Hello fellow traders. This is an awesome and an outstading forum. I have been trading actively for about 1 1/2 years. I have learned so much from this forum and very thankful for all of the great indicators that I have also downloaded from here and I wanted to give back something. I believe in sharing and giving and passing it forward. I believe that I have a great simple system and there is always room for improvement so I thought I would post it here and maybe get some feedback on it. I call this system (the pimpster grail)  Anyway this system is so simple and easy any beginner can do it successfully.

Anyway this system is so simple and easy any beginner can do it successfully.

As we all know, the market moves in 3 directions (up, down, and sideways). Some traders like to go with the trend, some trade ranging markets, and others counter trade (most riskier). I am the counter trader. It's not an easy way to trade but IMO it's the best way to trade. If you can master this, I believe that you should have hardly any bad trades and I will show you how. Granted you will not get as many trades as you would prefer, but when you do get a trade it is pretty much as I like to say (MITB), money in the bank. I traded this system live on smaller time frame risking a very high percentage of my capital (I won't say how much, just very high), and I doubled my capital in 3 weeks (mind you I said this was live trading and not demo). I have now toned it down a bit and I am risking less.

The key to this trading system is to have patience and wait for a trading opportunity. Let the indicators do the work for you and wait for you alert and signals for a trading opportunity. DISCIPLINE is the key to trading and staying focused. This system works if you strictly follow the rules, and if anyone has any ideas to improve this system by all means. This is why I want to share it with you. There is more than enough to share in the FOREX wealth world so why not share. The more minds, the more ideas, the better.

Below in the attachment is my trade for today for 50 pips on the eur/jpy pair (that one was way to easy). This one was a great setup and basically I knew it was MITB. I would have went for more but I do not like to stay in trades past a certain time. So I await your comments, suggestions and or improvements to this system.

Let's please keep this forum and discussion clean from any negativity. We are here for each other and improve our trading skills and of course make money.

OK so let's get down to it and start making some pips.

Timeframes traded (H4 & D1)

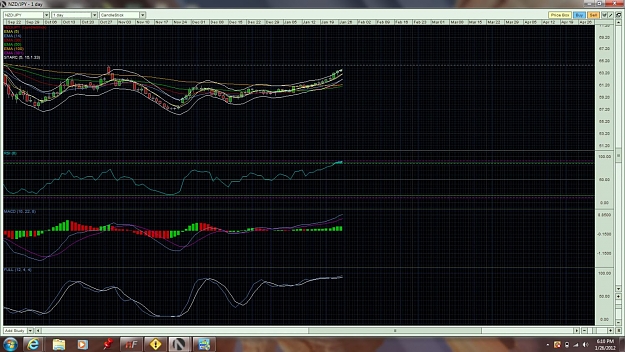

INDICATORS USED RSI, MACD, STARC BAND

I USE AN RSI INDICATOR THAT WILL ALERT VIA TEXT OR EMAIL WHEN THE OVERBOUGHT AND OVERSOLD LEVELS ARE BREACHED. IT IS ATTACHED.

H4 RSI ENTRY RULES (40 - 50 PIPS TP)

MACD (12-26-9), STARC BAND (5-15-1.33), RSI (PERIOD 8, Overbought 85, Oversold 15)

OPEN BAR ON H4 TF SHOULD HAVE PENETRATED OR IS TOUCHING THE STARC BAND INDICATOR UPPER BAND OR BELOW BAND (THESE WILL ACT AS S/R).

ONCE SIGNAL IS RECEIVED AND CONFIRMED, WAIT FOR THE NEW BAR TO BE FORMED ON THE H4 TF. SWITCH OVER TO THE H1 TF AND OBSERVE THE CURRENT BAR. IF THE CURRENT BAR HAS NOT CHANGED TO THE COLOR OF THE DIRECTION THAT YOU ARE TRADING YOU MUST WAIT FOR THE NEW BAR AND IT NEEDS TO BE EITHER RED FOR SHORT OR GREEN FOR LONG.

THE MACD (DEFAULT SETTING, 12-26-9) CURRENT BAR ON THE H1 TF MUST BE THE COLOR OF THE DIRECTION THAT YOU ARE GOING, RED FOR SHORT OR GREEN FOR LONG. ONCE THESE CONDITIONS ARE MET ENTER TRADE WITH MARKET ORDER AND PLACE YOUR SL ABOVE OR BELOW THE PREVIOUS HIGH OR LOW ON THE H4 TF. TAKE PROFIT OF 25 – 30 PIPS.

D1 RSI ENTRY RULES (70 - 100 PIPS TP)

MACD (12-26-9), STARC BAND (5-15-1.33), RSI (PERIOD 8, Over 85, Under 15)

OPEN BAR ON D1 TF SHOULD HAVE PENETRATED OR IS TOUCHING THE STARC BAND INDICATOR UPPER BAND OR BELOW BAND (THESE WILL ACT AS S/R).

ONCE SIGNAL IS RECEIVED AND CONFIRMED ON THE D1 TF, SWITCH OVER TO THE H4 TF AND OBSERVE THE CURRENT BAR. IF THE CURRENT BAR HAS NOT CHANGED TO THE COLOR OF THE DIRECTION THAT YOU ARE TRADING YOU MUST WAIT FOR THE NEW BAR AND IT NEEDS TO BE EITHER RED FOR SHORT OR GREEN FOR LONG.

