the 1H chart:

Attached Image

I would not

so the first part of this strategy is to zoom in/out so far until the chart does look "nice"

where "nice"means where you can clearly see the steps a typical trend does "HH-HL-HH" or "LH-LL-LH"

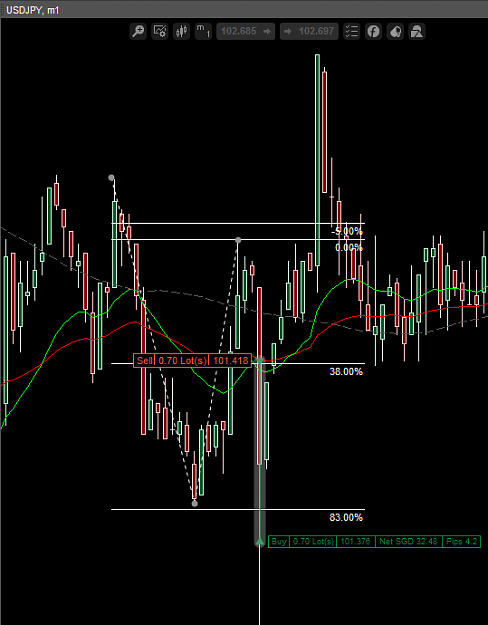

like this (same time as above, just on M3)

Attached Image

Indicators needed: None

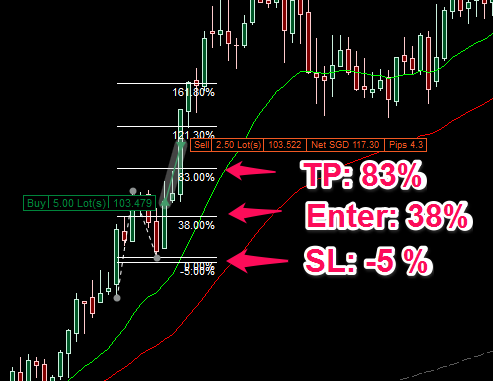

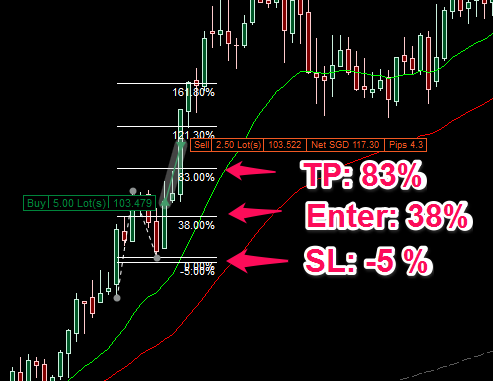

Tools Needed: Fibonacci extension tool with the values: 0, -5, 38, 83

find the trend-sequence appearing "CLEARLY"(this is VERY VERY important!!! .. if there is consolidation in the way .. drop it .. wait for next setup.)

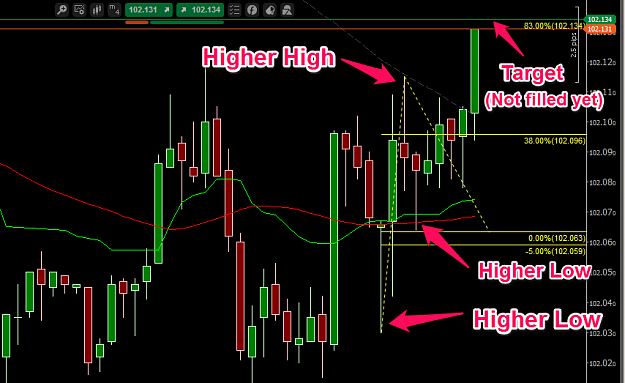

Long Setup:

- draw the first part of the extension from LH to HH while the retracement-candles are still building

- after this you can place a buy stop with SL and TP preset already as the range will not change anymore. this enables you to make proper Money Management.

- then "correct"the Extention line to the currently building HL ONLY Downwards and keep moving the Buy Stop to align with 38% of the Extention.

- once direction change upwards .. wait

Attached Image

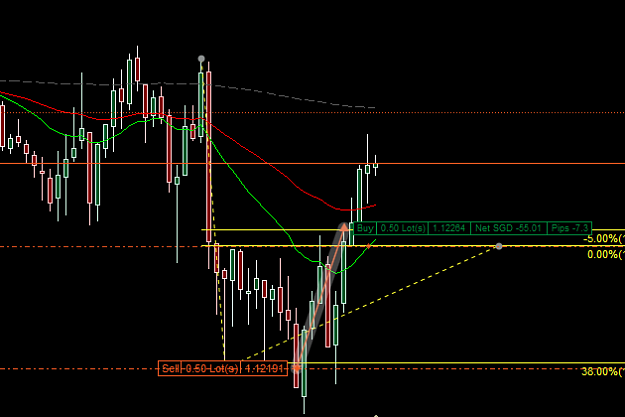

3 things can happen:

- price goes below stop loss -> move the extention to the new Low and -> move pending order to be filled at the new 38% level

- price goes lower than previous low -> Cancel order (trend is no longer valid)

- order get filed -> wait for TP

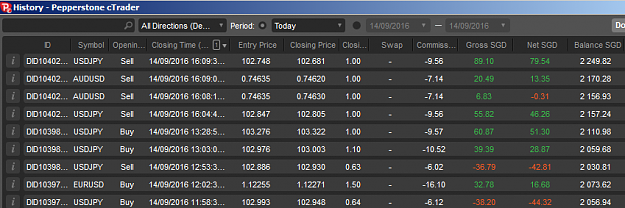

I tested this with 152 trades with a 56% Win Ratio.

let me know what you guys think of that.

quick Video about the re-positioning

Inserted Video

Quick example about re-evaluating via larger timeframes: http://www.forexfactory.com/showthre...08#post9301208