This is my first thread on forex factory.

I've been trading for about two years, have tried many systems,

on many different time frames and think I have eventually come up with what works for me.

I really like this method.

The ACD Method by Mark B Fisher.

I learned it from his book, "The Logical Trader" "Putting a method to the madness"

I have been experimenting and using it for about 3 months.

I have had huge success with it using it to help me scalp

but I am starting to find the scalping too stressfull and that is not

too good for your health and as the saying goes.. "Your health is your wealth".

ACD Method

It is used by most traders on the NYMEX commodities exchange.

The reason for this is because Mark B Fisher owns the biggest clearing house on the NYMEX and he has also taught this method to most of the traders on the NYMEX including all of Paul Tudor Jones's Traders. He has taught thousands of professional traders his method and believes the more who use it the better it works.

Each trader he has taught uses ACD with there own system and style.

The last 2 days I have being trying it out with a totally different

set of rules and money management than my scalping method. And it is these rules and money management I want to test out and see how I get on.

The system is based on one trade only per day.

I have back tested it for the last month and it has been very sucsessfull.

I find it works really well with both

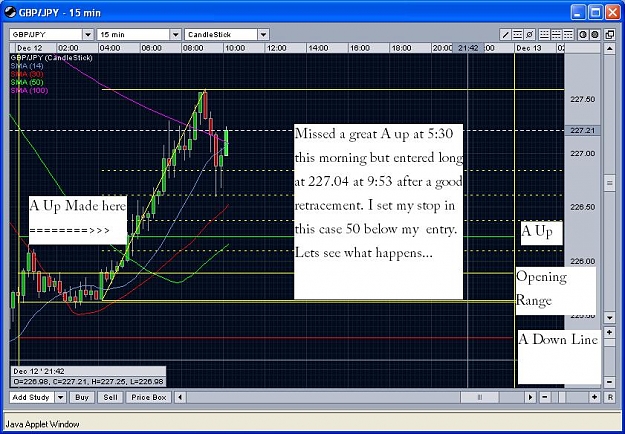

GBP/JPY and GBP/USD

Every day somewhere between 07:00 and 10:00 (GMT)I will post my trade for the day and later that night we will see how it goes.

I started using the system yesterday and I made 150 pips yesterday and lost 54 pips today.

And yes I am using a live account as demo accounts are make believe crap.

On the next post I will explain how it works very basicly.

It would be a good Idea to download the Chapter1 of the book I have uploaded if anyone is really interested in the system.

Last but not least. This is my personal journal.

These trades are a record of my personal performance and not intended for the purpose of trade calls or financial advise. please do not trade any trades I post on this thread.

I've been trading for about two years, have tried many systems,

on many different time frames and think I have eventually come up with what works for me.

I really like this method.

The ACD Method by Mark B Fisher.

I learned it from his book, "The Logical Trader" "Putting a method to the madness"

I have been experimenting and using it for about 3 months.

I have had huge success with it using it to help me scalp

but I am starting to find the scalping too stressfull and that is not

too good for your health and as the saying goes.. "Your health is your wealth".

ACD Method

It is used by most traders on the NYMEX commodities exchange.

The reason for this is because Mark B Fisher owns the biggest clearing house on the NYMEX and he has also taught this method to most of the traders on the NYMEX including all of Paul Tudor Jones's Traders. He has taught thousands of professional traders his method and believes the more who use it the better it works.

Each trader he has taught uses ACD with there own system and style.

The last 2 days I have being trying it out with a totally different

set of rules and money management than my scalping method. And it is these rules and money management I want to test out and see how I get on.

The system is based on one trade only per day.

I have back tested it for the last month and it has been very sucsessfull.

I find it works really well with both

GBP/JPY and GBP/USD

Every day somewhere between 07:00 and 10:00 (GMT)I will post my trade for the day and later that night we will see how it goes.

I started using the system yesterday and I made 150 pips yesterday and lost 54 pips today.

And yes I am using a live account as demo accounts are make believe crap.

On the next post I will explain how it works very basicly.

It would be a good Idea to download the Chapter1 of the book I have uploaded if anyone is really interested in the system.

Last but not least. This is my personal journal.

These trades are a record of my personal performance and not intended for the purpose of trade calls or financial advise. please do not trade any trades I post on this thread.

Attached File(s)

The more I wait the more I make