I would like to open a thread to discuss trading based on fibonacci, I know there are alot of traders out there including myself who trade with nothing but Fibs and I would like to share, along with gain some knowledge with other Fib traders. I have tried numerous methods but about a year or so ago I started looking more and more at fibs and began to see the repetitive nature and how price reacted to them. I have become pretty successful with Fibs now and think I can give something back, because I remember how hard it was to get started trading Forex with no experience.

Originally Fibs were very confusing so I simplified them to some degree and have had developed my own strategy with them. More or less a Fib breakout type strategy.

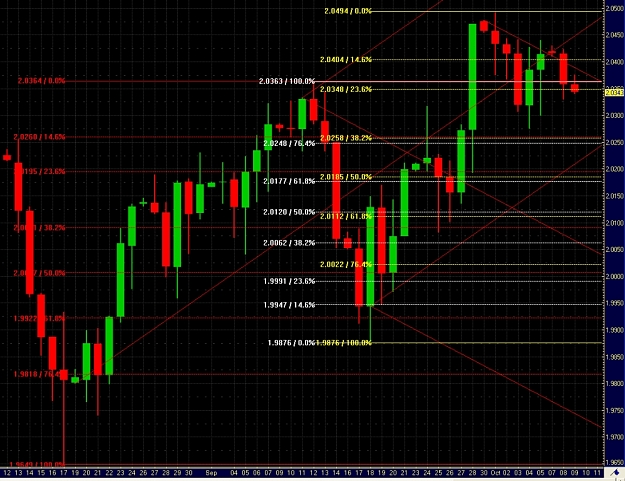

If there are any of you interested here is a sample of what my strategy looks like within the chart and we can discuss more if there are any traders interested. For the most part I only trade GBP/USD, but I have been known to take on a few others.

Ill post the actual strategy in the next coming post as well as open the thread to any questions.

Here is a quick explanation of the fib tool and what its levels represent, from this you should be able to understand the concept of applying the tool , too many question near the end of the thread that have been answered many times and I simply cannot keep repeating the basics over and over again because many are not willing to read the thread first. Ive added this in PDF format in the attachments. Please read this and attempt to read some of the thread before asking questions about basics.

Ive also added a template with the fib tools renamed already you simply have to set the chart up yourself. This is the updated version and where we attempted to restart things around (page 209) to simplify the usage and understanding of the different tools and their purpose.Just open a Cable chart to a weekly chart and apply the template.

* Ive added a PDF file in the use of Linear regression channels.If your interested its on page 277,post #4155.

*Current Video (New video 10/14/10)

Setting up the fib tool

GBP/Yen, S&R price following exercise

SampleTrade2 07/21/08

SampleTrade2 Part2 07/21/08

I am at a turning point in my career and after alot of hard work I am exploring that opportunity with my own website.

http://bobokus.com/

Out of respect of the admin here at Forex Factory and the rules of the forums I must depart. I contacted the Admin here at Forex Factory and wanted them to know ahead of time of my plans and did not want to cause a rift here on Forex Factory rather leave on a positive note as I have seen too often those that would use Forex Factory to prey on new traders and did not want to be in that same category.

I fully understand their reasoning and the rules. And on that note I would like to leave one last bit of information and encouragement. I wish everyone here the best in their trading and thank FF for a wonderful place for new traders.

The Web of The World Wide Web

The age of easy access to information now seems to have a negative flip side. The same easy access that can sometimes seem like a godsend, also allows a pile-on of bad information or content of little value which can lead you astray. Many older traders did not have to go through this as they were mentored by another successful trader or forced to learn through long tiresome study of charts and the live market. The common path for an aspiring trader these days is to pop open their web browser and begin searching for information to apply immediately in their live account. The problem is that their search often leads them to destinations which are infected by viruses of bad ideas, negativity, indicator obsession, and other road blocks to lead the knowledge seeker off their path. Even many of the books sold these days are filled with recycled concepts or hacked together strategies which the authors do not even use. The problem with this new found easy access to information, at least when it comes to the trading profession, is that trading remains a discretionary field, their is no clear path to success.The problem with this new found easy access to information, at least when it comes to the trading profession, is that trading remains a discretionary field, their is no clear path to success. There is no series of text books and exams that will graduate you as a trader. The same easy access to information that may be a godsend for other fields of study, can be a curse in our profession and might even make it harder to achieve success than it was 20 years ago. Add to this the continual barrage of sites with guru's who fuel the idea that trading is easy, then financially feed off those same people they have sold this idea to. At the end of the day what many of them offer is a gross misrepresentation of what it takes to trade for a living. Trading is far from easy. You know you have become a good trader when your are trading with profitably with ease, but that does not mean it is easy. At a certain point you will be at a stage where you are calm and at ease when entering and exiting trades, but the reality is it is still hard work and must be treated as a career.

