There is no ‘holy grail’. But I give you this, a very simple, sensible and profitable system that can be used on any pair. It's not revolutionary, hell it may already be the same as other trading systems, I don't know. But I like to call it true trading so if it's already here then it's worth repeating.

As for time frames again any, but I advise AGAINST 4hr as many brokers have different start/finish times. 1hr is ideal, so is daily for the working man (set and forget)

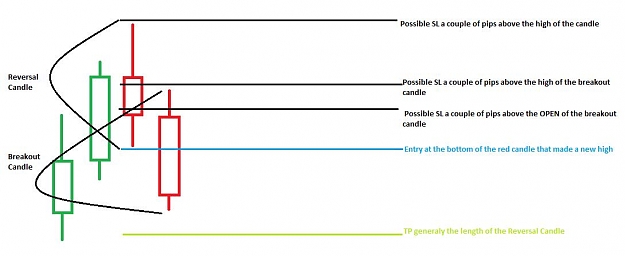

The first chart is a typical 1hr chart, full of highs and lows.

As for time frames again any, but I advise AGAINST 4hr as many brokers have different start/finish times. 1hr is ideal, so is daily for the working man (set and forget)

The first chart is a typical 1hr chart, full of highs and lows.