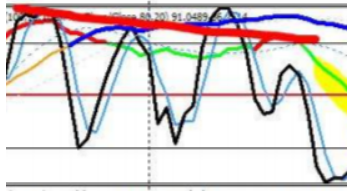

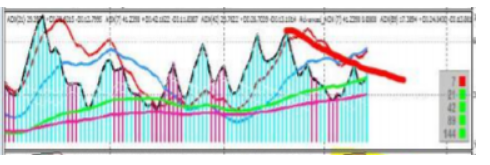

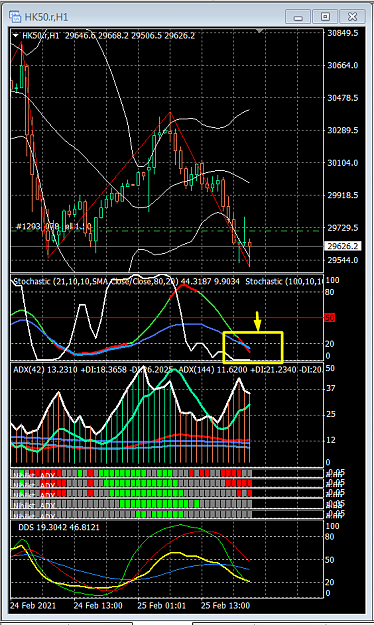

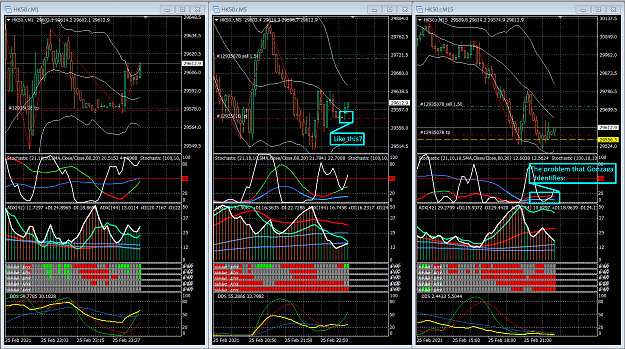

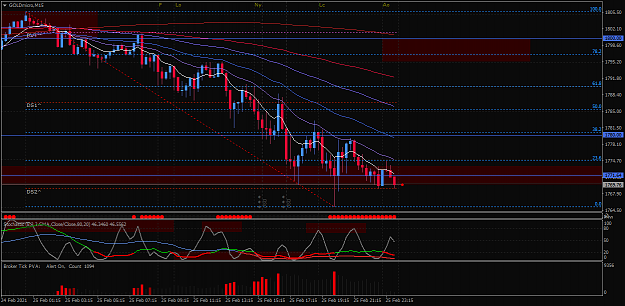

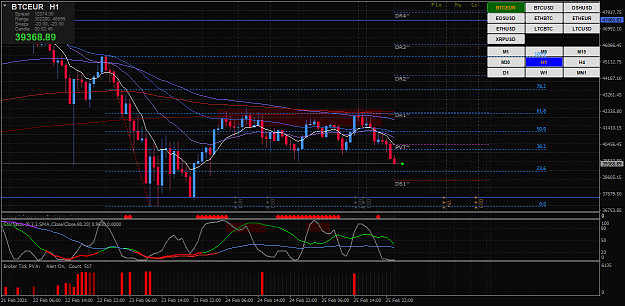

Multiple stoch-8's "zig-zag-ing" in or towards 20 zone. Got this from the FXlocater alien checklists in this thread. I see this as a wave in a wave. So the stoch-8 zig-zag pattern or what JPadvisor calls snake-pattern (correct me if I'm wrong JP), together with stoch-21/45-degree rule I see as a big thing. This was happening on GBPMXN W1 chart that I posted. To wrap things up, I see the zig-zag stochastic 8 pattern within the stochastic 21 with 45*-rule as a sort of a mini wave in a bigger wave. As in stoch 8 the mini wave and the stoch 21 is engulfing it.

Emotions vs Rules