The effect of much of the bad information you come across is that it leads many traders start off overly optimistic. Now don't get me wrong, having a positive attitude and being optimistic is a great thing, but not when the foundation for your optimism was built to crumble. Would-be new traders start by jumping right in to the live market after getting a hold of some set of indicators or "secret" set of moving averages and they are quickly punished for their naivety. Being led astray is not the fault of a new trader, In fact many now successful traders went through this learning process. It only becomes your fault if you continue to allow yourself to be led astray. A break from this cycle, and your first step back on the road to success, comes when you realize that the majority of those piling on this information will not help you nearly as much as you can help yourself. You help yourself by beginning to think for yourself and accepting the reality that you cannot just decide to "Be" a trader, rather you have to decide to "BECOME" a trader.

BECOME A Trader

The faster a new trader can make the mental shift to "I am going to become a trader" the faster they will get to the goal line where you can say "I am a trader."

To be a trader is easy, all you need is an account with money in it then you enter the market and start trading. To become a trader is more work. Becoming a trader involves you going through an evolution from the starting point of little knowledge to the point of having a tradeable framework, knowledge of the behavior of the market you trade, and a cool head while taking wins and losses. To Become a trader you must:

This is very important when you are starting your trading career. You must come to terms with the fact that you are a small fish in a big ocean. The big fish will happily enjoy you as a little snack. When you enter the Forex market most of the liquidity is coming from big banks and experienced traders. Don't for a second start off by thinking that it will be easy to take these big traders money out of the market. What you have to learn is to swim along side the big fish, catch the same currents they do, don't swim against them or they will eat you up in passing.

A funny misconception is that these big traders must have access to some holy grail strategy or use some secret indicator, but this is plain and simply not true. Online you can find access to daily bank analyst reports on currencies. Analysts at the biggest banks in the world generate these reports which are then sent off to their trade desks for the bank's traders to consider. In these reports you will find simple, but proven technical analysis techniques - most commonly horizontal support/resistance, identification of trading ranges, Fibonacci, and fundamental themes. Begin by accepting that the other participants are highly experienced in the market and then learn to trade like them. They make money because of experience, not because they hold a holy grail or secret indicators.

EMPHASIZE EQUITY MANAGEMENT

It is crucial that as a beginning trader your emphasis is not on how much you can make, but rather how you can properly manage what you have. This is most likely to be the downfall of traders. It would be common place to see a starting trader risk their entire account on one or two positions. This is not the way to a sustainable trading career and this is not how the professional traders you are up against in the market manage their risk. At some point in your trading career you will likely have a string of bad trades. A reasonable number might be 10 losing trades in a row. Are you managing your equity in a way that you can survive this?

The solution is using simple formulas to calculate your maximum risk per trade and total risk in the market at any one time. Doing this is not difficult, but you must have the discipline to follow through with it on each and every trade.

CREATE YOUR MARKET LENS

Many fail to realize that when you open your charting software and pop on the latest hot indicator or charting tool you've heard works so well, you are extremely unlikely to see much success from it. This is because an indicator on a chart does not provide you with a market lens to trade from. Your market lens comes from experience. It comes from knowing how the market behaves around your chosen framework.

There are many traders that are profitable with various indicators or tools such as fibs, pivots, price channels, MACD, etc. But the tools they have chosen are not what is making them profitable. A common theme between successful traders is that they have the experience of seeing how the market behaves around their chosen tools and framework, day in and day out. The only way to achieve this is to stop jumping between tools and select those that are based on logical reasoning, understand how they work, then spend time in the market experiencing them.

OPERATE LIKE A SURGEON

It should be your goal to take your pips out of the market with precision, the same precision a surgeon must use with his scalpel. Traders who don't treat each trade as a business decision by calculating their risk and defining entries and exits, open themselves to big losses when a trade goes bad.

