Great explanation as always. Thanks.

I don't have enough experience to agree or disagree with the 208.5 target indicated by several experienced members. When the price bounced from 203.75 on March 3, the 50 % retrace to the previous 213.42 high made sense. Perhaps we can say the retrace to 207.9 was close enough.

One thing I am learning from this thread is to not be married to an opinion, but to watch the actual price action.

Anyway, basd on teh current price actions I'll be looking for more shorts next week.

Android...

I don't have enough experience to agree or disagree with the 208.5 target indicated by several experienced members. When the price bounced from 203.75 on March 3, the 50 % retrace to the previous 213.42 high made sense. Perhaps we can say the retrace to 207.9 was close enough.

One thing I am learning from this thread is to not be married to an opinion, but to watch the actual price action.

Anyway, basd on teh current price actions I'll be looking for more shorts next week.

Android...

DislikedInteresting analysis. Why ?

Why would this pair retrace to 208 ? I do not see it

Lets see what is happened this week:

1) feds inject 20 billion last Friday ... market blipped up then continued down trend

2) feds thought oh well that did not work lets inject more ... they inject $200 billion .. markets have best up day in 5 years. Bulls out waving the flag and buying like crazy , mean while the smart money has left the house while retail investors are buying like mad men.

3) markets give most of the gains back by today ( they closed only 50 points above where they opened despite what the Feds injected $220 billion in to the markets)

Lets see what happens next week:

1) CPI was as expected today with the energy component being - 0.1% ..I laughed ... gas in Canada has gone up by a larger % than food did last month ( from 123 per litre to 134 per litre). So they are lying about CPI that is a given as I have experienced inflation right out of my own pocket book today when i went to fill my car with gas.

2) Why are they lying ? because if CPI goes up it mean inflation is going up and they should not cut rates as interest rate hike curbs inflation.

3) Tuesday is the big show .....The market is all excited about a 1% rate cut. Do you honestly think if they were cutting by 1% they would not have made an emergency rate cut today to stop the carnage ?

I think a .5% or less ( the market has .5% built in) rate cut on Tuesday.

scenario 1) rate cut is only 0.5% market not going to like it. They are going to like it even less if there is any mention of rate freeeze or increase.

scenario 2) rate cut is 0.25 % or less with feds waffling about inflation concerns .. markets going to drop 500 point in one day,

scenario 3) feds cut rate by 1% .... marekts will blip up but then drop as this shows panic from fed.

Lets see what is oil today oh $111 ... mmm remember the oil crisis of the 70's... interest rates were going up fast and we had hyper inflation and comparitively ( taking inflation in to consideration) oil was cheaper then

So from a fundamental perspective there is no reason the markets should go up.

Now lets look at the technicals :

today we finished 13 pips off the low of the day = no buyers = bearish.

The very best we could do is retest the 50 % fib of todays move at 202.70 . which is about half way up the weekly bar that formed today.

I doubt very much at this point that we will see 208 before we see 180 zone.

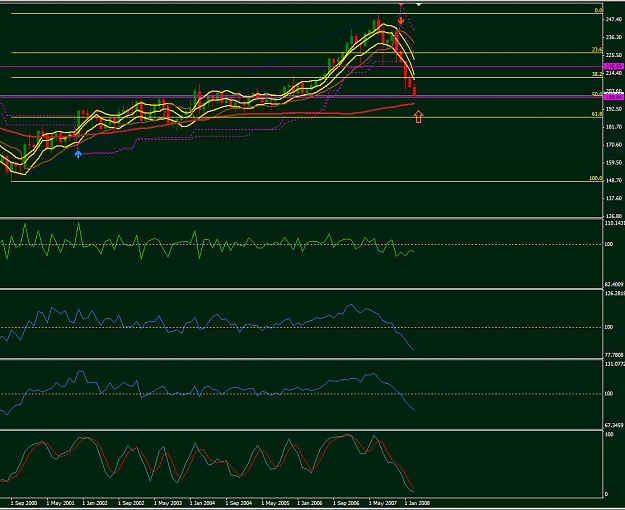

Aslo look at the weekly chart . It is classic step down chart . Where price drops then consolidates , then drops then consolidates.

If you are a newbie swing traders the worst thing you can do right now is go long. Sell into rallies.

Lets see how this plays out next week.Ignored

Regards, Android.