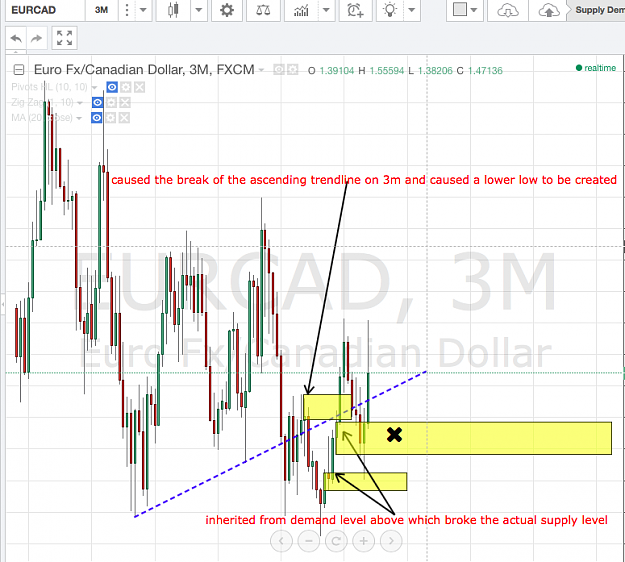

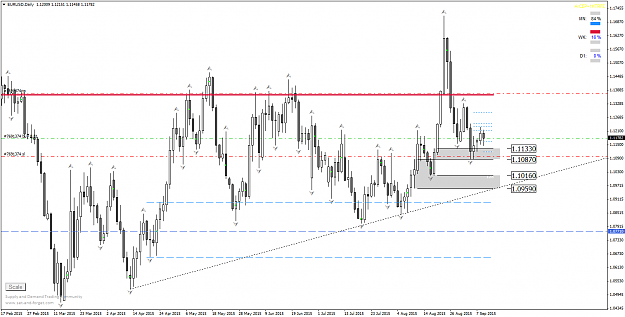

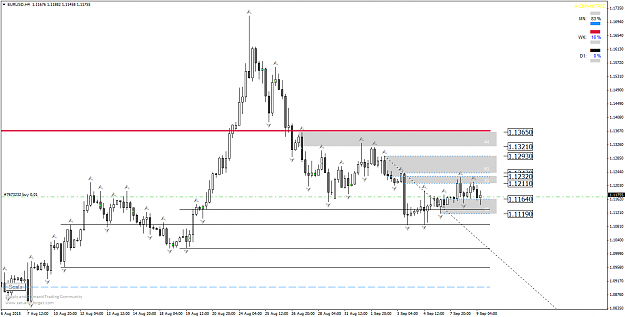

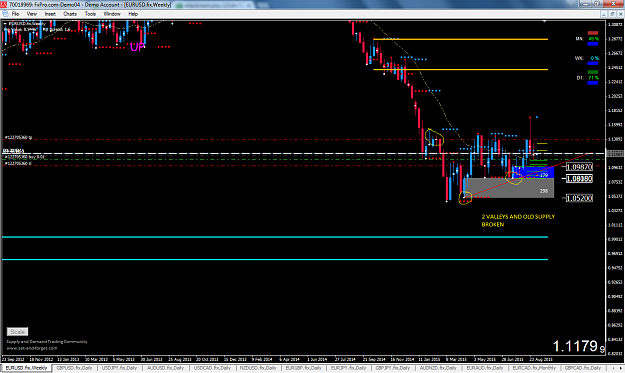

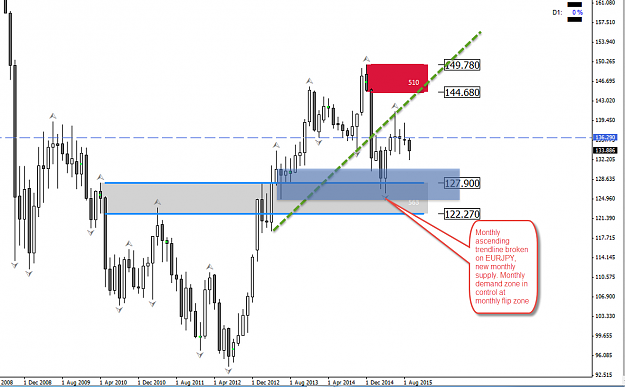

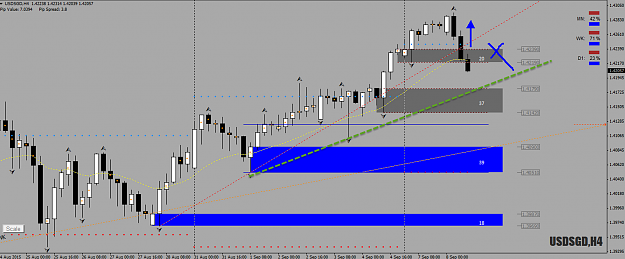

you also had an ascending trend line first vally was the lower demand the next was the demand onto if you look carefully you will see the higher high but it was broken quite quickly like alfonso already stated. but that zone was also a 3M zone which broke the ascending trend line on the 3m but was soon removed as seen on my chart

Disliked{quote} I think your levels are also true but it seems few are missed including the CP that Alfonso had drawn just because you neglect a flip zone and your chart is missing the trend line analysis. For example at the time of my vertical line, there would be a broken trend line which would be creating two demands on top of each other and your two supplies at the bottom would be supplies even there haven't been a historical low but as they broke the opposing demands. Also if you trace a bit, you can clearly see that when price had made to the lowest...Ignored