There have been two breeds of traders in the years past. Those that follow technicals and those that follow fundamentals. The fundamentalists get whipsawed around price volatility, where the technicians look for exact entry points, or slight pull backs looking for advantageous entry's.

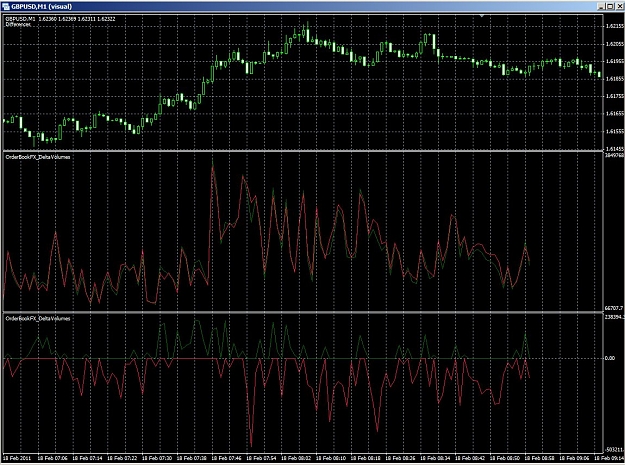

Now, with global liquidity aggregation coming to light in http://orderbookfx.com (http://orderbookfx.com) traders can now trade on Order Flow. The sum of all buyers and sellers in the marketplace, aggregated across the globe, identifying not just an indication.. but actual money flow. The attached chart is a one minute time frame of Globally Aggregated Supply/Demand aggregated from OrderBookFX and presented in an easily readable indicator in MT4.

From the chart, which is also an attached file. you will see the Green indicating significant buying bias, red indicating significant selling bias. These are live from the OrderBookFX feed that streams from our servers into your MT4 chart.

You should never trade against money flow as it happens. Now you don't have to. Visit us and watch global order flow LIVE (http://orderbookfx.com)

Now, with global liquidity aggregation coming to light in http://orderbookfx.com (http://orderbookfx.com) traders can now trade on Order Flow. The sum of all buyers and sellers in the marketplace, aggregated across the globe, identifying not just an indication.. but actual money flow. The attached chart is a one minute time frame of Globally Aggregated Supply/Demand aggregated from OrderBookFX and presented in an easily readable indicator in MT4.

From the chart, which is also an attached file. you will see the Green indicating significant buying bias, red indicating significant selling bias. These are live from the OrderBookFX feed that streams from our servers into your MT4 chart.

You should never trade against money flow as it happens. Now you don't have to. Visit us and watch global order flow LIVE (http://orderbookfx.com)

Attached File(s)