Once again it is a novel concept which you will hear again and again, but for some reason it is difficult for many traders to exercise the discipline to follow a plan for each trade. Instead what often happens is what I call the "Lazyboy Trade." The trader sees a potential set-up, Decides on some arbitrary sum to buy with a quick guesstimate, then carelessly gets in the trade without analyzing risk and having an exit strategy. The Lazyboy Trade may work out a few times solely because of luck, but eventually the trader wakes up from a nap to find themselves under water in a position and that's the end of their trading career. Now there's nothing wrong with trading from your Lazyboy, but be sure you never partake in the Lazy Boy trade and you must exercise discipline each day to keep your account healthy.

MAINTAIN YOUR MIND

Entire books have been dedicated to the subject of psychology and its role in trading. That doesn't mean they are all going to help you, but you should take this as a sign that the subject is not to be ignored. Like a professional athlete must maintain their fitness at a level that allows them to compete at the top, we must maintain our mind because it is relied on each and every day to trade at the top of your game.

This comes down to a few things. First you must understand the role psychology plays in trading. Second you must make it your aim to never stop learning. You cannot get yourself to a certain level and then become complacent. Your entire career in this industry will be a learning experience. Until the day you stop trading you must be prepared to learn lessons from the market and be willing to do R&D and testing of newly gained knowledge, just as a business would Invest in R&D.

EXPECT THE UNEXPECTED

I'm writing this at the end of 2008 which has been quite a wild year in the markets. We've seen bank runs followed by bail-outs, brokerage bankruptcy's, government intervention in free markets, housing bubbles exploding, and a global deleveraging of the financial system of historical proportions. At the beginning of the crash it seemed like every other week the market was being saved by rumors of Warren Buffet buying out struggling companies. Now we see pundits questioning the savvy of the oracle himself as he loses large sums on the same derivatives he once criticized as a bad idea and sees his prized AAA credit rating for Berkshire being threatened. Did anyone expect to see that?

These are indeed interesting times, but there is one thing every investor needs to learn. Expect the unexpected and do not get wrapped up in the euphoria of those around you. There will always be bubbles, crashes and threats to your profitability, but as long as you maintain and objective outlook and think for yourself you will have a feast when there is famine for those who are caught up in the hype.

Allow Yourself To Succeed

By putting in the effort to BECOME a trader you allow yourself the opportunity to one day evolve from saying "I am going to become" a trader to "I am a trader." And that is the ultimate reward.

To say "I am a trader" is a great privilege and achievement, it means you have done something that around 95% of those who tried could not. Congratulations to those who can make this statement and for those just beginning this journey start your evolution by allowing yourself to BECOME a trader.

Good Luck to all,

Jeff

Originally Fibs were very confusing so I simplified them to some degree and have had developed my own strategy with them. More or less a Fib breakout type strategy.

If there are any of you interested here is a sample of what my strategy looks like within the chart and we can discuss more if there are any traders interested. For the most part I only trade GBP/USD, but I have been known to take on a few others.

Ill post the actual strategy in the next coming post as well as open the thread to any questions.

Here is a quick explanation of the fib tool and what its levels represent, from this you should be able to understand the concept of applying the tool , too many question near the end of the thread that have been answered many times and I simply cannot keep repeating the basics over and over again because many are not willing to read the thread first. Ive added this in PDF format in the attachments. Please read this and attempt to read some of the thread before asking questions about basics.

Ive also added a template with the fib tools renamed already you simply have to set the chart up yourself. This is the updated version and where we attempted to restart things around (page 209) to simplify the usage and understanding of the different tools and their purpose.Just open a Cable chart to a weekly chart and apply the template.

* Ive added a PDF file in the use of Linear regression channels.If your interested its on page 277,post #4155.

*Current Video (New video 10/14/10)

Inserted Video

Inserted Video

Inserted Video

Inserted Video

Inserted Video

Inserted Video

Inserted Video

Inserted Video

I am at a turning point in my career and after alot of hard work I am exploring that opportunity with my own website.

http://bobokus.com/

Out of respect of the admin here at Forex Factory and the rules of the forums I must depart. I contacted the Admin here at Forex Factory and wanted them to know ahead of time of my plans and did not want to cause a rift here on Forex Factory rather leave on a positive note as I have seen too often those that would use Forex Factory to prey on new traders and did not want to be in that same category.

