Disliked{quote} Thats a good question about VZA mate, im glad you asked. The initial appeal of VZA is that I felt that it had some similarities to how I was trading before (using SD zones/order blocks) Just before Malcolm popped back I was using a combination of marking the zones plus marking the OR. I smugly thought that this would give an extra edge but really it was just a filter to take less trades as there was often 2 opposing rules so I decided at the time to discount the OR and use only VZA. My plan was to use no timeframes less than M15/M30 and...Ignored

I've been testing the OR too and was wondering how to fit it into the VZA approach, or whether it's an either-or thing. Add to that, I also use zones based on strong Weis Waves, so everything starts to get overwhelming. Especially when they conflict.

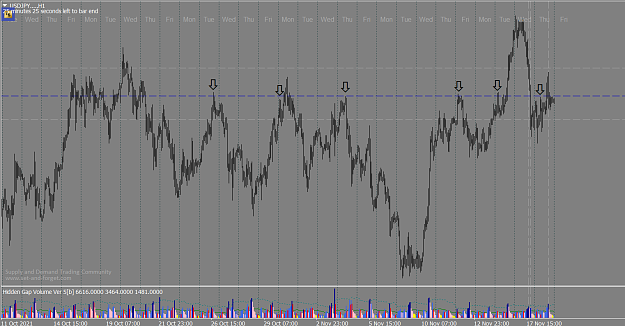

- But then I thought about it: they are all just high volume/activity areas, so I started to think of them like how I used to think of Support/Resistance zones. They don't have to be mutually exclusive - just use whichever is nearest.

- For me, if 2 zones are very close, I combine them into one zone so it's fibbed as one. I would not like to trade from one zone right into another zone, just as I would not want to trade from a local Support line right into a Resistance line.

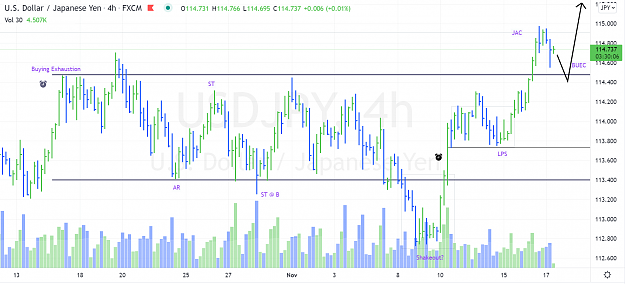

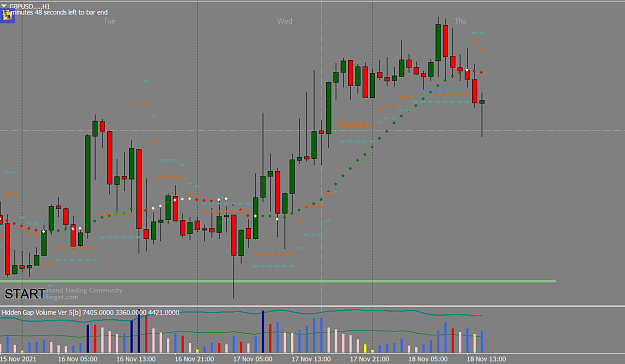

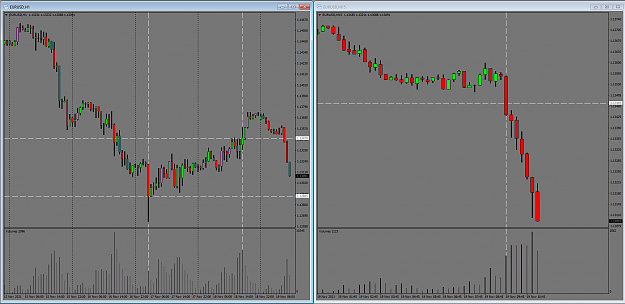

- Also, I came across this post by Pres, with both the OR and Yesterday's High Volume zone on the same chart. Good info on how he handles YHVZ and OR:

https://www.forexfactory.com/thread/...01#post8706601

4