Hi guys & girls, using my statistical knowledge i`ve put up the most optimal gambling trading system that can be used in forex.But first a little disclaimer:

RISK DISCLAIMER: BY USING THIS SYSTEM YOU AGREE TO NOT HOLD ME RESPONSIBLE FOR ANY FINANCIAL OR OTHER TYPE OF LOSSES OCCURRING BY USING THIS SYSTEM, NOR FOR ANY OTHER INFORMATION NOR FILE WHICH IS PRESENT IN THIS THREAD. IT IS A GAMBLING SYSTEM, SO IN THE LONG TERM THIS WILL LOSE YOU MONEY, BUT IN THE SHORT TERM IT CAN BE PROFITABLE.IT IS A VERY VERY HIGH RISK SYSTEM,IT COULD WIPE OUT YOUR ENTIRE ACCOUNT, SO MAKE SURE YOU UNDERSTAND THE RISKS OF IT, AND DON'T RISK MORE MONEY THAN YOU CAN AFFORD.

1)BASIC STATISTICS UPON WHICH I BUILT THE SYSTEM (i know its boring but its useful to read it):

Using all my statistical knowledge, i will show you how to maximize your gambling chances with this system.Most of you know about me that i dont like using indicators of any sort, but in this thread we will make an exception.The Bollinger Band and a Simple Moving average will guide us.Most of you dont know how to use the BB correctly, so i will show you how to use them correctly.

First of all, the Bollinger Band is not a range bouncing indicator or any of that sort, by using it as a range bound indicator to buy at low band sell at high band, is the biggest mistake one can make.The BB is a statistical tool, and measures the standard deviation of the distribution of the candlesticks.

For those of you who dont know anything about statistics, you can learn quick the basics here:

http://en.wikipedia.org/wiki/Standard_deviation

http://en.wikipedia.org/wiki/Probability_distribution

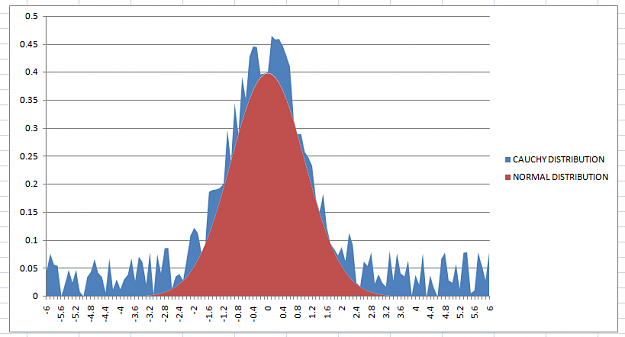

The system will use the "3 sigma rule" but we will use 7 sigma to ensure our odds of losing to be very very small.If the price is normally distributed, then we'd have a 99.999999999744% winrate.But PipMeUp showed that the price follows somewhat a Cauchy distribution which has a fat tail, so if we use even a 7 sigma distance for the STOPLOSS, our winrate will be less than that because the price has a bigger chance to deviate away from the median of a certain period, we use 5 days, but the winrate will be still very high.

http://www.forexfactory.com/showthre...58#post6646358

Here is a little spreadsheet to calculate it:

But the difference is that a Cauchy Distribution has an infinite range, whereas the forex market cannot have an infinite range because of liquidity, so in any way the price must reverse at some point (less chance during Quantitavie Easing when the Central Banks pump liquidity).But still have a fat tail, so we must use a very high deviation to counter that.

So because of this its hard to calculate exactly the winrate but its still higher than 95% presented in my system.I will rely on my backtest data to estimate the winrate.

==============================================================================================

2) PHILOSOPHY OF THE SYSTEM

The system will lose in the long term, and 1 loss can wipe out a significant portion of the account (OR CAN WIPE IT OUT COMPLETELY) , but the system has a so high winrate that it is very unlikely,nearly impossible that a loss can occur.So the longer you use it, the most likely the loss will occur (of course the outcome of each trade is statistically independent but still, the longer you try eventually you will take a loss at some point).

Because of this, since we have a very very high probability of succes, we must take advantage of it, be incrementing the LOT size acordingly to it.

So you cant use this system indefinitely, have to stop at some point or risk losing everything, but hopefully before a loss will come to wipe everything, we can already make much money.Its also good to withdraw cash regularly after all trades are closed, but dont close a trade prematurely.