THE MACD (DEFAULT SETTING, 12-26-9) CURRENT BAR ON THE H4 TF MUST BE THE COLOR OF THE DIRECTION THAT YOU ARE GOING, RED FOR SHORT OR GREEN FOR LONG. ONCE THESE CONDITIONS ARE MET ENTER TRADE WITH MARKET ORDER AND PLACE YOUR SL ABOVE OR BELOW THE PREVIOUS HIGH OR LOW ON THE D1 TF. TAKE PROFIT OF 50 –75 PIPS.

As we all know, the market moves in 3 directions (up, down, and sideways). Some traders like to go with the trend, some trade ranging markets, and others counter trade (most riskier). I am the counter trader. It's not an easy way to trade but IMO it's the best way to trade. If you can master this, I believe that you should have hardly any bad trades and I will show you how. Granted you will not get as many trades as you would prefer, but when you do get a trade it is pretty much as I like to say (MITB), money in the bank. I traded this system live on smaller time frame risking a very high percentage of my capital (I won't say how much, just very high), and I doubled my capital in 3 weeks (mind you I said this was live trading and not demo). I have now toned it down a bit and I am risking less.

The key to this trading system is to have patience and wait for a trading opportunity. Let the indicators do the work for you and wait for you alert and signals for a trading opportunity. DISCIPLINE is the key to trading and staying focused. This system works if you strictly follow the rules, and if anyone has any ideas to improve this system by all means. This is why I want to share it with you. There is more than enough to share in the FOREX wealth world so why not share. The more minds, the more ideas, the better.

Below in the attachment is my trade for today for 50 pips on the eur/jpy pair (that one was way to easy). This one was a great setup and basically I knew it was MITB. I would have went for more but I do not like to stay in trades past a certain time. So I await your comments, suggestions and or improvements to this system.

Let's please keep this forum and discussion clean from any negativity. We are here for each other and improve our trading skills and of course make money.

OK so let's get down to it and start making some pips.

Timeframes traded (H4 & D1)

INDICATORS USED RSI, MACD, STARC BAND

I USE AN RSI INDICATOR THAT WILL ALERT VIA TEXT OR EMAIL WHEN THE OVERBOUGHT AND OVERSOLD LEVELS ARE BREACHED. IT IS ATTACHED.

H4 RSI ENTRY RULES (40 - 50 PIPS TP)

MACD (12-26-9), STARC BAND (5-15-1.33), RSI (PERIOD 8, Overbought 85, Oversold 15)

OPEN BAR ON H4 TF SHOULD HAVE PENETRATED OR IS TOUCHING THE STARC BAND INDICATOR UPPER BAND OR BELOW BAND (THESE WILL ACT AS S/R).

ONCE SIGNAL IS RECEIVED AND CONFIRMED, WAIT FOR THE NEW BAR TO BE FORMED ON THE H4 TF. SWITCH OVER TO THE H1 TF AND OBSERVE THE CURRENT BAR. IF THE CURRENT BAR HAS NOT CHANGED TO THE COLOR OF THE DIRECTION THAT YOU ARE TRADING YOU MUST WAIT FOR THE NEW BAR AND IT NEEDS TO BE EITHER RED FOR SHORT OR GREEN FOR LONG.

THE MACD (DEFAULT SETTING, 12-26-9) CURRENT BAR ON THE H1 TF MUST BE THE COLOR OF THE DIRECTION THAT YOU ARE GOING, RED FOR SHORT OR GREEN FOR LONG. ONCE THESE CONDITIONS ARE MET ENTER TRADE WITH MARKET ORDER AND PLACE YOUR SL ABOVE OR BELOW THE PREVIOUS HIGH OR LOW ON THE H4 TF. TAKE PROFIT OF 25 – 30 PIPS.

D1 RSI ENTRY RULES (70 - 100 PIPS TP)

MACD (12-26-9), STARC BAND (5-15-1.33), RSI (PERIOD 8, Over 85, Under 15)

OPEN BAR ON D1 TF SHOULD HAVE PENETRATED OR IS TOUCHING THE STARC BAND INDICATOR UPPER BAND OR BELOW BAND (THESE WILL ACT AS S/R).

ONCE SIGNAL IS RECEIVED AND CONFIRMED ON THE D1 TF, SWITCH OVER TO THE H4 TF AND OBSERVE THE CURRENT BAR. IF THE CURRENT BAR HAS NOT CHANGED TO THE COLOR OF THE DIRECTION THAT YOU ARE TRADING YOU MUST WAIT FOR THE NEW BAR AND IT NEEDS TO BE EITHER RED FOR SHORT OR GREEN FOR LONG.

THE MACD (DEFAULT SETTING, 12-26-9) CURRENT BAR ON THE H4 TF MUST BE THE COLOR OF THE DIRECTION THAT YOU ARE GOING, RED FOR SHORT OR GREEN FOR LONG. ONCE THESE CONDITIONS ARE MET ENTER TRADE WITH MARKET ORDER AND PLACE YOUR SL ABOVE OR BELOW THE PREVIOUS HIGH OR LOW ON THE D1 TF. TAKE PROFIT OF 50 –75 PIPS.

Attached File(s)