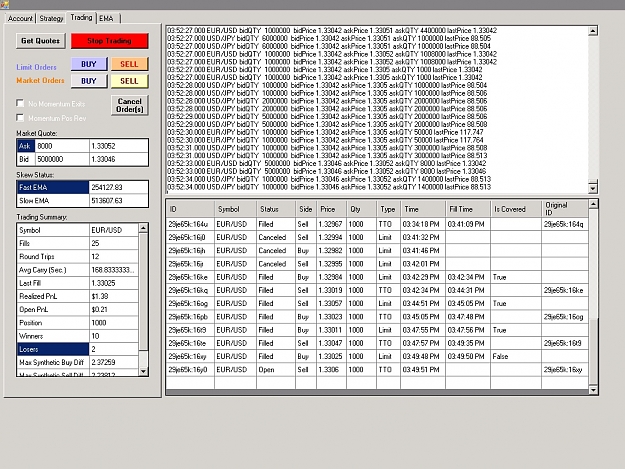

Making some great progress on scalping the EURUSD with low draw downs and nice results

If you would like to help beta test this in demo let me know

This is a much more sophisticated algo but at least it relies on "real" market events.

Glad to to share if anyone is interested. It would be great if someone had experience out there with this on the Quantitative Analysis side so that I can make these even better.

I will continue to share

http://www.forexfactory.com/attachme...1&d=1357924134

If you would like to help beta test this in demo let me know

This is a much more sophisticated algo but at least it relies on "real" market events.

Glad to to share if anyone is interested. It would be great if someone had experience out there with this on the Quantitative Analysis side so that I can make these even better.

I will continue to share

http://www.forexfactory.com/attachme...1&d=1357924134