I fully understand their reasoning and the rules. And on that note I would like to leave one last bit of information and encouragement. I wish everyone here the best in their trading and thank FF for a wonderful place for new traders.

The Web of The World Wide Web

The age of easy access to information now seems to have a negative flip side. The same easy access that can sometimes seem like a godsend, also allows a pile-on of bad information or content of little value which can lead you astray. Many older traders did not have to go through this as they were mentored by another successful trader or forced to learn through long tiresome study of charts and the live market. The common path for an aspiring trader these days is to pop open their web browser and begin searching for information to apply immediately in their live account. The problem is that their search often leads them to destinations which are infected by viruses of bad ideas, negativity, indicator obsession, and other road blocks to lead the knowledge seeker off their path. Even many of the books sold these days are filled with recycled concepts or hacked together strategies which the authors do not even use. The problem with this new found easy access to information, at least when it comes to the trading profession, is that trading remains a discretionary field, their is no clear path to success.The problem with this new found easy access to information, at least when it comes to the trading profession, is that trading remains a discretionary field, their is no clear path to success. There is no series of text books and exams that will graduate you as a trader. The same easy access to information that may be a godsend for other fields of study, can be a curse in our profession and might even make it harder to achieve success than it was 20 years ago. Add to this the continual barrage of sites with guru's who fuel the idea that trading is easy, then financially feed off those same people they have sold this idea to. At the end of the day what many of them offer is a gross misrepresentation of what it takes to trade for a living. Trading is far from easy. You know you have become a good trader when your are trading with profitably with ease, but that does not mean it is easy. At a certain point you will be at a stage where you are calm and at ease when entering and exiting trades, but the reality is it is still hard work and must be treated as a career.

The effect of much of the bad information you come across is that it leads many traders start off overly optimistic. Now don't get me wrong, having a positive attitude and being optimistic is a great thing, but not when the foundation for your optimism was built to crumble. Would-be new traders start by jumping right in to the live market after getting a hold of some set of indicators or "secret" set of moving averages and they are quickly punished for their naivety. Being led astray is not the fault of a new trader, In fact many now successful traders went through this learning process. It only becomes your fault if you continue to allow yourself to be led astray. A break from this cycle, and your first step back on the road to success, comes when you realize that the majority of those piling on this information will not help you nearly as much as you can help yourself. You help yourself by beginning to think for yourself and accepting the reality that you cannot just decide to "Be" a trader, rather you have to decide to "BECOME" a trader.

BECOME A Trader

The faster a new trader can make the mental shift to "I am going to become a trader" the faster they will get to the goal line where you can say "I am a trader."

To be a trader is easy, all you need is an account with money in it then you enter the market and start trading. To become a trader is more work. Becoming a trader involves you going through an evolution from the starting point of little knowledge to the point of having a tradeable framework, knowledge of the behavior of the market you trade, and a cool head while taking wins and losses. To Become a trader you must:

Begin With Humility

Emphasize Equity Management

Create Your Market Lens

Operate Like a Surgeoun

Maintain Your Mind

Expect The Unexpected

BEGIN WITH HUMILITYThis is very important when you are starting your trading career. You must come to terms with the fact that you are a small fish in a big ocean. The big fish will happily enjoy you as a little snack. When you enter the Forex market most of the liquidity is coming from big banks and experienced traders. Don't for a second start off by thinking that it will be easy to take these big traders money out of the market. What you have to learn is to swim along side the big fish, catch the same currents they do, don't swim against them or they will eat you up in passing.

A funny misconception is that these big traders must have access to some holy grail strategy or use some secret indicator, but this is plain and simply not true. Online you can find access to daily bank analyst reports on currencies. Analysts at the biggest banks in the world generate these reports which are then sent off to their trade desks for the bank's traders to consider. In these reports you will find simple, but proven technical analysis techniques - most commonly horizontal support/resistance, identification of trading ranges, Fibonacci, and fundamental themes. Begin by accepting that the other participants are highly experienced in the market and then learn to trade like them. They make money because of experience, not because they hold a holy grail or secret indicators.

