The story of the commodity trading Turtles has become one of the most famous in trading history. Their success has stirred the interest of many new traders and helped Richard Dennis become one of the most famous commodity traders of all time.

“The Turtle Trading System was a Complete Trading System. Its rules covered every aspect of trading, and left no decisions to the subjective whims of the trader. It had every component of a Complete Trading System.”

However i found the rules are a bit complicated for me to understand and execute the trade after going through so many times trying to understand. Since, here are my own simplified original turtle trading system as i would want to make my trading simple and easy to execute.

Time frame: daily chart only

Market: all pairs

Position sizing: 2% of the capital

Entries: when the price exceeded by one pips of the high or low of the preceding 20 days

Stops: when the price exceeding by one pips of the 2 x ATR (average true range, setting 20 days) OR when the price exceeding by one pips of the high or low of the preceding 10 days; whichever come first.

Exist: when the price exceeding by one pips of the high or low of the preceding 10 days.

10 days is red color line

20 days is yellow color line

example using GBPUSD

long at 1.5771 at 2011.01.13 (up arrow) when price exceed 20 days high (yellow color line)

exist at 1.6030 at 2011.03.11 (down arrow) when price exceeds 10 days low (red color line)

stop at 1.5477 (the red color horizontal line) if the price reverse to cut loss.

to calculate for stos loss,

2011.01.03, the ATR is 0.0147, thus 2 x ATR is 0.0294.

1.5771 - 0.0294 = 1.5477 (stop loss)

But, don't place stop order ! The reason why turtle system do not reveal stop loss is to prevent stop hunting by broker.

"I always say you could publish my trading rules in the newspaper and no one would follow them. The key is CONSISTENCY and DISCLIPLINE. What they couldn't do is give them the CONFIDENCE to stick to those rules even things are going bad." Richard Dennis, a famous trader and father of the Turtles.

Problem with me is that i don't have the CONFIDENCE with this system yet, need to find out whether this system is profitable through backtesting of the EA. As we know that trend trading might give us several losses first before come into a winning trade.

My purpose of posting the system here is so that out there who know how to make it into EA file and kind to share with everyone here so that can we backtest the results to see whether this simplified original turtle rules is profitable or not.

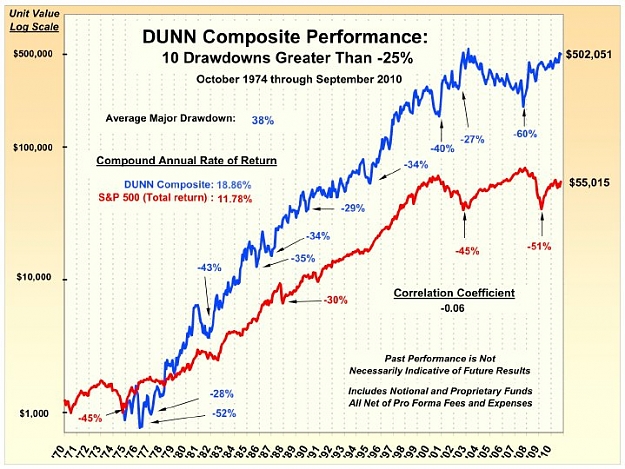

Hope build up a chart like this for the simplified original turtle system.

DUNN composite, using trend trading system.

Thanks everyone, the ultimate trend trader !

______________

My challenges to make consistent profits - http://www.101forexcurrencytrading.com/

“The Turtle Trading System was a Complete Trading System. Its rules covered every aspect of trading, and left no decisions to the subjective whims of the trader. It had every component of a Complete Trading System.”

However i found the rules are a bit complicated for me to understand and execute the trade after going through so many times trying to understand. Since, here are my own simplified original turtle trading system as i would want to make my trading simple and easy to execute.

Time frame: daily chart only

Market: all pairs

Position sizing: 2% of the capital

Entries: when the price exceeded by one pips of the high or low of the preceding 20 days

Stops: when the price exceeding by one pips of the 2 x ATR (average true range, setting 20 days) OR when the price exceeding by one pips of the high or low of the preceding 10 days; whichever come first.

Exist: when the price exceeding by one pips of the high or low of the preceding 10 days.

10 days is red color line

20 days is yellow color line

example using GBPUSD

long at 1.5771 at 2011.01.13 (up arrow) when price exceed 20 days high (yellow color line)

exist at 1.6030 at 2011.03.11 (down arrow) when price exceeds 10 days low (red color line)

stop at 1.5477 (the red color horizontal line) if the price reverse to cut loss.

to calculate for stos loss,

2011.01.03, the ATR is 0.0147, thus 2 x ATR is 0.0294.

1.5771 - 0.0294 = 1.5477 (stop loss)

But, don't place stop order ! The reason why turtle system do not reveal stop loss is to prevent stop hunting by broker.

"I always say you could publish my trading rules in the newspaper and no one would follow them. The key is CONSISTENCY and DISCLIPLINE. What they couldn't do is give them the CONFIDENCE to stick to those rules even things are going bad." Richard Dennis, a famous trader and father of the Turtles.

Problem with me is that i don't have the CONFIDENCE with this system yet, need to find out whether this system is profitable through backtesting of the EA. As we know that trend trading might give us several losses first before come into a winning trade.

My purpose of posting the system here is so that out there who know how to make it into EA file and kind to share with everyone here so that can we backtest the results to see whether this simplified original turtle rules is profitable or not.

Hope build up a chart like this for the simplified original turtle system.

DUNN composite, using trend trading system.

Thanks everyone, the ultimate trend trader !

______________

My challenges to make consistent profits - http://www.101forexcurrencytrading.com/

Attached File(s)