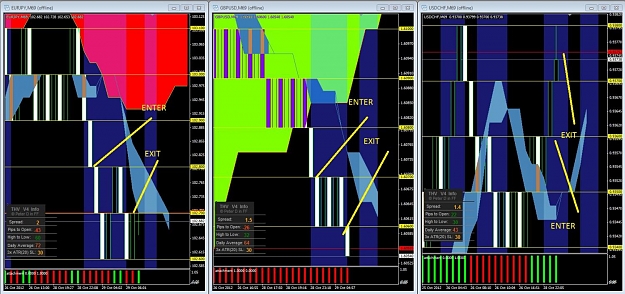

This trade journal is based off the trade system called Ichimoku Cloud Burst found in the Trade Systems in the forum.

I wanted to take all that information I have learned from the posters in that system and show how I applied to my trading. For me the system works and i wanted to focus on what is working and gather feedback from other traders who use the system and as a group create a stronger ever changing system.

Granted its not a holy grail and i dont claim for it be a holy grail its a system that is working right now for me. We all know that market changes anytime it wants too im looking to keep what i have and adapt what i am using to the ever changing market.

I wanted to take all that information I have learned from the posters in that system and show how I applied to my trading. For me the system works and i wanted to focus on what is working and gather feedback from other traders who use the system and as a group create a stronger ever changing system.

Granted its not a holy grail and i dont claim for it be a holy grail its a system that is working right now for me. We all know that market changes anytime it wants too im looking to keep what i have and adapt what i am using to the ever changing market.