Hi all,

I ran across a video on you tube that sounds so great for forex I thought I would look into it some more.

It sounded so excellent I sat and watched all the videos found in the VSA thread here.

By the time I finished I was a lot less convinced this method is a perfect fit for forex at all.

EDIT// FRIDAY 16:54 GMT

After pretty extensive chart queries via some statistical analysis I have come to the conclusion this system is not and I believe cannot be profitable for forex.

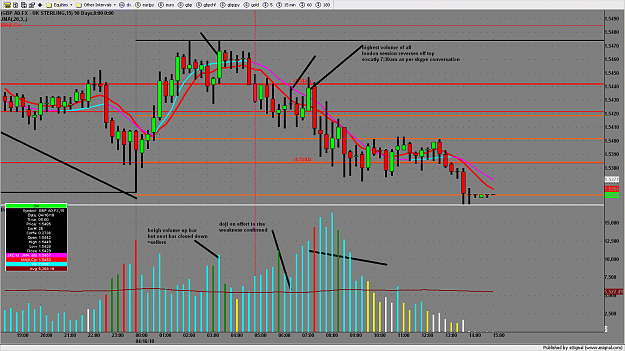

Although volume is important, the relevance of volume was applicable only to a few certain hours.

Surprisingly, when all three of the major markets were open, the results were consistent with random trading and could not be viewed with any credibility.

The larger spread or range of the HV bar after a trending market in either direction did have results indicative of weakness in the market but the timing of the change in trend was unpredictable, variable and could not be guaranteed.

The no demand bar was easily confused with the presence of many similar bars and waiting for the no demand to present clearly, missed the move on most occasions and I believe is overall non existent when applied to forex volume.

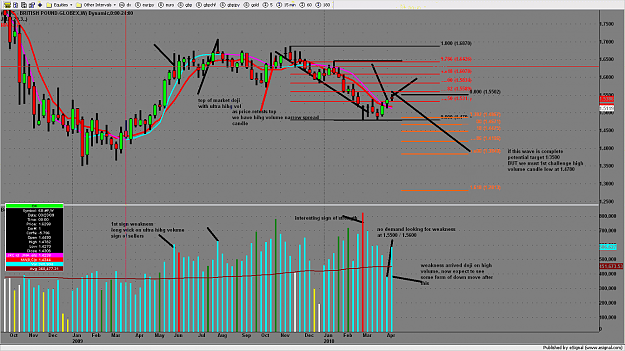

A Bearish Engulfing Pattern (two bar upthrust) is a standard forex warning at a Market high and since no volume is associated by the Trade Guider Method for this pattern, it cannot be considered to be a VSA pattern of extra merit.

An inverted hammer or a spinning top under extreme volume and at a market high (upthust) yielded the most consistent results as a turning signal. However, although the trade guider method of trading promotes relative volume of 20 bars, what appears to be extreme volume can easily be outclassed by the following volume bar of greater magnitude. This became a problem in that there was never a way to know what was extreme relative volume until after the event.

Overall I found the predictive nature of the method to be disappointing

I could write more on this but you will all be bored, if you have a question, feel free to ask.

.

I ran across a video on you tube that sounds so great for forex I thought I would look into it some more.

Inserted Video

It sounded so excellent I sat and watched all the videos found in the VSA thread here.

By the time I finished I was a lot less convinced this method is a perfect fit for forex at all.

EDIT// FRIDAY 16:54 GMT

After pretty extensive chart queries via some statistical analysis I have come to the conclusion this system is not and I believe cannot be profitable for forex.

Although volume is important, the relevance of volume was applicable only to a few certain hours.

Surprisingly, when all three of the major markets were open, the results were consistent with random trading and could not be viewed with any credibility.

The larger spread or range of the HV bar after a trending market in either direction did have results indicative of weakness in the market but the timing of the change in trend was unpredictable, variable and could not be guaranteed.

The no demand bar was easily confused with the presence of many similar bars and waiting for the no demand to present clearly, missed the move on most occasions and I believe is overall non existent when applied to forex volume.

A Bearish Engulfing Pattern (two bar upthrust) is a standard forex warning at a Market high and since no volume is associated by the Trade Guider Method for this pattern, it cannot be considered to be a VSA pattern of extra merit.

An inverted hammer or a spinning top under extreme volume and at a market high (upthust) yielded the most consistent results as a turning signal. However, although the trade guider method of trading promotes relative volume of 20 bars, what appears to be extreme volume can easily be outclassed by the following volume bar of greater magnitude. This became a problem in that there was never a way to know what was extreme relative volume until after the event.

Overall I found the predictive nature of the method to be disappointing

I could write more on this but you will all be bored, if you have a question, feel free to ask.

.