We could use the lot formula which would increment the lot size accordingly to risk a certain % of the account balance.But why bother? Instead to maximize the efficiency of our advantage of the winrate, we will always increment the LOT size, but make sure if the SL will be very wide to not stop incrementing it. You dont want to get a margin call, and also use smaller leverage for this.

So the risk is very high, but also the winrate, and the potential reward too, so make sure you can afford the risk.1 loss could wipe out the entire account, but the chances of it is still remotely small.

==============================================================================================

3) THE SYSTEM

You will only need a Bollinger Band and a Simple Moving Average, the system can be automated, but it can be used manually too.

Since our system profits from the distribution of candlesticks, and since the distribution of the price has a small chance of occurring in the tail of its distribution graph, we will use a very high period BB.

Pair: Smallest spread pair ,the smaller the spread the better the chances, so EUR/USD

Timeframe: H1 (1 HOUR CHART)

Bollinger Band: Use it on H1 (1 hour chart) and set it to period 120 = 24*5 , so it will look at the distibutions of the past 120 hours, a.k.a last 5 days of trading.Since the price sentiment usually changes weekly, the BB will learn the distribution of sticks within a week.Set the deviation to 7.

Moving Average: Timeframe H1, period 120, price close, and simple moving average

The middle line of the BB is exactly the SMA if you wondered, but it will give you a better visualization if you set the MA to another color

BUY ENTRY: If the price closed or simply moved above the SMA, and previously it was below or equal to the SMA, you enter long

SELL ENTRY: If the price closed or simply moved below the SMA, and previously it was above or equal to the SMA, you enter short

You dont have to wait for the price to close, since a close of a stick on H1 is 1 hour, and you might miss your 4 pip trade chance, the quicker you enter after the price penetrated above/below the SMA, the better the chances.

TAKEPROFIT: STOPLEVEL + 1 or 2 pipette , the smaller the TP the better the chances, so the smallest TP is your STOPLEVEL, my broker gives me a 40 pipette STOPLEVEL on the E/U + 1 or 2 pipettes depending on the volatility is 42 pipette on 5 digit broker or 4.2 pips ~ 4 pips on 4 digit broker.If your STOPLEVEL is bigger or smaller on the E/U, you have to calculate it.

BUY STOPLOSS: Exactly at the lower band of the Bollinger Band, so the chance of losing is 7 sigma small

SELL STOPLOSS: Exactly at the upper band of the Bollinger Band, so the chance of losing is 7 sigma small

You might think the RR is too small, but its mathematically proven that the chances of hitting your stop is very small, since we use a 7 sigma deviation,its very very small.Besides way its better than a NO SL system, and than a fixed SL system.You SL is dynamically set according to the distribution of candlesticks in your chart.

LOT SIZE: Since there is no point in adjusting the LOT to the % of risk of capital since our SL is small, we want to make the most cash possible until a loss comes and wipes our account.So the system uses 1% of the account balance (just to not get a margin call, but you can use more if you have more capital & small leverage).

The formula to convert that into LOT is: LOT = ACCOUNTBALANCEINCASH * RISKPERCENT/10000

So for 100$ the LOT = 100* 1/10000 = 0.01 in MT4 lot units or 1000 LOT UNITS (1 MICROLOT)

And adjust the lot size as your account increases.

ALSO MAKE SURE: STOPLOSSSIZE * TICKSIZE * LOTUNITS < FREEMARGIN , to not get a margin call , use smaller lot size if necessary!

, use smaller lot size if necessary!

FREEMARGIN = (ACCOUNTBALANCE - MARGIN REQUIREMENT)

NOTICES: Make sure your leverage is small not more than preferably 1:50 or 1:25 not more, so dont get a margin call when your SL will be very wide, and if you dont have enough cash in the account use smaller than 10% of your balance.Try to not enter on news, make sure your slippage is small, and the spread too.Also never move your SL or TP, or you compromise the system, so your trades could be on for days, so if you might get swap bonuses overnight or pay the swap depending on the currency, but with the EUR/USD you will lose a bit money there because of negative swaps , but not much.

