In my experience, this method produces high probability successful trades.

5 minute time frame (other time frames will work as well)

EURUSD, GBPUSD, AUDUSD, USDJPY, EURJPY (any pair that has enough daily movement)

New York and London sessions work best because of liquidity

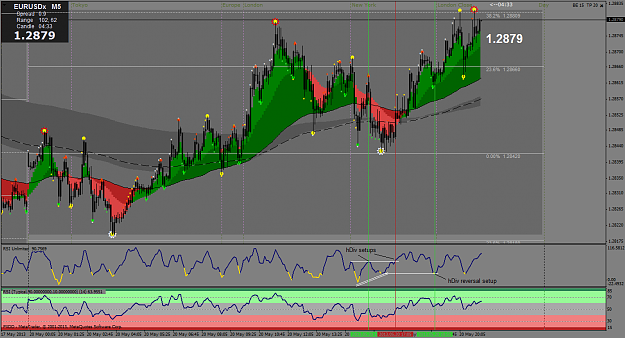

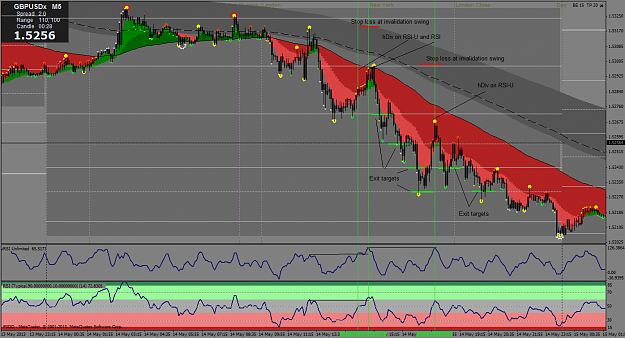

Trend Setup:

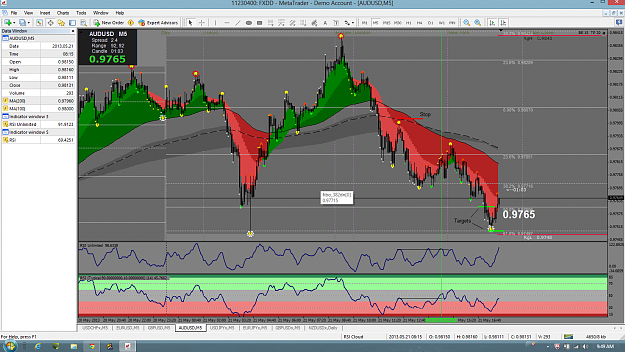

Look for hidden divergence between the oscillators (RSI Unlimited and/or the standard RSI) and price swings shown by the Semafor indicator. Match up significant swings in price with swings on the oscillator and look for the the oscillator to exceed its previous swing while price does not. This often occurs at a Daily Average Fibo level. Take the trade in favor of the trend and target a Fibo level for exit. Set the stop loss just beyond the swing in price used to create the hidden divergence, or if that is too far away, set it just beyond a fib level, or beyond the moving average cloud.

The RSI Unlimited and RSI indicators have overbought and oversold settings within them that can be manually set to notify you when the oscillator breaches the level you set. You can set the levels of the recent swing and then be notified when it is breached -- so you can determine if it is an entry or not.

Reversal Setup:

Look for regular divergence in the RSI Unlimited after a sustained move in price. Then wait for a hidden divergence setup to appear in the RSI Unlimited in the opposite direction.

5 minute time frame (other time frames will work as well)

EURUSD, GBPUSD, AUDUSD, USDJPY, EURJPY (any pair that has enough daily movement)

New York and London sessions work best because of liquidity

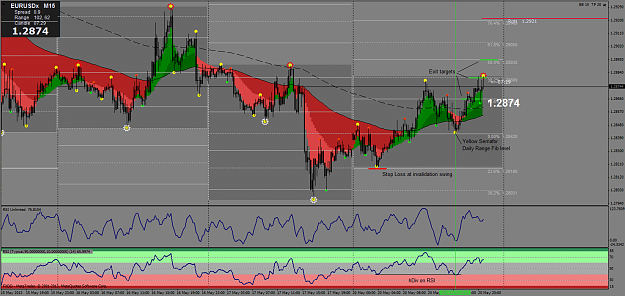

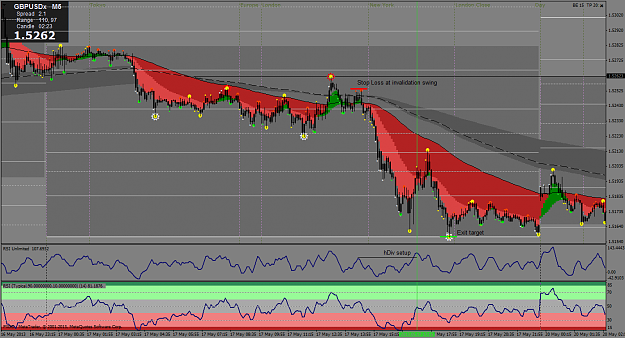

Trend Setup:

Look for hidden divergence between the oscillators (RSI Unlimited and/or the standard RSI) and price swings shown by the Semafor indicator. Match up significant swings in price with swings on the oscillator and look for the the oscillator to exceed its previous swing while price does not. This often occurs at a Daily Average Fibo level. Take the trade in favor of the trend and target a Fibo level for exit. Set the stop loss just beyond the swing in price used to create the hidden divergence, or if that is too far away, set it just beyond a fib level, or beyond the moving average cloud.

The RSI Unlimited and RSI indicators have overbought and oversold settings within them that can be manually set to notify you when the oscillator breaches the level you set. You can set the levels of the recent swing and then be notified when it is breached -- so you can determine if it is an entry or not.

Reversal Setup:

Look for regular divergence in the RSI Unlimited after a sustained move in price. Then wait for a hidden divergence setup to appear in the RSI Unlimited in the opposite direction.

Attached File(s)