EMPHASIZE EQUITY MANAGEMENT

It is crucial that as a beginning trader your emphasis is not on how much you can make, but rather how you can properly manage what you have. This is most likely to be the downfall of traders. It would be common place to see a starting trader risk their entire account on one or two positions. This is not the way to a sustainable trading career and this is not how the professional traders you are up against in the market manage their risk. At some point in your trading career you will likely have a string of bad trades. A reasonable number might be 10 losing trades in a row. Are you managing your equity in a way that you can survive this?

The solution is using simple formulas to calculate your maximum risk per trade and total risk in the market at any one time. Doing this is not difficult, but you must have the discipline to follow through with it on each and every trade.

CREATE YOUR MARKET LENS

Many fail to realize that when you open your charting software and pop on the latest hot indicator or charting tool you've heard works so well, you are extremely unlikely to see much success from it. This is because an indicator on a chart does not provide you with a market lens to trade from. Your market lens comes from experience. It comes from knowing how the market behaves around your chosen framework.

There are many traders that are profitable with various indicators or tools such as fibs, pivots, price channels, MACD, etc. But the tools they have chosen are not what is making them profitable. A common theme between successful traders is that they have the experience of seeing how the market behaves around their chosen tools and framework, day in and day out. The only way to achieve this is to stop jumping between tools and select those that are based on logical reasoning, understand how they work, then spend time in the market experiencing them.

OPERATE LIKE A SURGEON

It should be your goal to take your pips out of the market with precision, the same precision a surgeon must use with his scalpel. Traders who don't treat each trade as a business decision by calculating their risk and defining entries and exits, open themselves to big losses when a trade goes bad.

Once again it is a novel concept which you will hear again and again, but for some reason it is difficult for many traders to exercise the discipline to follow a plan for each trade. Instead what often happens is what I call the "Lazyboy Trade." The trader sees a potential set-up, Decides on some arbitrary sum to buy with a quick guesstimate, then carelessly gets in the trade without analyzing risk and having an exit strategy. The Lazyboy Trade may work out a few times solely because of luck, but eventually the trader wakes up from a nap to find themselves under water in a position and that's the end of their trading career. Now there's nothing wrong with trading from your Lazyboy, but be sure you never partake in the Lazy Boy trade and you must exercise discipline each day to keep your account healthy.

MAINTAIN YOUR MIND

Entire books have been dedicated to the subject of psychology and its role in trading. That doesn't mean they are all going to help you, but you should take this as a sign that the subject is not to be ignored. Like a professional athlete must maintain their fitness at a level that allows them to compete at the top, we must maintain our mind because it is relied on each and every day to trade at the top of your game.

This comes down to a few things. First you must understand the role psychology plays in trading. Second you must make it your aim to never stop learning. You cannot get yourself to a certain level and then become complacent. Your entire career in this industry will be a learning experience. Until the day you stop trading you must be prepared to learn lessons from the market and be willing to do R&D and testing of newly gained knowledge, just as a business would Invest in R&D.

EXPECT THE UNEXPECTED

I'm writing this at the end of 2008 which has been quite a wild year in the markets. We've seen bank runs followed by bail-outs, brokerage bankruptcy's, government intervention in free markets, housing bubbles exploding, and a global deleveraging of the financial system of historical proportions. At the beginning of the crash it seemed like every other week the market was being saved by rumors of Warren Buffet buying out struggling companies. Now we see pundits questioning the savvy of the oracle himself as he loses large sums on the same derivatives he once criticized as a bad idea and sees his prized AAA credit rating for Berkshire being threatened. Did anyone expect to see that?

These are indeed interesting times, but there is one thing every investor needs to learn. Expect the unexpected and do not get wrapped up in the euphoria of those around you. There will always be bubbles, crashes and threats to your profitability, but as long as you maintain and objective outlook and think for yourself you will have a feast when there is famine for those who are caught up in the hype.

Allow Yourself To Succeed

By putting in the effort to BECOME a trader you allow yourself the opportunity to one day evolve from saying "I am going to become" a trader to "I am a trader." And that is the ultimate reward.

To say "I am a trader" is a great privilege and achievement, it means you have done something that around 95% of those who tried could not. Congratulations to those who can make this statement and for those just beginning this journey start your evolution by allowing yourself to BECOME a trader.

Good Luck to all,

Jeff

Attached File(s)