Hi guys I am not sure I have new finding here or it is simple statistic and not sure if this is already widely known.

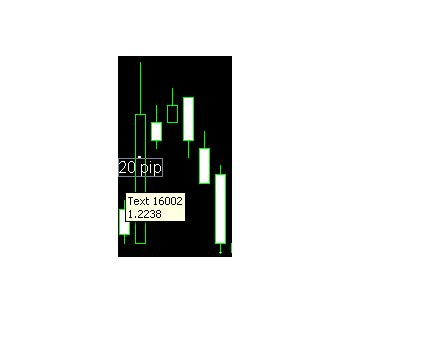

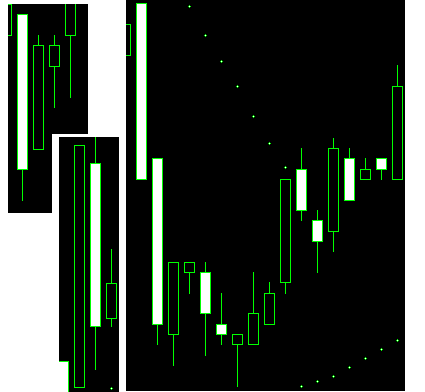

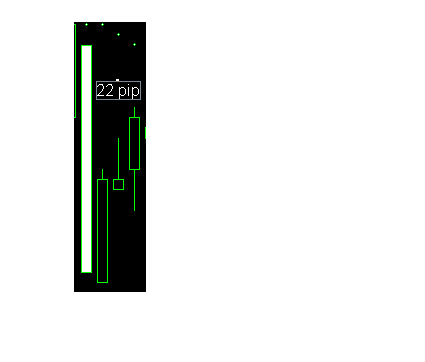

So I was looking at 5 min candles and I found that if there is minimum 20 pip (if more than better) move up or down during 5 minute, so after big rally as price begins falling it will reach minimum 2/3(sometimes more) of previous candle. However my finding does not work during fundamental releases. I checked and found out that there are cases when price action went on long time towards one direction when released fundamentals. So in choppy markets if suddenly appears the situation like this then you should expect price to come back. The best situation is when first 5 min candle makes 35 or more pip move and has big "body" and small "shadows" then second candle opens higher but comes back quickly. But if first candle makes only 20-25 pip move the second candle can follow it and you should not enter untill reversal confirms. The third is really reversal candle, after third candel begins correction. Today as EUR consolidated I tried this study and gained something quickly. But however you should always cover position when the correction candle reaches 2/3-3/4 of first "rally" candel. Never do it during fundamental info release. I attached here some files confirming my finding. this is made only for EUR/USD. I did not even looked if it is right for other pairs (I look later). If someone has already checked this study in practise so please write here if it really works. If someone has comments and notes which declines my finding please do not hesitate to write, it will be appreciated. thank you in advance. fx-trader777

So I was looking at 5 min candles and I found that if there is minimum 20 pip (if more than better) move up or down during 5 minute, so after big rally as price begins falling it will reach minimum 2/3(sometimes more) of previous candle. However my finding does not work during fundamental releases. I checked and found out that there are cases when price action went on long time towards one direction when released fundamentals. So in choppy markets if suddenly appears the situation like this then you should expect price to come back. The best situation is when first 5 min candle makes 35 or more pip move and has big "body" and small "shadows" then second candle opens higher but comes back quickly. But if first candle makes only 20-25 pip move the second candle can follow it and you should not enter untill reversal confirms. The third is really reversal candle, after third candel begins correction. Today as EUR consolidated I tried this study and gained something quickly. But however you should always cover position when the correction candle reaches 2/3-3/4 of first "rally" candel. Never do it during fundamental info release. I attached here some files confirming my finding. this is made only for EUR/USD. I did not even looked if it is right for other pairs (I look later). If someone has already checked this study in practise so please write here if it really works. If someone has comments and notes which declines my finding please do not hesitate to write, it will be appreciated. thank you in advance. fx-trader777

Attached Images

kiss the trend