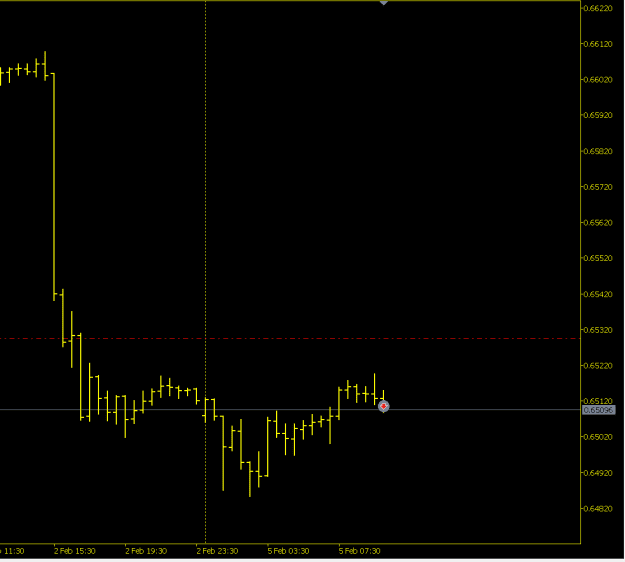

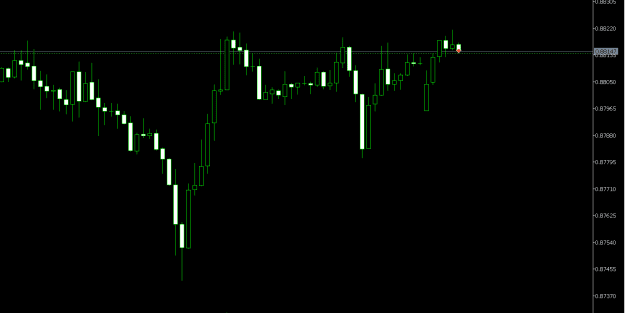

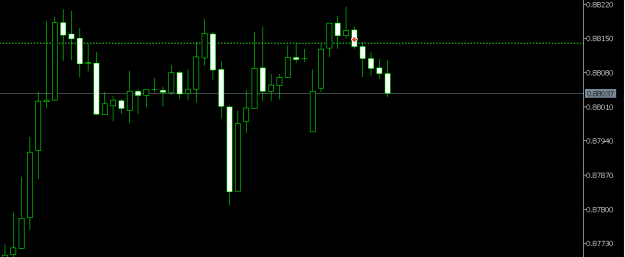

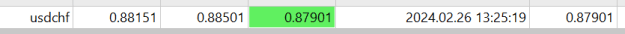

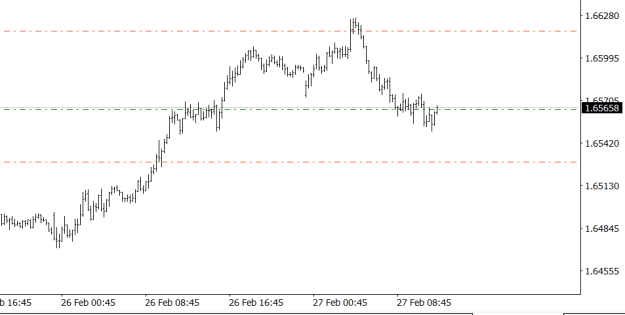

Symbol: AUDUSD - M30

Live Trade Signal: SELL @cmp

Australian Dollar (AUD):

