To simply state the obvious, this is going to be a trading journal (my first trading journal) to help me follow up on a recent strategy I have developed for myself.

There is the added advantage of having other traders around to check/look-in. This I hope should keep me in check so I do not deviate from my strategy and my goal for creating this thread going foward.

What is the strategy?

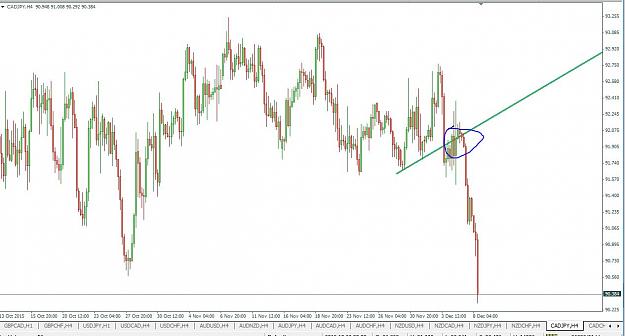

It is about analyzing and trading from higher-timeframe TRENDLINES; the lowest being the H4 time-frame. However my entries will be from the point a Supply or Demand zone intersects with the trendline.

Why this strategy?

It is simple and effective. For some reason I have found trendline trading to be a little bit more straightforward and easy to follow. This is mostly down to the way I draw my trendlines. It tells the story better and clearer than any other technical tools out there.

Also, In the past 1 year I have traded price action, I have learnt first-hand that higher timeframe analysis are best for my trading style. I love to trade very often, so to strike a balance I have opted to frequently using H4 timeframe for my analysis.

Supply and Demand zones help me find key levels on the price chart for high probability trade entries.

Key point:

Supply and demand zones are best traded fresh and untouched. Trendlines help me a great deal in trading from fresh zones, while i avoid the used up zones.

Confirmation:

For me the market SENTIMENT and FUNDAMENTALS serve as the first confirmation for my trades. Though they help me form my initial bias in the analysis phase, they are the last factors I must check to see if they confirm the direction of my entry. Other than that I may consider candlestick formations (Engulfs and pinbars) or lower timeframe (M5, M15) price action at confluence point.

ANY CONTRIBUTIONS IN WHATEVER FORM WILL BE APPRECIATED.

There is the added advantage of having other traders around to check/look-in. This I hope should keep me in check so I do not deviate from my strategy and my goal for creating this thread going foward.

What is the strategy?

It is about analyzing and trading from higher-timeframe TRENDLINES; the lowest being the H4 time-frame. However my entries will be from the point a Supply or Demand zone intersects with the trendline.

Why this strategy?

It is simple and effective. For some reason I have found trendline trading to be a little bit more straightforward and easy to follow. This is mostly down to the way I draw my trendlines. It tells the story better and clearer than any other technical tools out there.

Also, In the past 1 year I have traded price action, I have learnt first-hand that higher timeframe analysis are best for my trading style. I love to trade very often, so to strike a balance I have opted to frequently using H4 timeframe for my analysis.

Supply and Demand zones help me find key levels on the price chart for high probability trade entries.

Key point:

Supply and demand zones are best traded fresh and untouched. Trendlines help me a great deal in trading from fresh zones, while i avoid the used up zones.

Confirmation:

For me the market SENTIMENT and FUNDAMENTALS serve as the first confirmation for my trades. Though they help me form my initial bias in the analysis phase, they are the last factors I must check to see if they confirm the direction of my entry. Other than that I may consider candlestick formations (Engulfs and pinbars) or lower timeframe (M5, M15) price action at confluence point.

ANY CONTRIBUTIONS IN WHATEVER FORM WILL BE APPRECIATED.