It's like Pelagic fishing, try try try

- Post #9,744

- Quote

- May 27, 2022 9:16pm May 27, 2022 9:16pm

- | Joined Jan 2022 | Status: Member | 25 Posts

- Post #9,749

- Quote

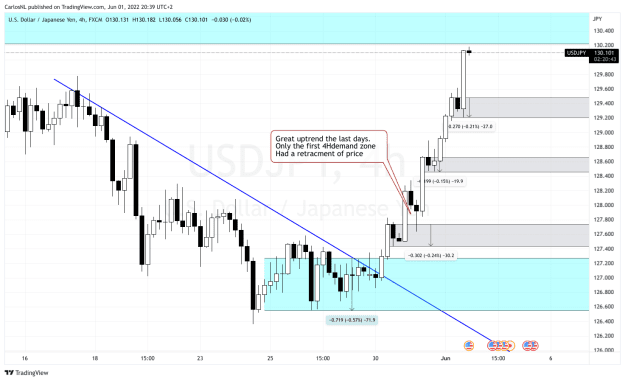

- May 30, 2022 1:29am May 30, 2022 1:29am

- | Commercial Member | Joined Jan 2016 | 2,681 Posts

Be careful what you think because your thoughts run your life..Solomon

- Post #9,753

- Quote

- Jun 4, 2022 7:03am Jun 4, 2022 7:03am

- | Commercial Member | Joined Jan 2016 | 2,681 Posts

Be careful what you think because your thoughts run your life..Solomon

- Post #9,754

- Quote

- Jun 5, 2022 7:24pm Jun 5, 2022 7:24pm

- | Joined Jan 2022 | Status: Member | 25 Posts

- Post #9,755

- Quote

- Jun 5, 2022 7:27pm Jun 5, 2022 7:27pm

- | Joined Jan 2022 | Status: Member | 25 Posts

- Post #9,756

- Quote

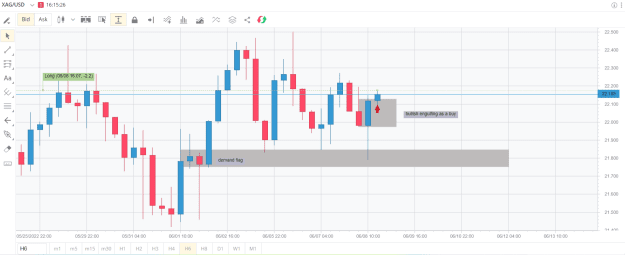

- Jun 6, 2022 12:48am Jun 6, 2022 12:48am

- | Commercial Member | Joined Jan 2016 | 2,681 Posts

Be careful what you think because your thoughts run your life..Solomon

- Post #9,757

- Quote

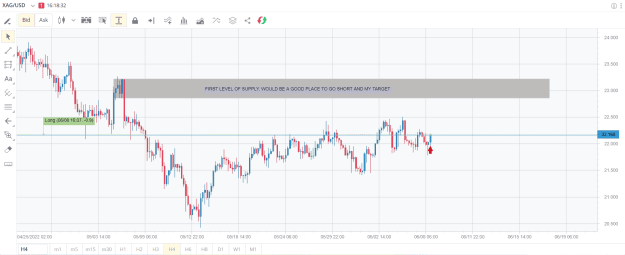

- Jun 8, 2022 11:30am Jun 8, 2022 11:30am

Indicators only Indicate, Price action dictates.

- Post #9,758

- Quote

- Jun 10, 2022 8:32am Jun 10, 2022 8:32am

Indicators only Indicate, Price action dictates.

- Post #9,760

- Quote

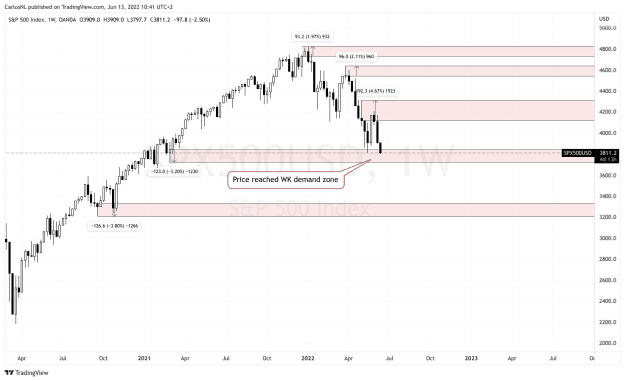

- Jun 13, 2022 3:14pm Jun 13, 2022 3:14pm

- | Commercial Member | Joined Jan 2016 | 2,681 Posts

Be careful what you think because your thoughts run your life..Solomon