FACTORS WHICH CAN IMPROVE THE PROBABILITY OF SUCCES:

RISK DISCLAIMER: BY USING THIS SYSTEM YOU AGREE TO NOT HOLD ME RESPONSIBLE FOR ANY FINANCIAL OR OTHER TYPE OF LOSSES OCCURRING BY USING THIS SYSTEM, NOR FOR ANY OTHER INFORMATION NOR FILE WHICH IS PRESENT IN THIS THREAD. IT IS A GAMBLING SYSTEM, SO IN THE LONG TERM THIS WILL LOSE YOU MONEY, BUT IN THE SHORT TERM IT CAN BE PROFITABLE.IT IS A VERY VERY HIGH RISK SYSTEM,IT COULD WIPE OUT YOUR ENTIRE ACCOUNT, SO MAKE SURE YOU UNDERSTAND THE RISKS OF IT, AND DON'T RISK MORE MONEY THAN YOU CAN AFFORD.

1)BASIC STATISTICS UPON WHICH I BUILT THE SYSTEM (i know its boring but its useful to read it):

Using all my statistical knowledge, i will show you how to maximize your gambling chances with this system.Most of you know about me that i dont like using indicators of any sort, but in this thread we will make an exception.The Bollinger Band and a Simple Moving average will guide us.Most of you dont know how to use the BB correctly, so i will show you how to use them correctly.

First of all, the Bollinger Band is not a range bouncing indicator or any of that sort, by using it as a range bound indicator to buy at low band sell at high band, is the biggest mistake one can make.The BB is a statistical tool, and measures the standard deviation of the distribution of the candlesticks.

For those of you who dont know anything about statistics, you can learn quick the basics here:

http://en.wikipedia.org/wiki/Standard_deviation

http://en.wikipedia.org/wiki/Probability_distribution

The system will use the "3 sigma rule" but we will use 7 sigma to ensure our odds of losing to be very very small.If the price is normally distributed, then we'd have a 99.999999999744% winrate.But PipMeUp showed that the price follows somewhat a Cauchy distribution which has a fat tail, so if we use even a 7 sigma distance for the STOPLOSS, our winrate will be less than that because the price has a bigger chance to deviate away from the median of a certain period, we use 5 days, but the winrate will be still very high.

http://www.forexfactory.com/showthre...58#post6646358

Here is a little spreadsheet to calculate it:

Attached File(s)

But the difference is that a Cauchy Distribution has an infinite range, whereas the forex market cannot have an infinite range because of liquidity, so in any way the price must reverse at some point (less chance during Quantitavie Easing when the Central Banks pump liquidity).But still have a fat tail, so we must use a very high deviation to counter that.

So because of this its hard to calculate exactly the winrate but its still higher than 95% presented in my system.I will rely on my backtest data to estimate the winrate.

==============================================================================================

2) PHILOSOPHY OF THE SYSTEM

The system will lose in the long term, and 1 loss can wipe out a significant portion of the account (OR CAN WIPE IT OUT COMPLETELY) , but the system has a so high winrate that it is very unlikely,nearly impossible that a loss can occur.So the longer you use it, the most likely the loss will occur (of course the outcome of each trade is statistically independent but still, the longer you try eventually you will take a loss at some point).

Because of this, since we have a very very high probability of succes, we must take advantage of it, be incrementing the LOT size acordingly to it.

So you cant use this system indefinitely, have to stop at some point or risk losing everything, but hopefully before a loss will come to wipe everything, we can already make much money.Its also good to withdraw cash regularly after all trades are closed, but dont close a trade prematurely.

We could use the lot formula which would increment the lot size accordingly to risk a certain % of the account balance.But why bother? Instead to maximize the efficiency of our advantage of the winrate, we will always increment the LOT size, but make sure if the SL will be very wide to not stop incrementing it. You dont want to get a margin call, and also use smaller leverage for this.

So the risk is very high, but also the winrate, and the potential reward too, so make sure you can afford the risk.1 loss could wipe out the entire account, but the chances of it is still remotely small.

==============================================================================================

3) THE SYSTEM

You will only need a Bollinger Band and a Simple Moving Average, the system can be automated, but it can be used manually too.

Since our system profits from the distribution of candlesticks, and since the distribution of the price has a small chance of occurring in the tail of its distribution graph, we will use a very high period BB.

Pair: Smallest spread pair ,the smaller the spread the better the chances, so EUR/USD

Timeframe: H1 (1 HOUR CHART)

Bollinger Band: Use it on H1 (1 hour chart) and set it to period 120 = 24*5 , so it will look at the distibutions of the past 120 hours, a.k.a last 5 days of trading.Since the price sentiment usually changes weekly, the BB will learn the distribution of sticks within a week.Set the deviation to 7.

