Entry Rules (see attachment for valid entries)

- Only trade in direction of the coral (green=long, red=short)

- Candle must be above/below Ichimoku cloud for long/short

- Enter on fast TRIX color change (risky)

- Enter on TRIX cross (conservative)

- Watch for divergence opportunities on the 5min chart

- Be wary of entries around key support or resistance, pivot points

- 1min and 5min charts to enter, longer timeframe charts to monitor/analyze

Exit Rules

- Bank 50%+ profit after +10 pips

- Exit if coral/TRIX change colour or cross back

- Use SL of 300% of ATR(20), or appropriate support/resistance

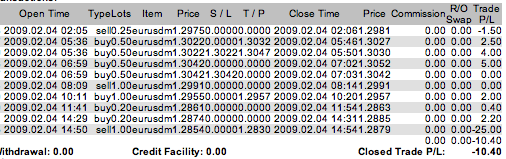

The entries will be fairly mechanical and easy to identify. However, the exits will be much more discretionary, and will be tough to master. If a trade gets to +10, I will bank half my profits (or more) and set the rest to break even. I do not want to turn a winner into a loser. This system can produce some good runners, so I will probably scale out of my position at times to catch a big move.

Goals/Tracking Results

Because I will be scaling out of positions, my goals will be set in terms of dollar value rather than number of pips. Initially, I am aiming for $50/day on an entry size of ~$1/pip (this may vary according to SL). I will try to post daily results, but there may be days I am too busy to trade altogether.

If I reach my goal of $50, I may or may not keep trading. If I do keep trading, I will limit my losses as to not give up all my profit, possibly reducing my entry size. I will stop trading for the day if my losses reach $100.

That's it! Feel free to monitor my progress, offer encouragement, constructive criticism, or anything else you want.