Hey guys I'm reading through Steve Nison's Japanese Candlestick Charting book and I have a question on its applications to Forex.

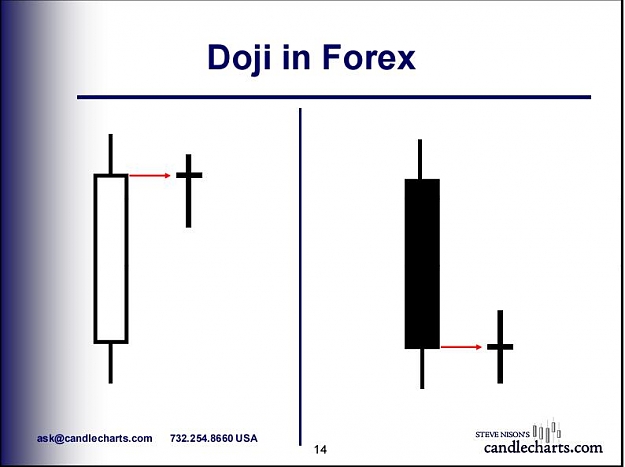

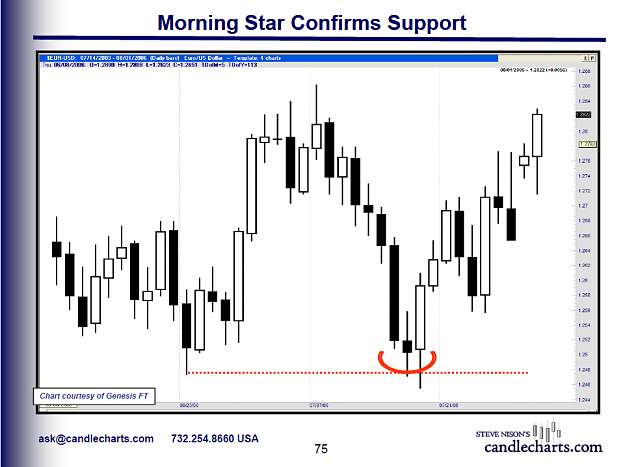

I've just started reading the book, but it seems that some of the patterns depend on the difference of close/open prices between days. Since it talks about markets with limited trading hours, the closing price of one day is not necessarily the same as the opening price of the next day. He uses these differences in the definition of some of these patterns. Since Forex is a 24h market, these don't really apply. I'm wondering if anyone here has read the book (most probably) and how they deal with this.

I've just started reading the book, but it seems that some of the patterns depend on the difference of close/open prices between days. Since it talks about markets with limited trading hours, the closing price of one day is not necessarily the same as the opening price of the next day. He uses these differences in the definition of some of these patterns. Since Forex is a 24h market, these don't really apply. I'm wondering if anyone here has read the book (most probably) and how they deal with this.