Let me tell you guys…

This is a painful thread to start. But considering my trading biography I think I am morally obligated to propose this little round table. It might be provocative for some, for me (and I hope for other rookies too), it’s somehow cathartic. So, bear with me fellow traders!

These last few days, using Tim Wilcox’s “trading plan template”, I objectively came across with some personal difficulties that might be permanently impeditive to the possibility of success. Also considering that (they say) 90 to 95% of traders fail to be consistent, I might deduce that these impediments are scaringly frequent and transversal to those who start their turtle walk through the business of trading.

This thread is an impudic description of my failure to understand this business. Through the expression of my frailties I hope that others can join me and start a dynamic group of mutual support that might help us cope with our limitations. If this is not your thing, no worries, use this thread the way you want. There are no limitations and no rules for the expression of our frustrations here… as long as you keep within minimal ethical standards, fire away!

First and obvious considerations:

1. Trading the forex market for a profit is hard! As hard as it gets! Fewer intellectual challenges are as hard as this. But so managing a restaurant in New York! I keep believing it is possible to be profitable… just don’t know why!

2. There is no holy-grail. This is obviously not debatable.

3. I never met a successful forex trader in person. That’s as hard as finding a gnome! But they say they exist…

My frailties:

I will share my frailties point by point in the hopes you can identify with it (or not). So let’s start this psychological stripping:

1. I’m arrogant: I always believed I’m intellectually superior. I always believed there is no problem I couldn’t solve. I’m an intellectual dictator. If I think it, it must be right!

2. I’m skeptic: I have a very hard time believing other fellows systems and strategies. At the first sign of trouble I have a tendency to disbelieve the system. At that moment I lose control.

3. I’m obsessive: If I fail I tend to keep at it until it hurts. And I like to have the feeling I can control all the variables. Considering the randomness of this business you might imagine what being a control freak means… total psychological disruption! In the end I just lose my confidence real easy!

4. I’m ambitious: I hate to lose. I want to win for the sake of winning. I must be the best at all times. I want to chase the markets to recover losses. In the trading business that’s a very good way to ruin your account.

5. I’m emotionally labile: all the characteristics above produce a very unstable mental situation. When winning I become an arrogant jackass, when losing I become clinically depressed. What a fruit cake!

My vicious circle of failure:

Let’s combine these characteristics and see what we get.

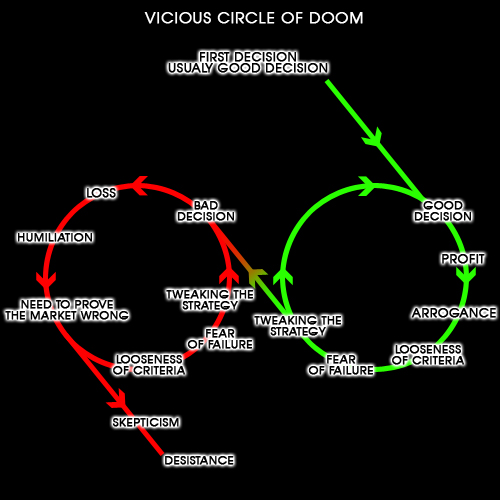

First I look at a chart, I examine it and I act according to my strategy. All good. Usually I get it right the first time. I become intellectually arrogant. I think I know what’s happening and I act in a relaxed more instinctive manner. The impulsiveness get me a little off track. I start to get scared with the possibility of losing. I tweak the system to protect myself. Then all hell breaks loose. I get into my position with an ambivalent felling to it. On one side there is my belief of the market development, on the other side there is the fact that I didn’t follow the system and I know that that might change the results. I start to get all doubtful and at the first sign of loss I panic. I retweak the system to protect myself even more. Even get trading frozen. I start to have serious doubts and all that system changes get me to lose more and more frequently. I start disbelieve my strategy. I start considering all strategies to be “snake oil”. I eventually give up. I stop believing that it might be possible to be successful at the trading business.

These cycles last for, normally, 3 to 6 months. Then I take a vacation of 3 to 4 months: I cannot look at the charts. I feel traumatized and cannot get into it again. After that time out, one day I look at a chart again and then an amazing thing happens. The trading bug bites me again and I jump into it even stronger than before.

This story, my friends, have been lasting for 4 years now.

The only thing I am proud of is that in all this deleterious vicious circle I haven’t spent a dime of real money… at least I’m that wise!

