When I am not around here anymore, this thread can be a trading course itself to be reviewed again and again (at the very least post 1).

Many times direction bias and set ups were shown before a trade input was done.

There are also many scenarios in different situations shown and answering of traders' questions.

What others see as randomness, i see orderliness within the randomness.

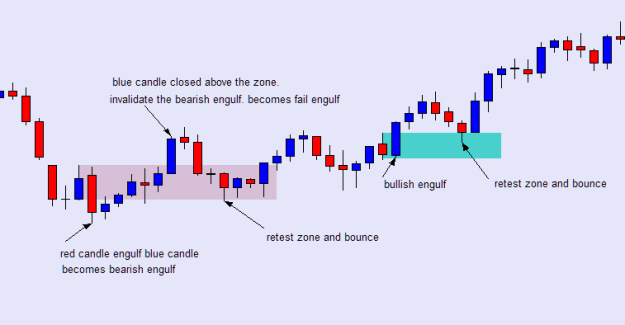

i define engulf for 2 candles as follows:

https://www.forexfactory.com/thread/...0#post14742860

Engulf does not apply to 2 candles only, it can be in multiple candles..

for example the same 2 candles engulf in h4 appears as multiple candles in h1

i define engulf for multiple candles as per 1st image below but not limited to that.

Rules

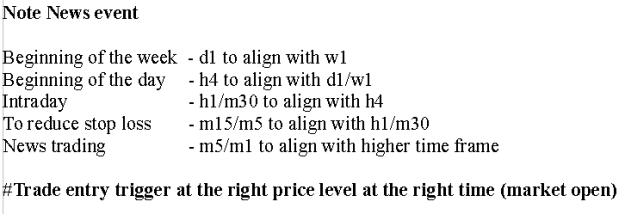

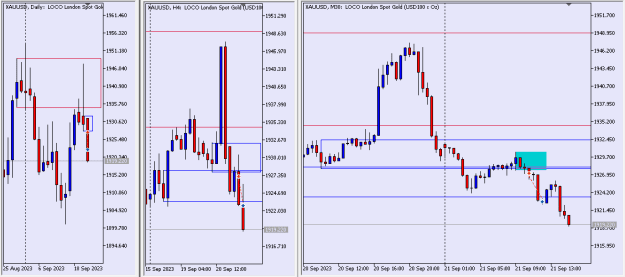

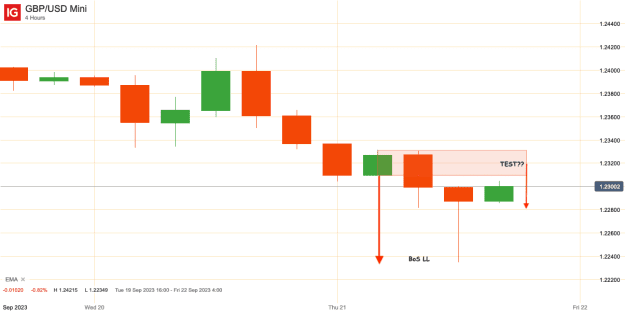

(1) Direction Bias

Road Block and Current Market Price (CMP)

Time frames: w1, d1, h4 Engulfs/Engulfs Fail

video: https://www.forexfactory.com/thread/...7#post14593437

https://www.forexfactory.com/thread/...7#post14594927

https://www.forexfactory.com/thread/...0#post14606270

https://www.forexfactory.com/thread/...3#post14606923

concept:

