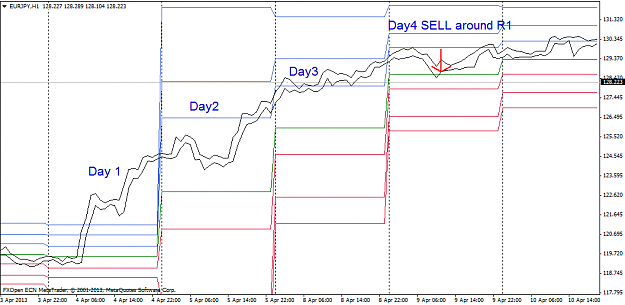

This is a simple setup, when it occurs it is a high probability for a reversal.

In an uptrend If price reaches the R1 but not tests the PP (pivot point) for three days in a row, the 4th day is a great day to sell at R1 targeting the PP. The same is for a downtrend if price reaches S1 but not comes back to the PP for three days it is a high probability trade to buy at S1 on the 4th day targeting the PP.

This is only a setup I include here, in case you gonna use it, use it with your own money management and own risk. This is based on only visual back testing on eur/jpy. And I have to add, you not gonna get many trades a month. Good luck.

In an uptrend If price reaches the R1 but not tests the PP (pivot point) for three days in a row, the 4th day is a great day to sell at R1 targeting the PP. The same is for a downtrend if price reaches S1 but not comes back to the PP for three days it is a high probability trade to buy at S1 on the 4th day targeting the PP.

This is only a setup I include here, in case you gonna use it, use it with your own money management and own risk. This is based on only visual back testing on eur/jpy. And I have to add, you not gonna get many trades a month. Good luck.

Attached File(s)