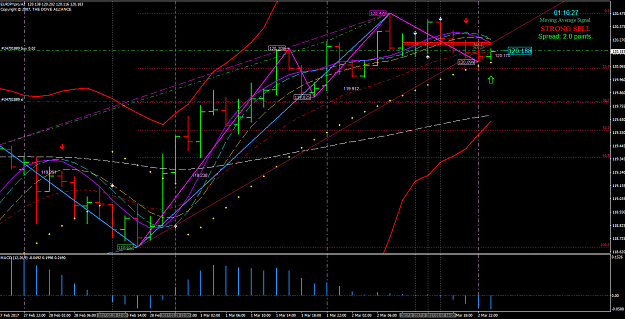

DislikedAlright Traders - to start with you have the H1 and H2 ROMAR in an uptrend consolidation with the Daily downtrend ROMAR. You also had the H2 SAR/DB attached on the previous candle in CONSOLIDATION with the H2 uptrend ROMAR PLUS - Divergence. THE BIG PICTURE - back into the H2 ROMAR trend with confluence. Bottom line is seeing the the whole picture on your trading plan before pulling the trigger.Ignored

So the DB/SAR attachment at the bottom in consolidation with ROMAR uptrend plus Divergence attachment means: Back into the ROMAR trend.