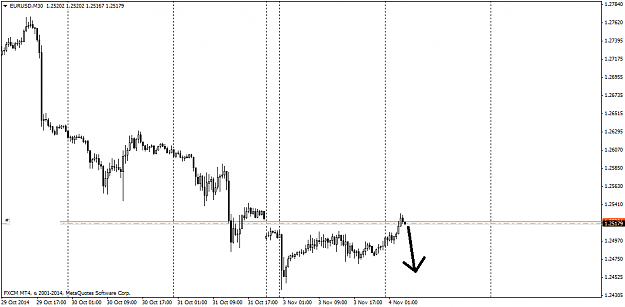

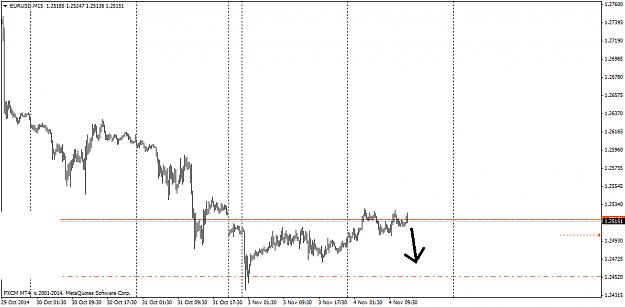

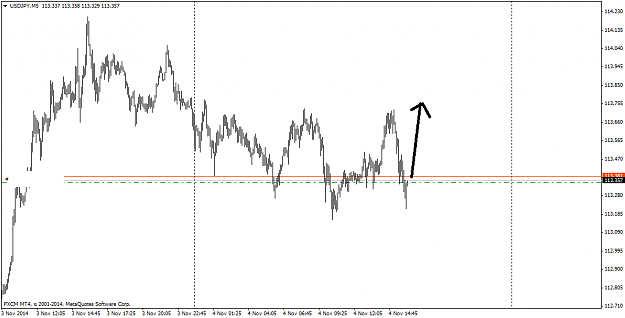

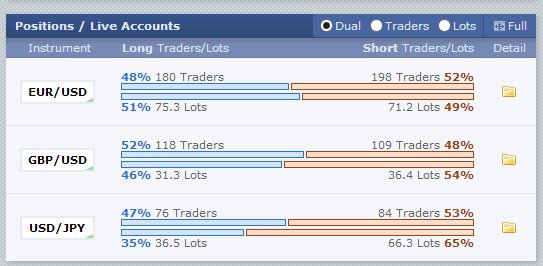

Disliked{quote} I am just aiming to catch technical pullback. It had gone to almost 200% extension and there are often some kind of pullbacks. Besides that there was that tight range which I find just perfect for this kind of situation. But to be honest - I missed that there are news and because of that I do slightly regret taking that trade - I could have been stepped out already.Ignored

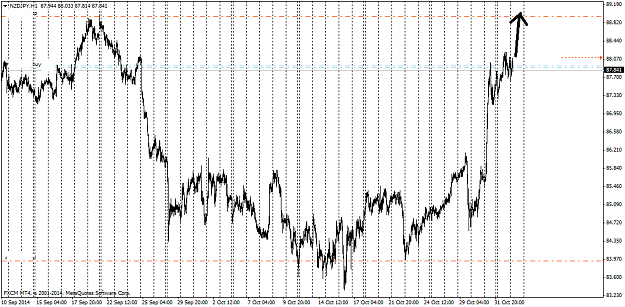

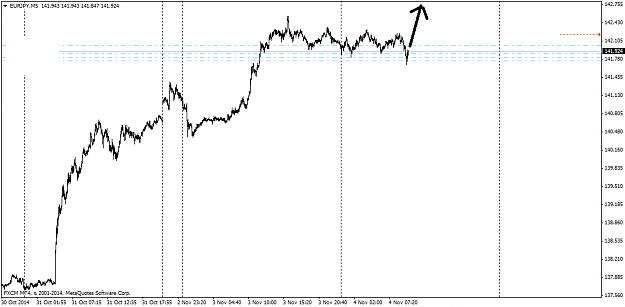

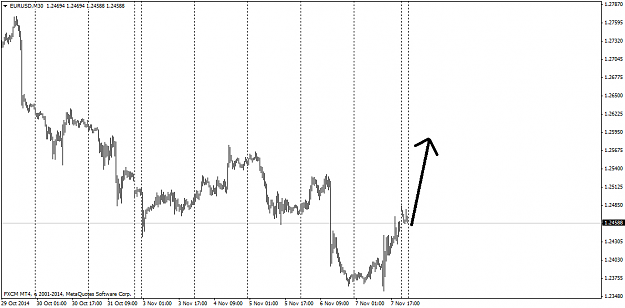

The big thing about the jpy pairs is that bank of japan have expanded its qe some days ago, printing now annually around 84 trillion yens (from around 50 previously), now that's a 30trillion yen difference, and the market is just pricing in this.

With this i don't say that jpy pairs will continue going up of 200pips everyday forever, mmm i really have no idea where the equilibrium price will be, but for now they will continue going up untill such point is reached, regardless of 161% 200% 261% extensions etc., anyway that's just how i see xxx/jpy pairs.

Let's be careful!