My methodology is based on Leading Indicators such as Pivot Points and Fibonacci. I do not use Oscillators since they are lagging in nature and are only telling me what the candles are already telling me and I don't like having a bunch of indicators that tell me the same thing and cloud up my charts so that I cannot decipher price action.

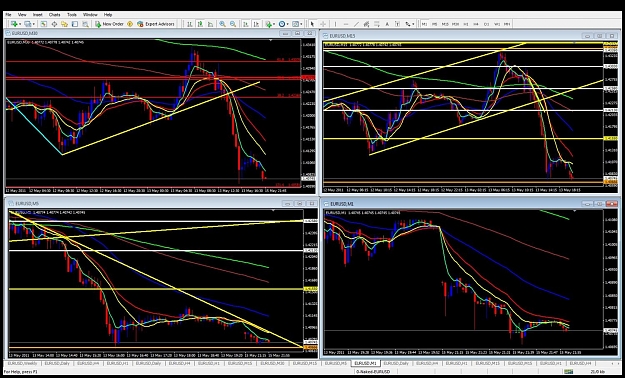

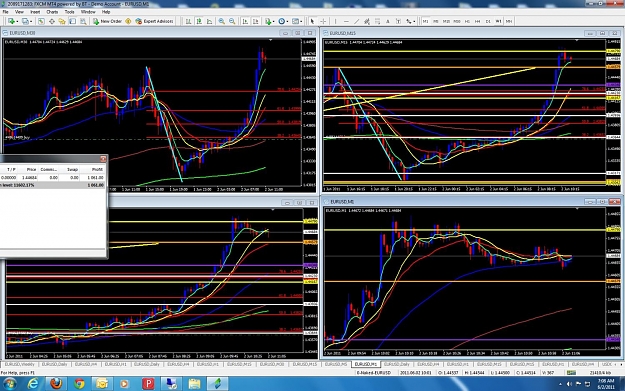

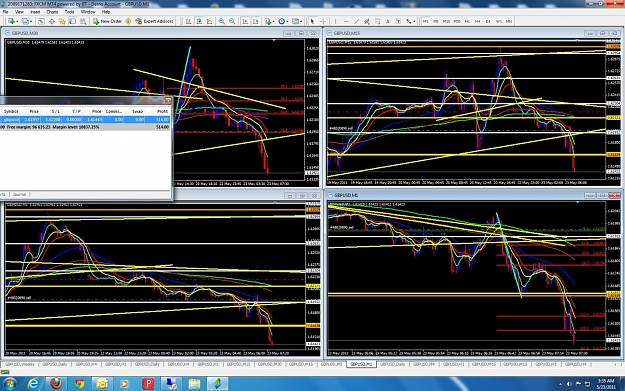

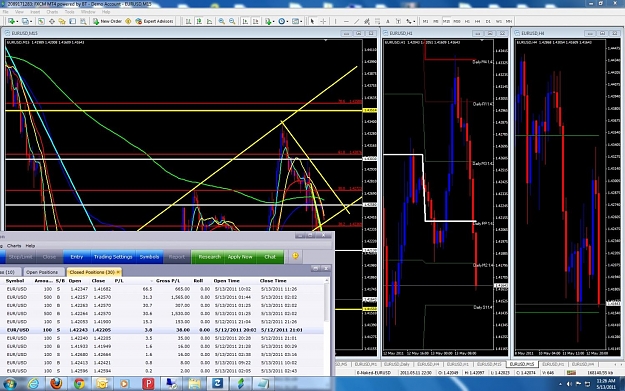

The methodology I use is very, very simple. I use a simple set of EMA's:

233/144 - Tracks the sustained trend

55/21 - Tracks the current Market Direction

13/5 - Tracks current price action and momentum

I monitor touches to these ema's as well as ema crossovers. I do this over multiple timeframes. I add Monthly, Weekly, Daily and even 4 Hour Pivot Points into the mix as well. I love Pivot Points since they are leading and very reliable. I also note previous days high & low

I make use of Trend lines and I am constantly fibbing in every direction

I start out making a few decisions. Am I Bearish or Bullish? Which Pair will I trade today? I look at the ec, eg, uc, uj to determine relative strength since I prefer to pair a strong currency with a weak currency.

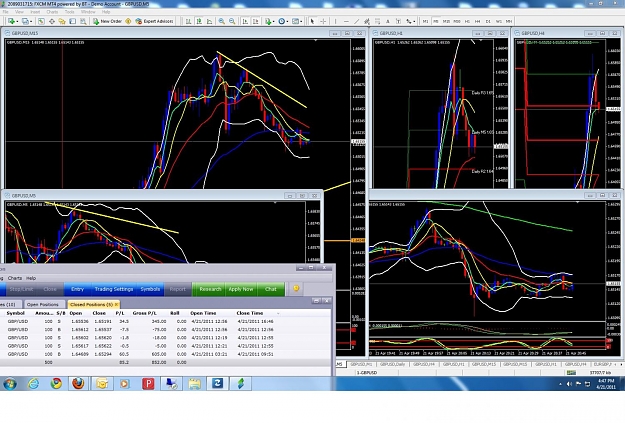

Below I will post some screenshots of my mt4 profiles I use then a brief video that will take you through a live trade as it happens. If this thread receives interest from other traders I will keep it going but for now I will play it by ear.

This was one of my earlier videos and didn't have mi mic turned up so high so you should turn up your volume. I also recommend watching my videos in 720P Quality. The whole video thing is very new to me so bare with me. My videos will get better and better.

To find out more about me and my Trading Methodology please visit my Website at:

http://www.forextradeplans.com

The methodology I use is very, very simple. I use a simple set of EMA's:

233/144 - Tracks the sustained trend

55/21 - Tracks the current Market Direction

13/5 - Tracks current price action and momentum

I monitor touches to these ema's as well as ema crossovers. I do this over multiple timeframes. I add Monthly, Weekly, Daily and even 4 Hour Pivot Points into the mix as well. I love Pivot Points since they are leading and very reliable. I also note previous days high & low

I make use of Trend lines and I am constantly fibbing in every direction

I start out making a few decisions. Am I Bearish or Bullish? Which Pair will I trade today? I look at the ec, eg, uc, uj to determine relative strength since I prefer to pair a strong currency with a weak currency.

Below I will post some screenshots of my mt4 profiles I use then a brief video that will take you through a live trade as it happens. If this thread receives interest from other traders I will keep it going but for now I will play it by ear.

Inserted Video

This was one of my earlier videos and didn't have mi mic turned up so high so you should turn up your volume. I also recommend watching my videos in 720P Quality. The whole video thing is very new to me so bare with me. My videos will get better and better.

To find out more about me and my Trading Methodology please visit my Website at:

http://www.forextradeplans.com