I've been trading with MT4 for a few years now, and recently decided to give cTrader a try....

Pros / Cons so far...

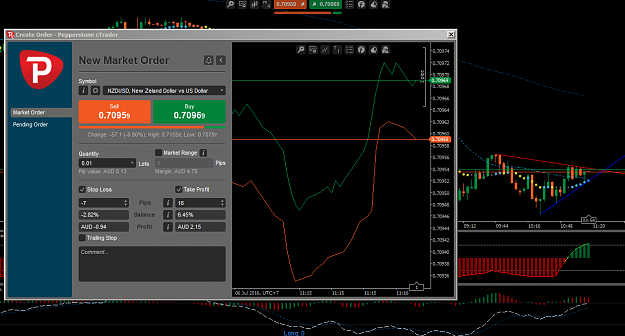

1) The user interface, tooling, look and feel, is far better than MT4: cTrader wins

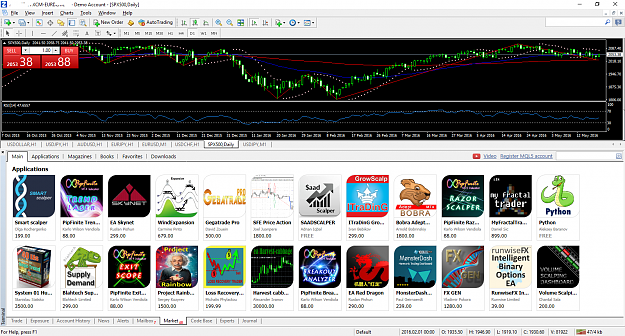

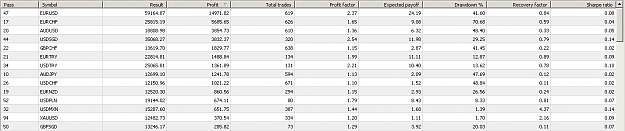

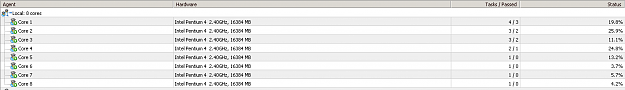

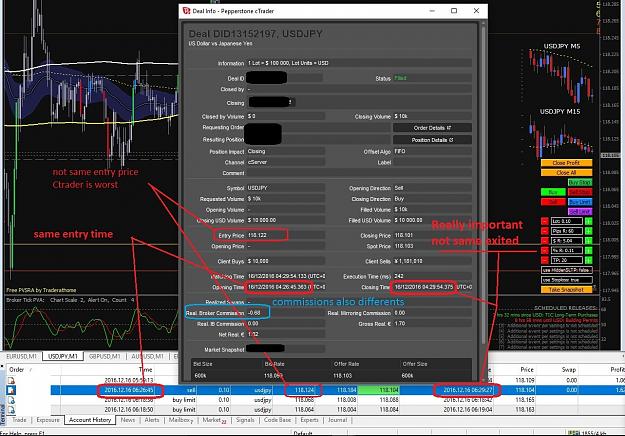

2) When it comes to EAs though, MT4 has a far more developed community, you are spoiled with choice when it comes to 3rd party automation: MT4 wins

It would seem to me, it's easier and nicer to work with a cTrader interface, manual trading, short term trading and set ups that require some analysis might go better with cTrader. Automated trading, perhaps because I'm not familiar with the cBot market, seems to be more MT4s area.

But what do people that use it every day have to say?

Pros / Cons so far...

1) The user interface, tooling, look and feel, is far better than MT4: cTrader wins

2) When it comes to EAs though, MT4 has a far more developed community, you are spoiled with choice when it comes to 3rd party automation: MT4 wins

It would seem to me, it's easier and nicer to work with a cTrader interface, manual trading, short term trading and set ups that require some analysis might go better with cTrader. Automated trading, perhaps because I'm not familiar with the cBot market, seems to be more MT4s area.

But what do people that use it every day have to say?

- 1) Is cTrader reliable? Can you trust what's behind it?

- 2) Which brokers that offer cTrader are reliable and trustworthy?

- 3) Has anybody ever used mt4 and cTrader from the same broker (eg. FxPro, any other broker)? If so, which one was better?