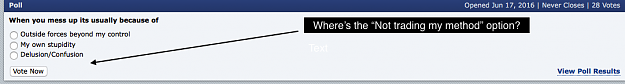

"own stupitidy" sounds so sad... but yes( it's really the most frequent reason of my losses. And unpatience is the other one

- Joined Nov 2006 | Status: Member | 3,927 Posts

to trade and code, keep both simple... no call to impress....h