Hello friends,

My purpose in this thread:

1) Test out a simple system using Heiken Ashi candles

2) Post my trades and results when I have the time

3) Hopefully help others in their trading

Disclaimers:

1) I'm NOT an expert trader. Any systems or advice offered here are for educational purposes only. Trade at your own risk.

2) I have no idea how profitable this system will be, as I've only just started testing it.

3) This system is based upon other systems here at FF.

4) I have NO commercial interests, but commercial members are welcome as long as they play by the rules.

Rules:

1) Please be respectful of others.

2) Please be constructive with your comments.

3) Please do not be overly negative or critical just for the sake of it.

Suggestions:

1) Post pictures when you can.

2) Keep cool and relaxed. We are all here to learn to improve our trading.

3) Try to make the system simpler, not more complex (e.g., avoid adding extra indicators).

------------------------------------------------------------------------------------------------------------------------

Heiken Ashi System:

1) BUY = the previous heiken ashi bar was bullish

2) SELL = the previous heiken ashi bar was bearish

Time frame:

1) Higher time frames (daily or weekly charts preferred)

Exit rules for manual trading:

1) Exit when the heiken ashi bar changes colors

2) Set SL to just below prior resistance

Exit rules for automated trading:

1) Exit when a fixed TP or SL has been hit

------------------------------------------------------------------------------------------------------------------------

My thoughts:

1) I prefer the weekly charts

2) I prefer to make my trading more automated

3) In my opinion, this leaves two primary setups.

Setup A - Follow the trend:

1) Follow the prior weekly heiken ashi candle

2) Set a fixed SL and TP using a 1:1 ratio (e.g., 30 pips TP and 30 pips SL)

You may be thinking: "Why such a low TP and SL?"

The reason is simple: volume.

We can take many trades each week using this criteria, and my estimation is we will have around 75% winners (this is my ESTIMATE).

Example:

30 trades

21 = win

9 = loss

Pips gained:

(21 * 30 pips) = 630 pips

(9 * 30 pips) = 270 pips

Weekly gain = +360 pips

**In most cases, we will just follow the prior weekly trend!**

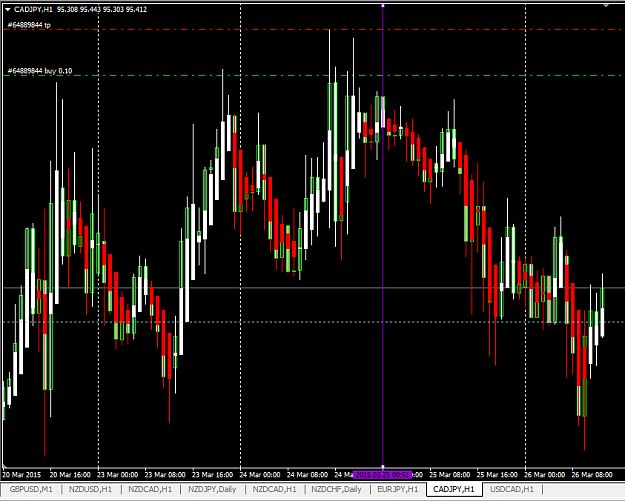

Here's an example trade I took this week on the GBP/JPY with a 30 pip TP (the trade won).

Setup B - Catch the new trend early:

1) If the weekly heiken ashi bar changed colors, trade the new color for a possible trend reversal.

2) Set SL below prior weekly candle, and exit trade once heiken ashi bar changes colors.

Example: The last 5 weekly heiken ashi candles were bearish. This week it closed bullish. Place a BUY order.

**The idea with this system is to be getting in early on a possible trend reversal!**

Here's an example trade I took this week on the EUR/USD with no TP and a SL below the prior weekly candle (which I've now moved to break-even level).

This is the system I'll be exploring in this thread! Feel free to join along if you'd like.

My purpose in this thread:

1) Test out a simple system using Heiken Ashi candles

2) Post my trades and results when I have the time

3) Hopefully help others in their trading

Disclaimers:

1) I'm NOT an expert trader. Any systems or advice offered here are for educational purposes only. Trade at your own risk.

2) I have no idea how profitable this system will be, as I've only just started testing it.

3) This system is based upon other systems here at FF.

4) I have NO commercial interests, but commercial members are welcome as long as they play by the rules.

Rules:

1) Please be respectful of others.

2) Please be constructive with your comments.

3) Please do not be overly negative or critical just for the sake of it.

Suggestions:

1) Post pictures when you can.

2) Keep cool and relaxed. We are all here to learn to improve our trading.

3) Try to make the system simpler, not more complex (e.g., avoid adding extra indicators).

------------------------------------------------------------------------------------------------------------------------

Heiken Ashi System:

1) BUY = the previous heiken ashi bar was bullish

2) SELL = the previous heiken ashi bar was bearish

Time frame:

1) Higher time frames (daily or weekly charts preferred)

Exit rules for manual trading:

1) Exit when the heiken ashi bar changes colors

2) Set SL to just below prior resistance

Exit rules for automated trading:

1) Exit when a fixed TP or SL has been hit

------------------------------------------------------------------------------------------------------------------------

My thoughts:

1) I prefer the weekly charts

2) I prefer to make my trading more automated

3) In my opinion, this leaves two primary setups.

Setup A - Follow the trend:

1) Follow the prior weekly heiken ashi candle

2) Set a fixed SL and TP using a 1:1 ratio (e.g., 30 pips TP and 30 pips SL)

You may be thinking: "Why such a low TP and SL?"

The reason is simple: volume.

We can take many trades each week using this criteria, and my estimation is we will have around 75% winners (this is my ESTIMATE).

Example:

30 trades

21 = win

9 = loss

Pips gained:

(21 * 30 pips) = 630 pips

(9 * 30 pips) = 270 pips

Weekly gain = +360 pips

**In most cases, we will just follow the prior weekly trend!**

Here's an example trade I took this week on the GBP/JPY with a 30 pip TP (the trade won).

Setup B - Catch the new trend early:

1) If the weekly heiken ashi bar changed colors, trade the new color for a possible trend reversal.

2) Set SL below prior weekly candle, and exit trade once heiken ashi bar changes colors.

Example: The last 5 weekly heiken ashi candles were bearish. This week it closed bullish. Place a BUY order.

**The idea with this system is to be getting in early on a possible trend reversal!**

Here's an example trade I took this week on the EUR/USD with no TP and a SL below the prior weekly candle (which I've now moved to break-even level).

This is the system I'll be exploring in this thread! Feel free to join along if you'd like.

I am NOT an expert. I post to learn from others.