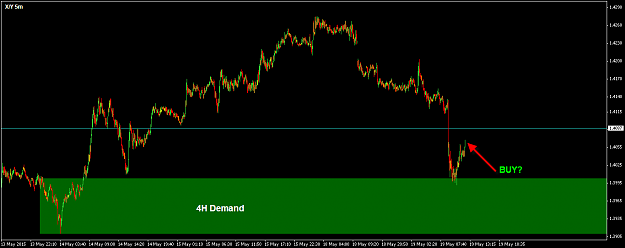

DislikedTrying to identify potential trades and potential loser trades. I am not sure why I shouldn't have taken that trade. Ok 1- the time was not right. {image}Ignored

Either way, you should probably not pay any attention to what I am about to say.

I see many Supply/Demand traders here doing this and it makes absolutely no sense to me. The more experienced Supply/Demand Zone traders can feel free to chime in and let me know where I am mistaken.

First off, let's start out with what defines a Supply area or a Demand area on a price chart. What price action is the manifestation of the order imbalance we seek?

For Demand we look for:

1. Rally Base Rally

2. Drop Base Rally

For Supply we look for:

1. Drop Base Drop

2. Rally Base Drop

Okay, so here's the thing. A Supply Zone can not become a Demand zone simply because price traded through it. That is to say, ZONES CAN NOT FLIP. Our definitions state that in order to have a Demand Zone, we need to see either a Drop Base Rally or a Rally Base Rally. The act of simply trading through a Supply Zone does not satisfy either of those.

When you look at your chart the question becomes, would you have called that area a Supply Zone if it had not first "engulfed" Demand? I believe you would not have seen this area a Supply Zone in the first place. Hence, it would be in error to see it as such in this case.

Obviously, if a Demand Zone is breached to the down side and in the process we see a Drop Base Drop, then we can conclude that a new Supply Zone has been created where there once was Demand. But this is completely distinct from simply saying a Demand Zone once broken is now Supply.

Help me out here fellas, what don't I get?

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect