I posted this thread in the N&A section on Wednesday afternoon-hope you caught it: http://www.forexfactory.com/showthread.php?p=1460820

There are certain fundamental indicators you want to look for when making this kind of assesment and they really are not that hard to spot. Timing can be a little tricky, but if you can be patient prices will often move as the indicators suggest they should

Economic indicators fall under two broad categories: Growth and Inflation. When those numbers are higher then consensus, it's generally good for the dollar and vice versa. There's a pecking order here too; Central bankers take precedence over economic indicators, but when they both agree-then things can really move.

Tuesday:

Bernanke's statements regarding positive growth going forward were a major influence on market participants, because they decreased the possibility of a rate cut. The non-manufacturing ISM was higher as were the prices paid. The dollar weakens slightly on the day vs the GBP and EUR after data prints that indicates it should do the opposite. The reason for that is because there is an ECB rate decision and press conference on Wednesday and market participants will be looking for clues regarding the ECB's next moves.

Wednesday:

The ECB hikes rates as expected and Trichet omits the term "strong vigilance" from his statement. This means that the next hike cannot occur before September, although the markets is still expecting two more hikes this year from the ECB. In other words two rate increases are already priced in. US data prints inflation positive.

The dollar gains a bit on both the EUR and GBP on the day, but there's still the BoE rate decision on Thursday morning.

Thursday:

The BoE holds rates and issues no statement; markets are disappointed, although they still expect one more hike from the BoE this year. US unemployment claims print strong.

If you've been short the GBP and EUR vs the dollar you're about to get rewarded. All the US data has basically printed growth and inflation positive. The addition of Bernanke's comments is causing equities to tank and the 10y yeild to shoot up to levels not seen in a year as the yeild curve reverts to normal.

Going Forward:

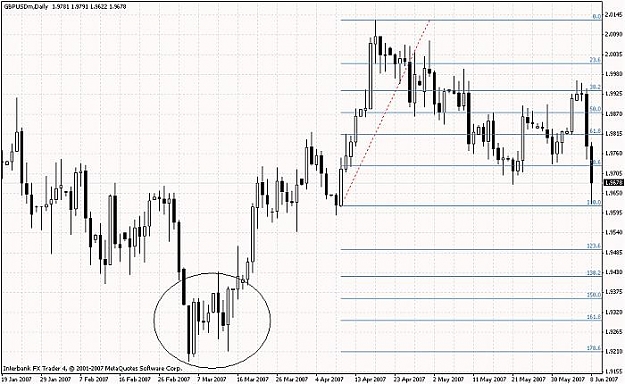

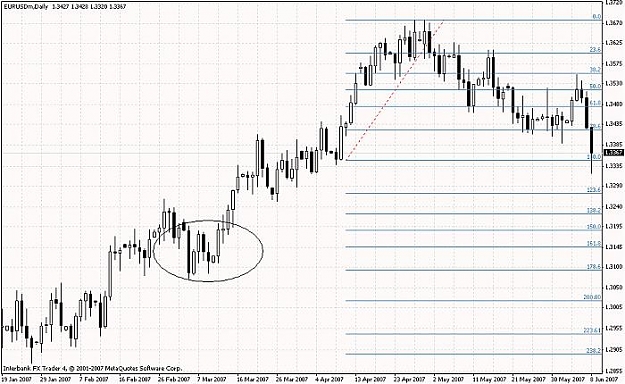

The dollar still looks strong and has a lot of potential IF the data prints dollar positive and negative for the GBP and EUR. Given the right set of circumstances, the dollar can reach the circled areas on both charts.

There are certain fundamental indicators you want to look for when making this kind of assesment and they really are not that hard to spot. Timing can be a little tricky, but if you can be patient prices will often move as the indicators suggest they should

Economic indicators fall under two broad categories: Growth and Inflation. When those numbers are higher then consensus, it's generally good for the dollar and vice versa. There's a pecking order here too; Central bankers take precedence over economic indicators, but when they both agree-then things can really move.

Tuesday:

Bernanke's statements regarding positive growth going forward were a major influence on market participants, because they decreased the possibility of a rate cut. The non-manufacturing ISM was higher as were the prices paid. The dollar weakens slightly on the day vs the GBP and EUR after data prints that indicates it should do the opposite. The reason for that is because there is an ECB rate decision and press conference on Wednesday and market participants will be looking for clues regarding the ECB's next moves.

Wednesday:

The ECB hikes rates as expected and Trichet omits the term "strong vigilance" from his statement. This means that the next hike cannot occur before September, although the markets is still expecting two more hikes this year from the ECB. In other words two rate increases are already priced in. US data prints inflation positive.

The dollar gains a bit on both the EUR and GBP on the day, but there's still the BoE rate decision on Thursday morning.

Thursday:

The BoE holds rates and issues no statement; markets are disappointed, although they still expect one more hike from the BoE this year. US unemployment claims print strong.

If you've been short the GBP and EUR vs the dollar you're about to get rewarded. All the US data has basically printed growth and inflation positive. The addition of Bernanke's comments is causing equities to tank and the 10y yeild to shoot up to levels not seen in a year as the yeild curve reverts to normal.

Going Forward:

The dollar still looks strong and has a lot of potential IF the data prints dollar positive and negative for the GBP and EUR. Given the right set of circumstances, the dollar can reach the circled areas on both charts.