Last Update 12/04/2019

See My Other New Strategy, I See It More Safe, So I Will Stop Selling Any Other Old Strategies.

Here: FMH-ManualTrade System (EA & Indicator)

---------------------------------------------------------

This Is Part1 Of My Hedge Trading System,

---------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------

This Is Part2 Of My Hedge Trading System,

---------------------------------------------------------------------------------------------------------------

Part3 Is Preparing Now,

---------------------------------------------------------

15/04/2016

Download The Strategy Simulator/Tester v3.0:

Method1 Is Part2 Video

Method2 Is Part3 Video

Method1_New Is Part2 Video Without Hedge.

Method2_New Is Part3 Video Without Hedge.

---------------------------------------------------------

21/04/2016

EA Version 9.0 (Demo)

Method 1 & 2 & NoHedge

For More Details See Link

---------------------------------------------------------

2/05/2016

EA Version 22.0 (Demo)

Four CPanel(s) (Multi Pairs/Setting + Auto Search)

For More Details See This Post

----------------------------------------------------------

EA Version 32.0 Demo

Method1 Only

Fast, Profitable

For More Information See This Post

Update (17-4-2017)

Download Full 2015 M1 Historical Data From Here

Tested At Standard Account

Lot 0.10 , Deposit 2000$ , From 1.1.2015 - 31.12.2015 , (EURUSD , 1M , Every Tick)

Download Test Result In Full Details

----------------------------------------------------------

Hunt & mHunt

All Latest Versions Is Here:

Hunt Key (For Demo Accounts Only):

HUNTzFBQKKWIXmwsqoisqisreqotsewouap

hunt v5113

http://www.forexfactory.com/showthre...58#post9159958

mHunt Key (For Demo Accounts Only):

MHUNTzFBQKKWIXmwsqoisqisreqpqoewoooy

mhunt few

http://www.forexfactory.com/showthre...73#post9124373

mhunt v5035

http://www.forexfactory.com/showthre...80#post9120280

demo keys link

http://www.forexfactory.com/showthre...17#post9221517

See My Other New Strategy, I See It More Safe, So I Will Stop Selling Any Other Old Strategies.

Here: FMH-ManualTrade System (EA & Indicator)

---------------------------------------------------------

This Is Part1 Of My Hedge Trading System,

Inserted Video

---------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------

This Is Part2 Of My Hedge Trading System,

Inserted Video

---------------------------------------------------------------------------------------------------------------

Part3 Is Preparing Now,

---------------------------------------------------------

15/04/2016

Download The Strategy Simulator/Tester v3.0:

Method1 Is Part2 Video

Method2 Is Part3 Video

Method1_New Is Part2 Video Without Hedge.

Method2_New Is Part3 Video Without Hedge.

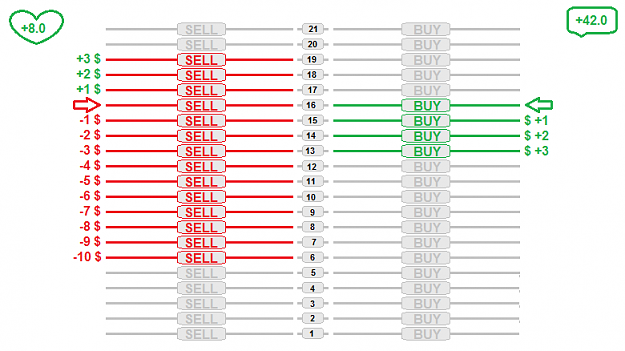

Attached Image

Attached File(s)

---------------------------------------------------------

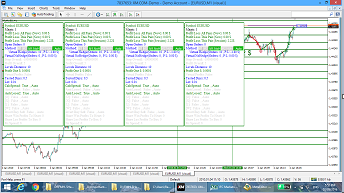

21/04/2016

Attached Image

EA Version 9.0 (Demo)

Method 1 & 2 & NoHedge

For More Details See Link

Attached File(s)

---------------------------------------------------------

2/05/2016

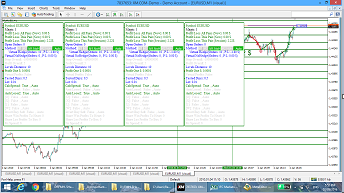

Attached Image

EA Version 22.0 (Demo)

Four CPanel(s) (Multi Pairs/Setting + Auto Search)

For More Details See This Post

Attached File(s)

----------------------------------------------------------

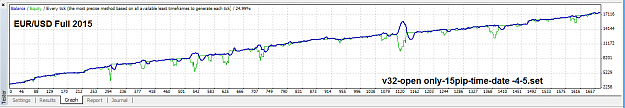

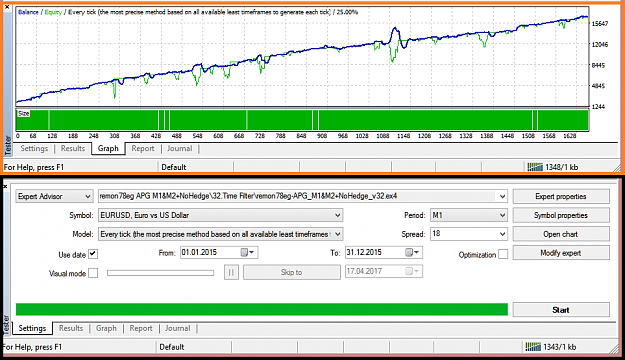

EA Version 32.0 Demo

Method1 Only

Fast, Profitable

For More Information See This Post

Attached File(s)

Update (17-4-2017)

Download Full 2015 M1 Historical Data From Here

Tested At Standard Account

Lot 0.10 , Deposit 2000$ , From 1.1.2015 - 31.12.2015 , (EURUSD , 1M , Every Tick)

Download Test Result In Full Details

Attached File(s)

----------------------------------------------------------

Hunt & mHunt

All Latest Versions Is Here:

Hunt Key (For Demo Accounts Only):

HUNTzFBQKKWIXmwsqoisqisreqotsewouap

hunt v5113

http://www.forexfactory.com/showthre...58#post9159958

mHunt Key (For Demo Accounts Only):

MHUNTzFBQKKWIXmwsqoisqisreqpqoewoooy

mhunt few

http://www.forexfactory.com/showthre...73#post9124373

mhunt v5035

http://www.forexfactory.com/showthre...80#post9120280

demo keys link

http://www.forexfactory.com/showthre...17#post9221517

FMH-ManualTrade ECN.PRO All Time Return:

na