Hello all I have been toying with a simple system that just seems to do pretty well so far.

It is traded on a daily chart for people who like me don't have enough time to check every 30 minutes or hour. Hopefully some day I can become a professional trader lol.

I have been a hobbiest (*May not be a real word) trader you could say for the past 10 years at least trading everything from Stocks, Options and Forex. I haven't blown my accounts as much as I have to dip into them for emergencies and that sucks. Recently I finally got my finances (Not trading related. Govt contract fell through and lost a bit of money that could not be refunded... Live and learn lol) back in order and have some extra money to start trading again Woot! and hopefully get that Island I always wanted O_o

So for the strat here goes it:

KISS method Trading

Stragey Viable on Forex Currencies. "Any so Far"

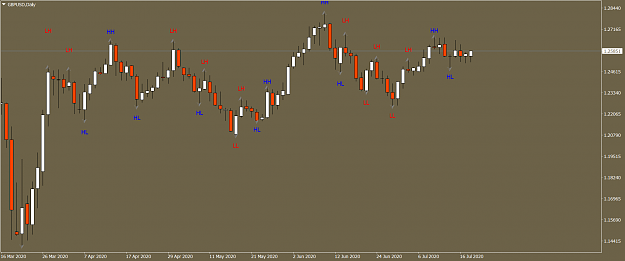

When chart trading there are only 3 directions a chart can trade.

1. Long

2. Short

3. Sideways

1. When trading long we assume above moving averages and making new highs and higher lows.

2. When trading Short we assume below moving averages and making new lows and lower highs.

3. When trading sideways above moving average with lower highs or below with Higher highs.

Using these to determine overall market trend will keep you out of losses 80-90% of the time. On the currencies I have backtested/forward tested on.

When entering a trade and we are trending use fibo and place buy or sell limit/stop on 32 fibo retracement. If it is a strong trend may open manually at day close if near 21 retracement.

TP can be 161 fibo line or greater. After three days if not making new low or new high place tp on open of your trade the 21 or 32 retracement where you opened.

If we are trading sideways and above ma place buy at lowest recent support. If below place sell at recent resistance. Here is where the strategy comes into play. If you have not made significant profit after three days can close out trade

or if at a loss can place TP at your open price to zero out trade with no lose or a bit of profit to cover swap and commisions. This is the 80-90% I was talking about.

I'll try and provide more info and some screenshots as a go and hopefully the community can provide some feedback to make the system a bit better.

Key skills in trading this chart stragegy

Is to be able to determine overall trend. To avoid being stopped out.

Is to be able to determine key support resistance levels.

Determining when the market is changed suddenly and is no longer your friend. Close trade as soon as possible in this case.

Being able to check the market once a day.

Decent profit almost green every month and depending on your risk can be very profitable. If you don't blow your account on that 10-20% chance you will have a loss.

It is traded on a daily chart for people who like me don't have enough time to check every 30 minutes or hour. Hopefully some day I can become a professional trader lol.

I have been a hobbiest (*May not be a real word) trader you could say for the past 10 years at least trading everything from Stocks, Options and Forex. I haven't blown my accounts as much as I have to dip into them for emergencies and that sucks. Recently I finally got my finances (Not trading related. Govt contract fell through and lost a bit of money that could not be refunded... Live and learn lol) back in order and have some extra money to start trading again Woot! and hopefully get that Island I always wanted O_o

So for the strat here goes it:

KISS method Trading

Stragey Viable on Forex Currencies. "Any so Far"

When chart trading there are only 3 directions a chart can trade.

1. Long

2. Short

3. Sideways

1. When trading long we assume above moving averages and making new highs and higher lows.

2. When trading Short we assume below moving averages and making new lows and lower highs.

3. When trading sideways above moving average with lower highs or below with Higher highs.

Using these to determine overall market trend will keep you out of losses 80-90% of the time. On the currencies I have backtested/forward tested on.

When entering a trade and we are trending use fibo and place buy or sell limit/stop on 32 fibo retracement. If it is a strong trend may open manually at day close if near 21 retracement.

TP can be 161 fibo line or greater. After three days if not making new low or new high place tp on open of your trade the 21 or 32 retracement where you opened.

If we are trading sideways and above ma place buy at lowest recent support. If below place sell at recent resistance. Here is where the strategy comes into play. If you have not made significant profit after three days can close out trade

or if at a loss can place TP at your open price to zero out trade with no lose or a bit of profit to cover swap and commisions. This is the 80-90% I was talking about.

I'll try and provide more info and some screenshots as a go and hopefully the community can provide some feedback to make the system a bit better.

Key skills in trading this chart stragegy

Is to be able to determine overall trend. To avoid being stopped out.

Is to be able to determine key support resistance levels.

Determining when the market is changed suddenly and is no longer your friend. Close trade as soon as possible in this case.

Being able to check the market once a day.

Decent profit almost green every month and depending on your risk can be very profitable. If you don't blow your account on that 10-20% chance you will have a loss.