I've been trading for several years, and during that journey I have found that you have to find your own style and comfort level.

I live in the Pacific time zone, and hate getting up at the crack of dawn to trade the NY session, and similarly I refuse to stay up all night to trade the London session. I know that everyone says that those are the times you must trade to be successful, but I hope to challenge that thinking.

I also believe in relative simplicity, i.e. no complex indicators or deep analytical thinking.

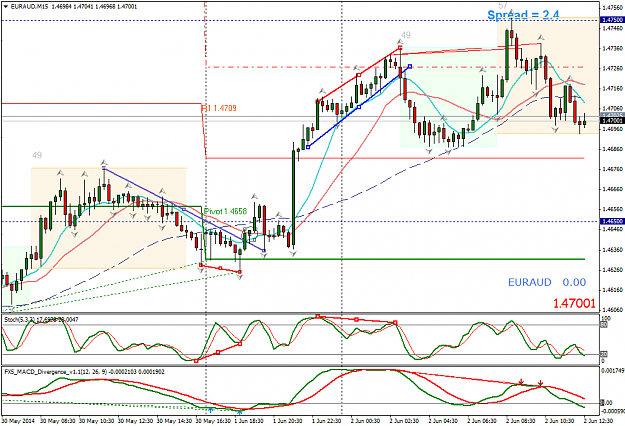

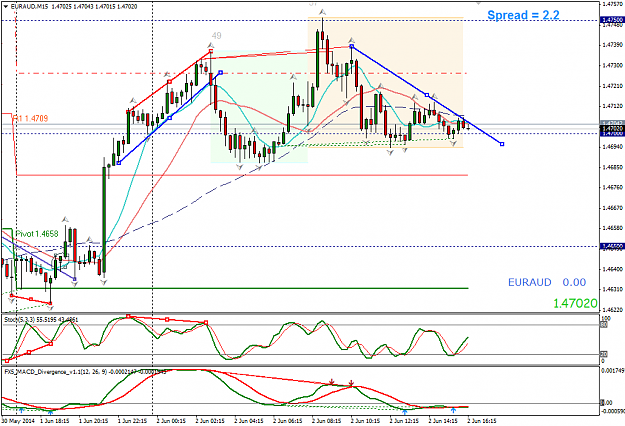

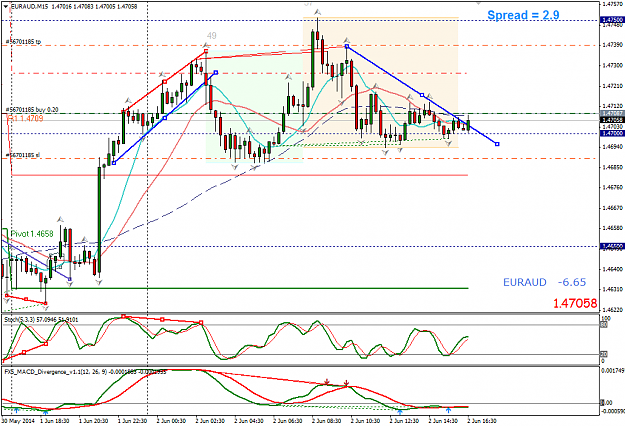

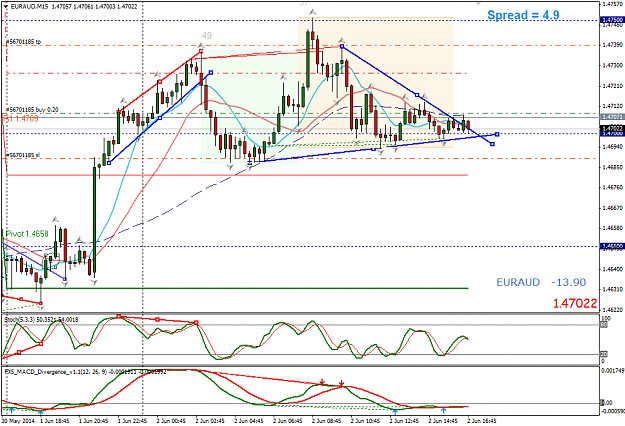

My methods are not new and are straight forward. I like to see some confluence if possible, but in general I use trend line breaks and indicator divergence (that is the only thing I use indicators for).

I trade off the 15 minute charts (I have never been proficient with higher time frames).

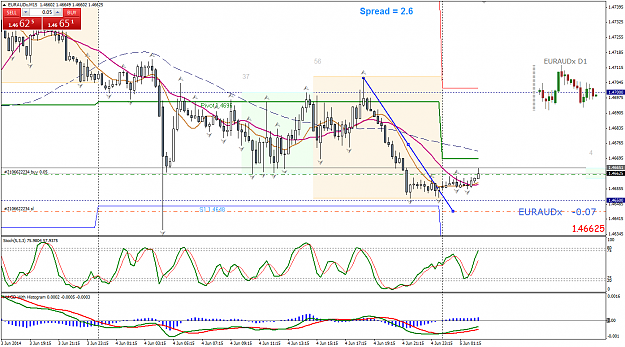

At the moment I am trading only one pair - EUR/AUD

I am attaching last nights chart to give you a better view of my methods. After the NY close I try to put on a trend line with an alert that texts my phone when price crosses. Then I go about my normal activities until I receive an alert. The blue lines on the chart are trend lines and the red lines indicate divergence. There is a small circle on the chart where the first alert occured. There was also a confirming Stochastic divergence.

When I enter a trade, I do so in 2 halves - one with a 20 pip SL and 30pip TP, and the other with just a 30 pip trailing stop and a 20 pip SL.

Last night was exceptional, and a second trade set up which I will explain in the next post.

I live in the Pacific time zone, and hate getting up at the crack of dawn to trade the NY session, and similarly I refuse to stay up all night to trade the London session. I know that everyone says that those are the times you must trade to be successful, but I hope to challenge that thinking.

I also believe in relative simplicity, i.e. no complex indicators or deep analytical thinking.

My methods are not new and are straight forward. I like to see some confluence if possible, but in general I use trend line breaks and indicator divergence (that is the only thing I use indicators for).

I trade off the 15 minute charts (I have never been proficient with higher time frames).

At the moment I am trading only one pair - EUR/AUD

I am attaching last nights chart to give you a better view of my methods. After the NY close I try to put on a trend line with an alert that texts my phone when price crosses. Then I go about my normal activities until I receive an alert. The blue lines on the chart are trend lines and the red lines indicate divergence. There is a small circle on the chart where the first alert occured. There was also a confirming Stochastic divergence.

When I enter a trade, I do so in 2 halves - one with a 20 pip SL and 30pip TP, and the other with just a 30 pip trailing stop and a 20 pip SL.

Last night was exceptional, and a second trade set up which I will explain in the next post.