I designed this system of variables in a schema that you can see in anex. This way, the interactions are more clear (I hope). See how the green circle (circle of profit) feeds the red one (circle of loss) and not the way around. See how my skepticism is the factor of desistance. See how my tweaking is the central deleterious reaction. I think that this is nothing new for you guys but at least I got it on paper, for everybody to see, and for me to look at. This way I cannot escape.

I leave you for now saying…Hi, I’m Mr Short and I’m a bad forex trader!

This is a painful thread to start. But considering my trading biography I think I am morally obligated to propose this little round table. It might be provocative for some, for me (and I hope for other rookies too), it’s somehow cathartic. So, bear with me fellow traders!

These last few days, using Tim Wilcox’s “trading plan template”, I objectively came across with some personal difficulties that might be permanently impeditive to the possibility of success. Also considering that (they say) 90 to 95% of traders fail to be consistent, I might deduce that these impediments are scaringly frequent and transversal to those who start their turtle walk through the business of trading.

This thread is an impudic description of my failure to understand this business. Through the expression of my frailties I hope that others can join me and start a dynamic group of mutual support that might help us cope with our limitations. If this is not your thing, no worries, use this thread the way you want. There are no limitations and no rules for the expression of our frustrations here… as long as you keep within minimal ethical standards, fire away!

First and obvious considerations:

1. Trading the forex market for a profit is hard! As hard as it gets! Fewer intellectual challenges are as hard as this. But so managing a restaurant in New York! I keep believing it is possible to be profitable… just don’t know why!

2. There is no holy-grail. This is obviously not debatable.

3. I never met a successful forex trader in person. That’s as hard as finding a gnome! But they say they exist…

My frailties:

I will share my frailties point by point in the hopes you can identify with it (or not). So let’s start this psychological stripping:

1. I’m arrogant: I always believed I’m intellectually superior. I always believed there is no problem I couldn’t solve. I’m an intellectual dictator. If I think it, it must be right!

2. I’m skeptic: I have a very hard time believing other fellows systems and strategies. At the first sign of trouble I have a tendency to disbelieve the system. At that moment I lose control.

3. I’m obsessive: If I fail I tend to keep at it until it hurts. And I like to have the feeling I can control all the variables. Considering the randomness of this business you might imagine what being a control freak means… total psychological disruption! In the end I just lose my confidence real easy!

4. I’m ambitious: I hate to lose. I want to win for the sake of winning. I must be the best at all times. I want to chase the markets to recover losses. In the trading business that’s a very good way to ruin your account.

5. I’m emotionally labile: all the characteristics above produce a very unstable mental situation. When winning I become an arrogant jackass, when losing I become clinically depressed. What a fruit cake!

My vicious circle of failure:

Let’s combine these characteristics and see what we get.

First I look at a chart, I examine it and I act according to my strategy. All good. Usually I get it right the first time. I become intellectually arrogant. I think I know what’s happening and I act in a relaxed more instinctive manner. The impulsiveness get me a little off track. I start to get scared with the possibility of losing. I tweak the system to protect myself. Then all hell breaks loose. I get into my position with an ambivalent felling to it. On one side there is my belief of the market development, on the other side there is the fact that I didn’t follow the system and I know that that might change the results. I start to get all doubtful and at the first sign of loss I panic. I retweak the system to protect myself even more. Even get trading frozen. I start to have serious doubts and all that system changes get me to lose more and more frequently. I start disbelieve my strategy. I start considering all strategies to be “snake oil”. I eventually give up. I stop believing that it might be possible to be successful at the trading business.

These cycles last for, normally, 3 to 6 months. Then I take a vacation of 3 to 4 months: I cannot look at the charts. I feel traumatized and cannot get into it again. After that time out, one day I look at a chart again and then an amazing thing happens. The trading bug bites me again and I jump into it even stronger than before.

This story, my friends, have been lasting for 4 years now.

The only thing I am proud of is that in all this deleterious vicious circle I haven’t spent a dime of real money… at least I’m that wise!

I designed this system of variables in a schema that you can see in anex. This way, the interactions are more clear (I hope). See how the green circle (circle of profit) feeds the red one (circle of loss) and not the way around. See how my skepticism is the factor of desistance. See how my tweaking is the central deleterious reaction. I think that this is nothing new for you guys but at least I got it on paper, for everybody to see, and for me to look at. This way I cannot escape.

I leave you for now saying…Hi, I’m Mr Short and I’m a bad forex trader!

Attached Image