Moving Average: Timeframe H1, period 120, price close, and simple moving average

The middle line of the BB is exactly the SMA if you wondered, but it will give you a better visualization if you set the MA to another color

BUY ENTRY: If the price closed or simply moved above the SMA, and previously it was below or equal to the SMA, you enter long

SELL ENTRY: If the price closed or simply moved below the SMA, and previously it was above or equal to the SMA, you enter short

You dont have to wait for the price to close, since a close of a stick on H1 is 1 hour, and you might miss your 4 pip trade chance, the quicker you enter after the price penetrated above/below the SMA, the better the chances.

TAKEPROFIT: STOPLEVEL + 1 or 2 pipette , the smaller the TP the better the chances, so the smallest TP is your STOPLEVEL, my broker gives me a 40 pipette STOPLEVEL on the E/U + 1 or 2 pipettes depending on the volatility is 42 pipette on 5 digit broker or 4.2 pips ~ 4 pips on 4 digit broker.If your STOPLEVEL is bigger or smaller on the E/U, you have to calculate it.

BUY STOPLOSS: Exactly at the lower band of the Bollinger Band, so the chance of losing is 7 sigma small

SELL STOPLOSS: Exactly at the upper band of the Bollinger Band, so the chance of losing is 7 sigma small

You might think the RR is too small, but its mathematically proven that the chances of hitting your stop is very small, since we use a 7 sigma deviation,its very very small.Besides way its better than a NO SL system, and than a fixed SL system.You SL is dynamically set according to the distribution of candlesticks in your chart.

LOT SIZE: Since there is no point in adjusting the LOT to the % of risk of capital since our SL is small, we want to make the most cash possible until a loss comes and wipes our account.So the system uses 1% of the account balance (just to not get a margin call, but you can use more if you have more capital & small leverage).

The formula to convert that into LOT is: LOT = ACCOUNTBALANCEINCASH * RISKPERCENT/10000

So for 100$ the LOT = 100* 1/10000 = 0.01 in MT4 lot units or 1000 LOT UNITS (1 MICROLOT)

And adjust the lot size as your account increases.

ALSO MAKE SURE: STOPLOSSSIZE * TICKSIZE * LOTUNITS < FREEMARGIN , to not get a margin call

FREEMARGIN = (ACCOUNTBALANCE - MARGIN REQUIREMENT)

NOTICES: Make sure your leverage is small not more than preferably 1:50 or 1:25 not more, so dont get a margin call when your SL will be very wide, and if you dont have enough cash in the account use smaller than 10% of your balance.Try to not enter on news, make sure your slippage is small, and the spread too.Also never move your SL or TP, or you compromise the system, so your trades could be on for days, so if you might get swap bonuses overnight or pay the swap depending on the currency, but with the EUR/USD you will lose a bit money there because of negative swaps , but not much.

FACTORS WHICH CAN IMPROVE THE PROBABILITY OF SUCCES:

- the smaller the Takeprofit the better, but a STOPLEVEL + a few pipette sized TP is good

- the smaller the spread & slippage the better

- the less volatility in the pair the better

- the higher liquidity the better (assuming that the volatility is low)

- the higher the deviation the better (7 sigma deviation is enough)

- after the price moves below/above the simple moving average , the quicker you put in the BUY/SELL order, the better chance of winning it, dont let the price move too far away from the SMA because the odds of failure increase by every pip away from the SMA.

- the longer the period of the BB the better, we use 5 days price distribution (24*5 hours =120 period) which is fairly enough, because the sentiment changes somewhat every week, so the BB will contain the entire weekly distribution of the price, so the price deviating away for than 7 sigma from the weekly median is very very small, so perfect option to put the STOPLOSS outside it.

- stay away from all news, and high volatility events, but dont close the trades manually once they are on, and never move the TP or the SL

LATEST VERSION 1.5 CAN BE SEEN HERE (post #330):

http://www.forexfactory.com/showthre...48#post7248548

EXPERT ADVISOR FOR V1.5 (post #352):

http://www.forexfactory.com/showthre...53#post7256253

"There's a sucker born every minute" - P.T. Barnum