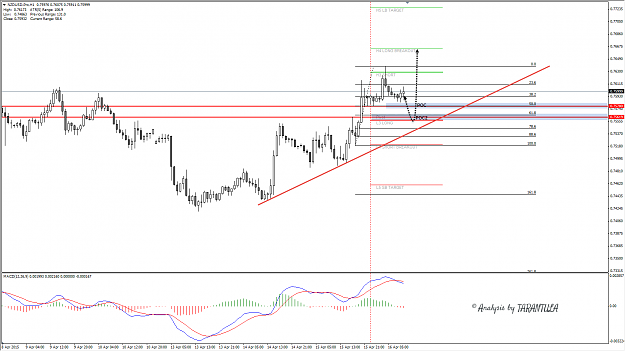

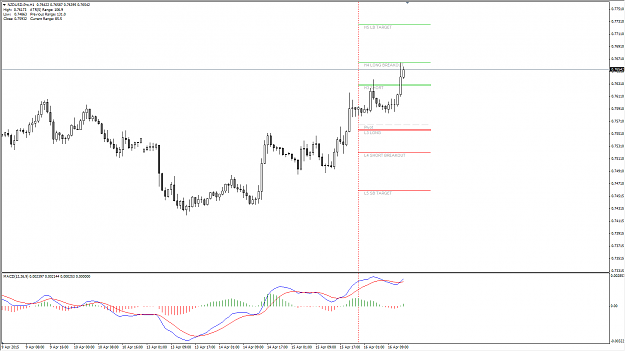

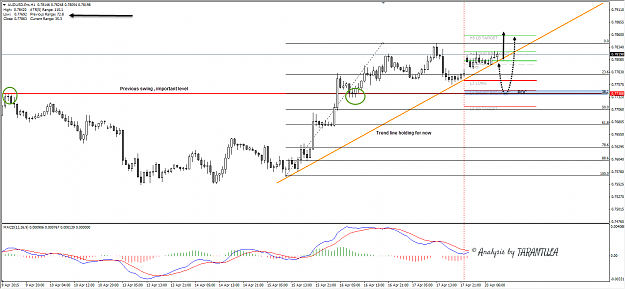

NZDUSD has broken through previous high (0.7607) and it is showing a pullback. 0.7575 region shows confluence ( previous 4 time bottom rejection, 50.0 ) and the price might bounce from that spot. However 0.7560-50 region shows stronger confluence ( DPP, L3, 61.8, trend line ) and the pair might pullback to the zone and reject towards H4 -0.7665. We need to pay close attention to the price if it pullbacks to the zone as we have building permits + unemployment news later in the day which will also influence the move for the pair. Yesterday NZD performed very strong and due to pattern -inverted head and shoulders variant and technical picture the pair could proceed higher.

- Post #21,301

- Quote

- Apr 16, 2015 4:14am Apr 16, 2015 4:14am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,302

- Quote

- Apr 16, 2015 6:01am Apr 16, 2015 6:01am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,303

- Quote

- Apr 16, 2015 7:32am Apr 16, 2015 7:32am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,304

- Quote

- Apr 16, 2015 2:44pm Apr 16, 2015 2:44pm

Scalping

small stop loss ; ) All Time Return:

61.3%

- Post #21,305

- Quote

- Apr 16, 2015 4:26pm Apr 16, 2015 4:26pm

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,306

- Quote

- Apr 16, 2015 9:15pm Apr 16, 2015 9:15pm

Scalping

small stop loss ; ) All Time Return:

61.3%

- Post #21,307

- Quote

- Apr 17, 2015 1:51am Apr 17, 2015 1:51am

- | Joined Jan 2015 | Status: Zaedno pravi sila. Cosmos e za nas. | 1,915 Posts

- Post #21,308

- Quote

- Apr 17, 2015 3:25am Apr 17, 2015 3:25am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,309

- Quote

- Apr 17, 2015 8:22am Apr 17, 2015 8:22am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,310

- Quote

- Edited 9:35am Apr 17, 2015 9:22am | Edited 9:35am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,311

- Quote

- Apr 17, 2015 3:51pm Apr 17, 2015 3:51pm

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,312

- Quote

- Apr 17, 2015 11:12pm Apr 17, 2015 11:12pm

- | Joined Apr 2014 | Status: Member | 263 Posts

- Post #21,313

- Quote

- Edited 4:35pm Apr 19, 2015 7:45am | Edited 4:35pm

- | Joined Oct 2014 | Status: Member | 110 Posts

- Post #21,314

- Quote

- Apr 20, 2015 4:16am Apr 20, 2015 4:16am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,317

- Quote

- Apr 20, 2015 6:43am Apr 20, 2015 6:43am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,319

- Quote

- Apr 21, 2015 4:56am Apr 21, 2015 4:56am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,320

- Quote

- Apr 21, 2015 1:20pm Apr 21, 2015 1:20pm

Scalping

small stop loss ; ) All Time Return:

61.3%