I guess this is a sequel to my thread about managing an open position. I'd like to ask for your advice on opening a position in the first place.

I totally disagree with the common teaching that says your exit is more important than you entry. I've accumulated enough live trading experience to say that your entry is AS CRUCIAL AS your exit. Many of my good trades end up as a loss as the entry was terrible.

To me, a bad entry = big drawdown/repeated SL hit = clouded mind to spot real entry = may hedge the opposite position now that my belief is shaken = big loss of money over time.

To me, a good entry, even though ended being a lost, does give me a satisfaction. I don't to rely on luck on trading, but on skill. And a great entry reflects a great skill of a trader.

Often when I had the general bias right, my stop is hit, or a hedge and martingale is opened, only to see the price went to my original direction, but leaving me behind with a big mess of hedge and martingale. I'm furious at the number of times it has happened to me. It was a stupid entry with even stupider exit.

The other thing that I also notice about making an entry is that a market entry often slips worse than a pending order entry.

Question:

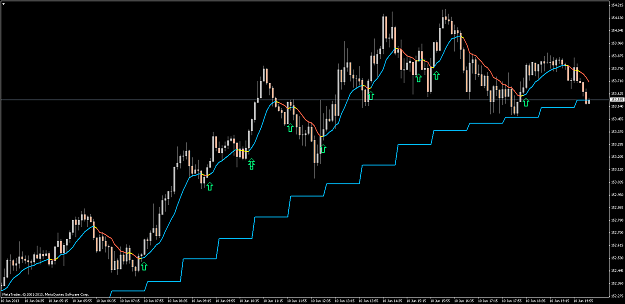

How do you make your entry on your system? Live candle (market entry regardless of time)? Closed candle (market entry but entering only at specific time e.g. at the end of the hour)? Indicator signal (when price crosses your indicator regardless of time)? Pending orders (setting up pending order on where you'd like to enter the market regardless of time)?

Is there really a best method to enter the market regardless of what your trading system is?

I totally disagree with the common teaching that says your exit is more important than you entry. I've accumulated enough live trading experience to say that your entry is AS CRUCIAL AS your exit. Many of my good trades end up as a loss as the entry was terrible.

To me, a bad entry = big drawdown/repeated SL hit = clouded mind to spot real entry = may hedge the opposite position now that my belief is shaken = big loss of money over time.

To me, a good entry, even though ended being a lost, does give me a satisfaction. I don't to rely on luck on trading, but on skill. And a great entry reflects a great skill of a trader.

Often when I had the general bias right, my stop is hit, or a hedge and martingale is opened, only to see the price went to my original direction, but leaving me behind with a big mess of hedge and martingale. I'm furious at the number of times it has happened to me. It was a stupid entry with even stupider exit.

The other thing that I also notice about making an entry is that a market entry often slips worse than a pending order entry.

Question:

How do you make your entry on your system? Live candle (market entry regardless of time)? Closed candle (market entry but entering only at specific time e.g. at the end of the hour)? Indicator signal (when price crosses your indicator regardless of time)? Pending orders (setting up pending order on where you'd like to enter the market regardless of time)?

Is there really a best method to enter the market regardless of what your trading system is?