The math behind pyramiding (adding to positions already in profit, or 'averaging up')

Because I like to be a provocative smarta$$ , I (a rookie who trades only in demo) would like to very respectfully challenge a point made by a Millionaire Trader (Roland Campbell, interviewed in Boris and Kathy's book).

, I (a rookie who trades only in demo) would like to very respectfully challenge a point made by a Millionaire Trader (Roland Campbell, interviewed in Boris and Kathy's book).

In the scenario being discussed here, Roland had added to a position already in profit, and moved his SL to BE on the original position. Roland says that "Your unrealized gains are not profits and therefore should not be considered as such. When you double down and move the stop to breakeven your trading with the houses money."

IWVRAT (I would very respectfully argue that) unrealized P/L is very real P/L, and that there's ultimately no difference between the "house's" and one's own money. Let's suppose that I am currently short 1 lot. I could immediately close the position and open another short of equal size. Now the P/L is realized, and I'm playing with my own money instead of the house's. Apart from the additional spread cost, my P/L, my net position (1 lot short), and my total exposure are all exactly the same as if I'd left the P/L unrealized. (Of course it would be senseless to do this, due to the additional cost, but I'm merely trying to demonstrate that there's no difference between realized and unrealized profit).

A similar argument has been put forward by those who hedge (in the same pair). They close profitable positions, on the assumption that the offsetting (unrealized) losses don't count until the trades are closed. But it's the net (realized plus unrealized) P/L that is significant, when it comes to funds that may be withdrawn from the account, or otherwise utilized elsewhere. If a margin call occurs, the trader can't say to the broker "hold on, those losses don't count, I haven't closed the positions yet". Everything else being equal, any unrealized loss has a 50/50 probability of either returning to breakeven, or worsening.

Now let's say that I'm short, in profit with my SL at BE, and I add to the position. In terms of considering overall bottom line, the second trade will win or lose on its own merit. If it tanks, it is decreasing my annual P/L, regardless of whether the first trade is a "free trade" or not. In fact, its effect is the same even if the first trade had never existed. Hence IWVRAT the "house money" concept is nothing more than an illusion.

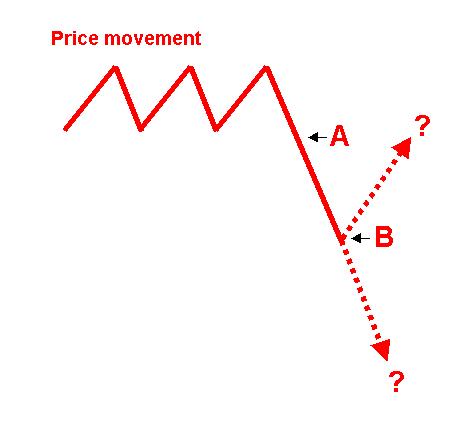

Assuming one has opened a short position at "A" (see the diagram below), pyramiding is smart only if the probability of a continued fall at "B" exceeds 50%. In fact, if the probability of price falling at "B" is not significantly better than it was at "A", then one's overall expectancy is greatly improved by putting the entire position on at "A". Work through an imaginary example and prove the math for yourself.

As Roland points out "….you wouldn't use this strategy in a ranging market or when you expect a support/resistance level to hold." I agree, but IWVRAT it's the analysis (or market knowledge) that price will continue to fall that's providing the edge, not the operation of pyramiding itself.

As I've always attempted to point out, MM in itself can never provide an edge. Positive expectancy can only be achieved by the effectiveness (accuracy in timing) of entries and exits, on every component trade. It's all about being net long when price is rising, and net short when it's falling (more detail here).

Don't get me wrong. I happily congratulate (and admire) those who are more successful traders than I am. Their market knowledge and experience is vastly greater than mine, and I seek to learn from whatever crumbs they are willing to share. But I'm willing to take a David-vs-Goliath type stance when I want to allow math and logic to speak for itself.

Because I like to be a provocative smarta$$

In the scenario being discussed here, Roland had added to a position already in profit, and moved his SL to BE on the original position. Roland says that "Your unrealized gains are not profits and therefore should not be considered as such. When you double down and move the stop to breakeven your trading with the houses money."

IWVRAT (I would very respectfully argue that) unrealized P/L is very real P/L, and that there's ultimately no difference between the "house's" and one's own money. Let's suppose that I am currently short 1 lot. I could immediately close the position and open another short of equal size. Now the P/L is realized, and I'm playing with my own money instead of the house's. Apart from the additional spread cost, my P/L, my net position (1 lot short), and my total exposure are all exactly the same as if I'd left the P/L unrealized. (Of course it would be senseless to do this, due to the additional cost, but I'm merely trying to demonstrate that there's no difference between realized and unrealized profit).

A similar argument has been put forward by those who hedge (in the same pair). They close profitable positions, on the assumption that the offsetting (unrealized) losses don't count until the trades are closed. But it's the net (realized plus unrealized) P/L that is significant, when it comes to funds that may be withdrawn from the account, or otherwise utilized elsewhere. If a margin call occurs, the trader can't say to the broker "hold on, those losses don't count, I haven't closed the positions yet". Everything else being equal, any unrealized loss has a 50/50 probability of either returning to breakeven, or worsening.

Now let's say that I'm short, in profit with my SL at BE, and I add to the position. In terms of considering overall bottom line, the second trade will win or lose on its own merit. If it tanks, it is decreasing my annual P/L, regardless of whether the first trade is a "free trade" or not. In fact, its effect is the same even if the first trade had never existed. Hence IWVRAT the "house money" concept is nothing more than an illusion.

Assuming one has opened a short position at "A" (see the diagram below), pyramiding is smart only if the probability of a continued fall at "B" exceeds 50%. In fact, if the probability of price falling at "B" is not significantly better than it was at "A", then one's overall expectancy is greatly improved by putting the entire position on at "A". Work through an imaginary example and prove the math for yourself.

As Roland points out "….you wouldn't use this strategy in a ranging market or when you expect a support/resistance level to hold." I agree, but IWVRAT it's the analysis (or market knowledge) that price will continue to fall that's providing the edge, not the operation of pyramiding itself.

As I've always attempted to point out, MM in itself can never provide an edge. Positive expectancy can only be achieved by the effectiveness (accuracy in timing) of entries and exits, on every component trade. It's all about being net long when price is rising, and net short when it's falling (more detail here).

Don't get me wrong. I happily congratulate (and admire) those who are more successful traders than I am. Their market knowledge and experience is vastly greater than mine, and I seek to learn from whatever crumbs they are willing to share. But I'm willing to take a David-vs-Goliath type stance when I want to allow math and logic to speak for itself.

Attached Image