Disliked{quote} I second that thought. Somehow I'm unable to digest that USDCAD trade of AKT. Might reflect my limited understanding of the process or smthing else. @Autokon I'll consider yr point too .. thanksIgnored

it's really quite straightforward.

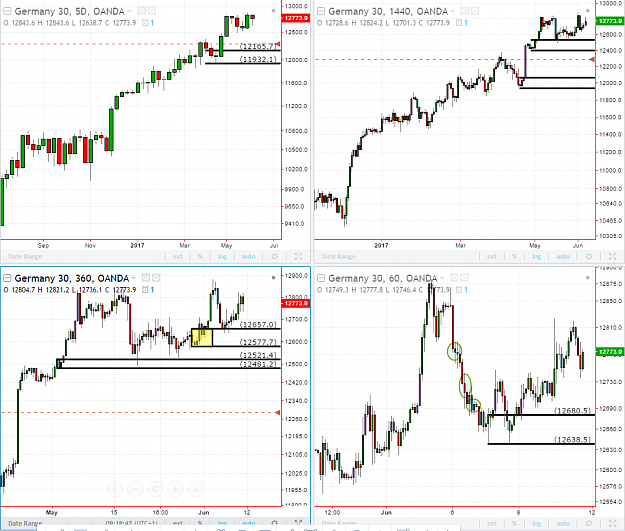

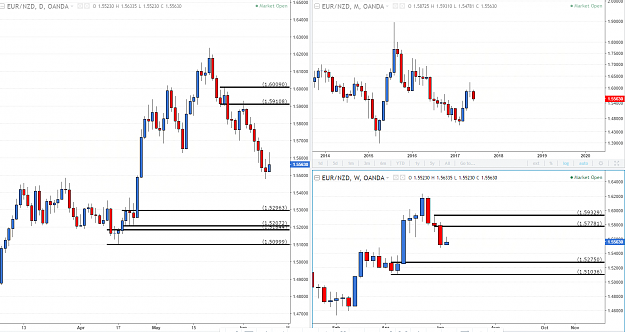

Price is in big picture demand levels, just went down to entry time-frame and found demand zones to trade at

That is pretty much it, nothing complicated once the concept is clear in your mind

best wishes

Be careful what you think because your thoughts run your life..Solomon

1