7

- Post #35,421

- Quote

- Jan 27, 2022 12:18pm Jan 27, 2022 12:18pm

- Joined Jan 2015 | Status: Member | 1,298 Posts

- Post #35,425

- Quote

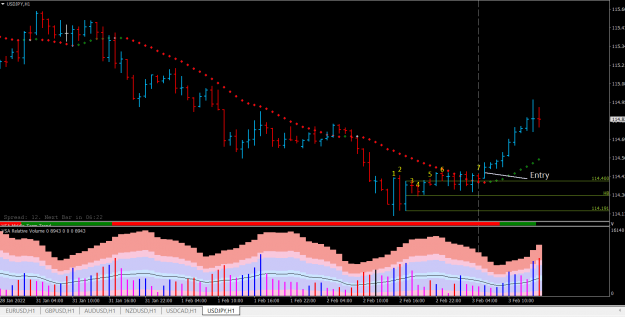

- Feb 2, 2022 6:28pm Feb 2, 2022 6:28pm

- | Joined Oct 2020 | Status: Member | 94 Posts

- Post #35,426

- Quote

- Feb 2, 2022 6:58pm Feb 2, 2022 6:58pm

- Joined Feb 2021 | Status: Member | 717 Posts

- Post #35,427

- Quote

- Feb 2, 2022 9:36pm Feb 2, 2022 9:36pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #35,428

- Quote

- Feb 2, 2022 10:15pm Feb 2, 2022 10:15pm

- | Joined Oct 2020 | Status: Member | 94 Posts

- Post #35,429

- Quote

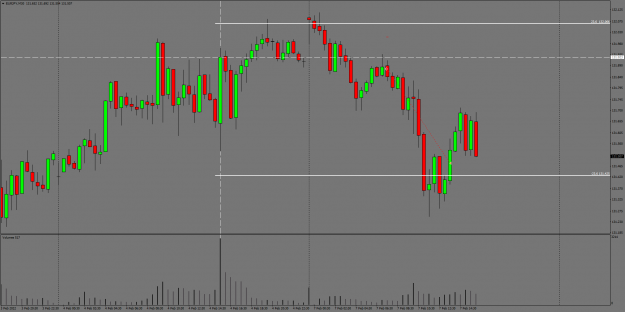

- Feb 3, 2022 2:47am Feb 3, 2022 2:47am

- Joined Feb 2021 | Status: Member | 717 Posts

- Post #35,431

- Quote

- Feb 3, 2022 8:14am Feb 3, 2022 8:14am

- | Joined Oct 2020 | Status: Member | 94 Posts

- Post #35,432

- Quote

- Edited 10:10am Feb 3, 2022 9:03am | Edited 10:10am

Learning is a never ending Journey

- Post #35,434

- Quote

- Feb 3, 2022 11:48am Feb 3, 2022 11:48am

- Joined Feb 2021 | Status: Member | 717 Posts

- Post #35,435

- Quote

- Feb 4, 2022 3:29am Feb 4, 2022 3:29am

- Joined Jan 2015 | Status: Member | 1,298 Posts

- Post #35,436

- Quote

- Feb 4, 2022 4:19am Feb 4, 2022 4:19am

- Joined Feb 2021 | Status: Member | 717 Posts

- Post #35,438

- Quote

- Feb 7, 2022 9:25am Feb 7, 2022 9:25am

- Joined Jan 2015 | Status: Member | 1,298 Posts

- Post #35,440

- Quote

- Feb 8, 2022 1:36am Feb 8, 2022 1:36am

- Joined Feb 2021 | Status: Member | 717 Posts