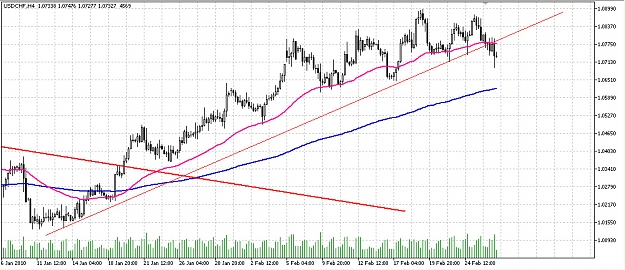

Trendlines are significant in any timeframe.

3 touches of any trendline and subsequent breakout should see a retest of the breakout and then the start of another trend.

As of current time, eurusd on the 60 min sees possibility of a trend (in the 30 min timeframe) upwards from current levels.

Now that the 60 m trend is up how do we play it?

1 Enter on retrace to the breakout level or just above it

2 Enter 1/2 position now, then scale in when the market retraces to the breakout point.

3 Trading trends the stop loss should be larger 100 ticks and over. Just make sure $ risk is 2% of trading account. Aggressive traders can take positions 1 standard lot (100k) per 10K in the account.

4 The 18 simple moving average provide the risk parameters for the trade. If 2 whole candles close below this then it is time to exit.

Let's see how it pans out...

3 touches of any trendline and subsequent breakout should see a retest of the breakout and then the start of another trend.

As of current time, eurusd on the 60 min sees possibility of a trend (in the 30 min timeframe) upwards from current levels.

Now that the 60 m trend is up how do we play it?

1 Enter on retrace to the breakout level or just above it

2 Enter 1/2 position now, then scale in when the market retraces to the breakout point.

3 Trading trends the stop loss should be larger 100 ticks and over. Just make sure $ risk is 2% of trading account. Aggressive traders can take positions 1 standard lot (100k) per 10K in the account.

4 The 18 simple moving average provide the risk parameters for the trade. If 2 whole candles close below this then it is time to exit.

Let's see how it pans out...