Live Trade Signal: SELL @cmp

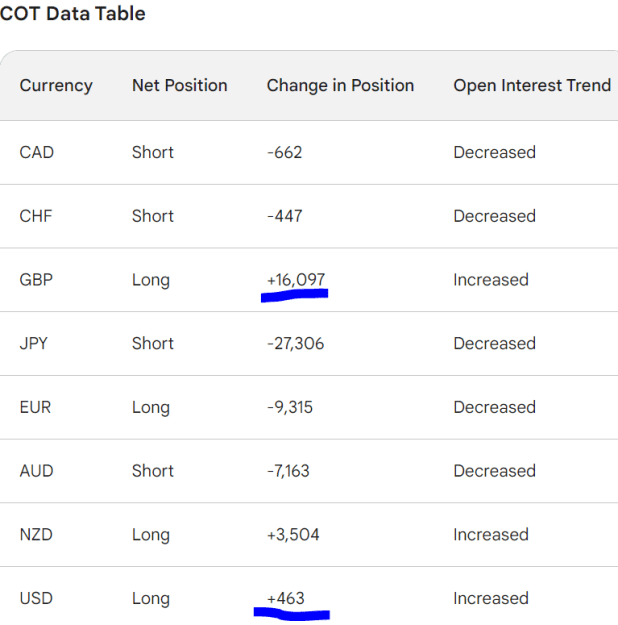

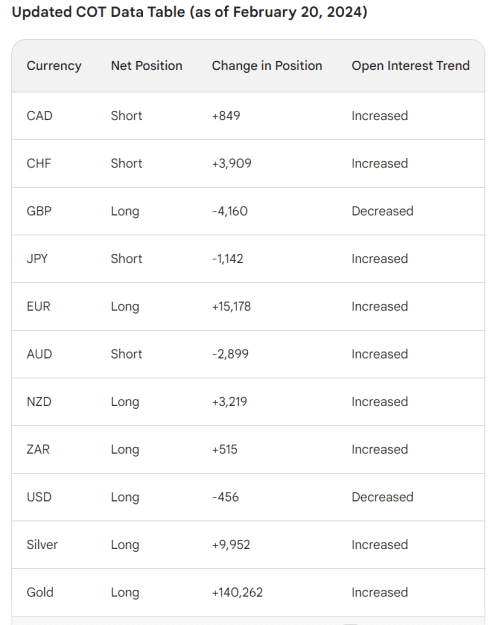

Based on Commitments of Traders (COT) data as of January 30, 2024, here is an analysis for the AUDUSD pair:

Australian Dollar (AUD):

- Non-Commercial Long: 36,956 contracts

- Non-Commercial Short: 95,251 contracts

- Changes in Non-Commercial Long: -5,897 contracts

- Changes in Non-Commercial Short: -1,722 contracts

- Percent of Open Interest represented by Non-Commercial Long: 22.3%

- Percent of Open Interest represented by Non-Commercial Short: 57.5%

US Dollar (USD):

- Non-Commercial Long: 200,360 contracts

- Non-Commercial Short: 111,589 contracts

- Changes in Non-Commercial Long: 5,170 contracts

- Changes in Non-Commercial Short: 4,723 contracts

- Percent of Open Interest represented by Non-Commercial Long: 27.6%

- Percent of Open Interest represented by Non-Commercial Short: 15.3%

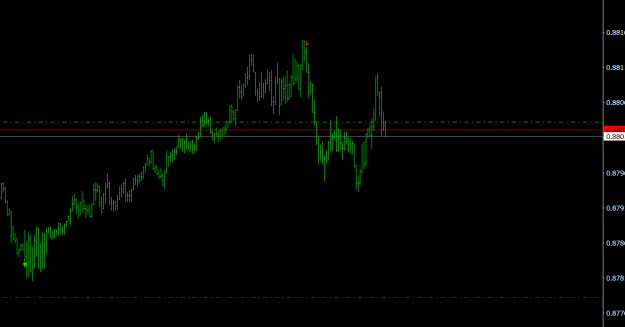

Net Bias for AUDUSD: The net bias for AUDUSD is bearish. This is inferred from the higher percentage of open interest represented by non-commercial short positions in AUD (57.5%) compared to the percentage of open interest represented by non-commercial long positions in USD (27.6%).

Key Findings from Non-Commercial COT Data:

- There is a strong bearish sentiment among non-commercial traders for AUD, with a significant number of short positions.

- There is a moderate bullish sentiment among non-commercial traders for USD, with a higher number of long positions compared to short positions.

- There has been a decrease in long positions for AUD and an increase in long positions for USD, further supporting the bearish bias for AUDUSD.

Implications for AUDUSD:

- The bearish sentiment for AUD and bullish sentiment for USD among non-commercial traders could potentially lead to a downward trend in the AUDUSD pair.

- Traders should monitor changes in non-commercial positions, as these could signal shifts in market sentiment.

Recommendations:

- Traders might consider entering short positions in AUDUSD, given the current market sentiment.

- However, it’s important to incorporate other technical and fundamental analysis into your trading decisions and always implement sound risk management strategies.