jing is a screencapture software. very easy to use, its just easier than copy and pasting into paint

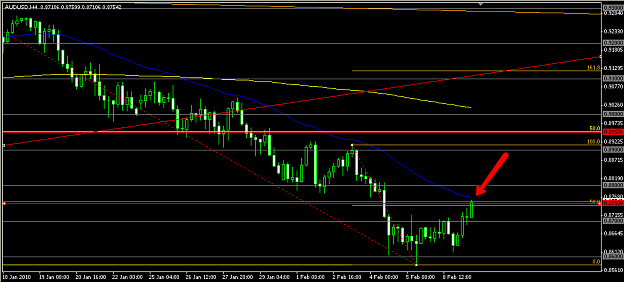

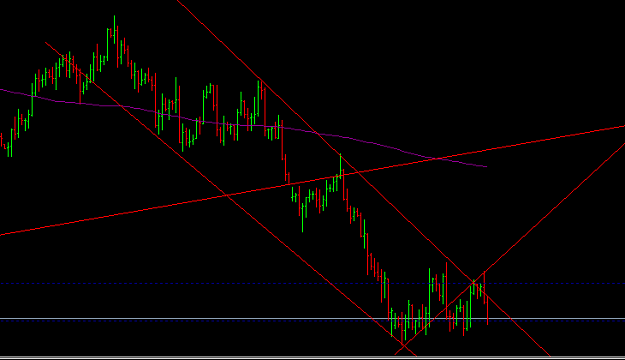

ps. is everyone waiting for retracements up to fibs and trendlines now?

seems like everything is at the same spot and needs to pullback abit to go with some of these trends?

ps. is everyone waiting for retracements up to fibs and trendlines now?

seems like everything is at the same spot and needs to pullback abit to go with some of these trends?