https://www.forexfactory.com/thread/...7#post14608247

https://www.forexfactory.com/thread/...9#post14608979

https://www.forexfactory.com/thread/...3#post14610713

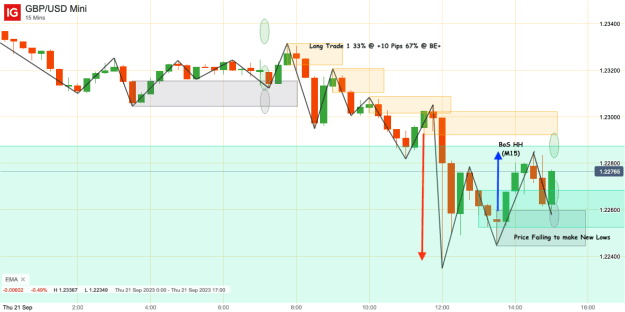

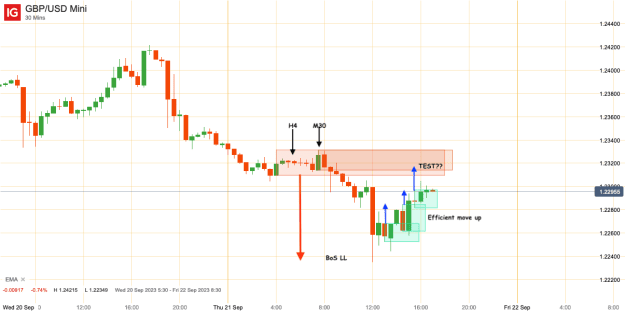

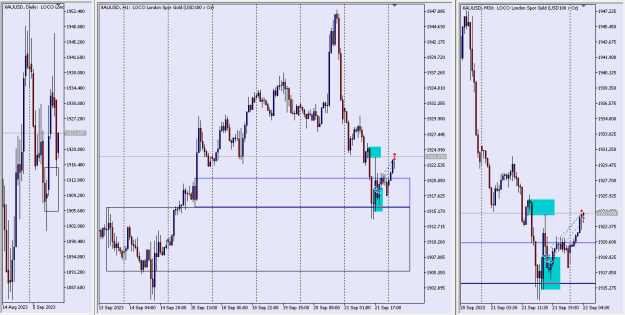

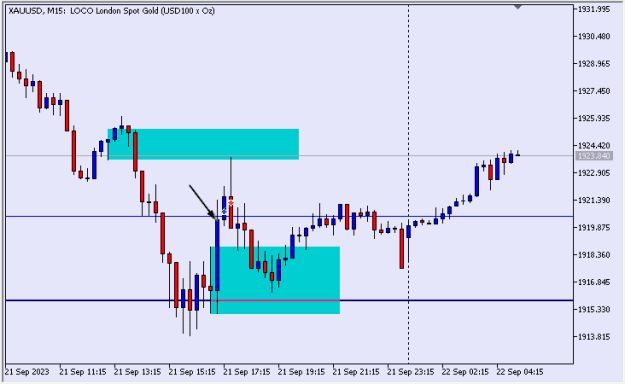

(2) Entry

Road Block and Current Market Price (CMP)

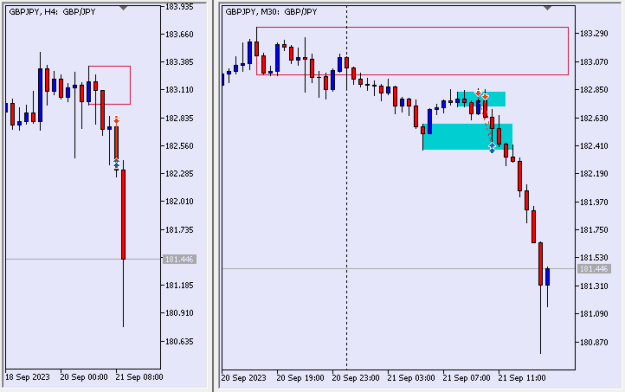

Time frames: h1, m30, m15 Engulfs/Engulfs Fail

When price retraces to the htf h4 Engulf zone (the lowest direction time frame).

Drop down to h1 or m30 or m15 and find Engulf or Engulf Fail set up.

Entry upon retest of Engulf or Engulf Fail set up zone.

Zone as SL (40 pips maximum).

TP at opposite Engulf or support / resistant.

video: https://www.forexfactory.com/thread/...1#post14623881

https://www.forexfactory.com/thread/...2#post14742022

https://www.forexfactory.com/thread/...4#post14633084

https://www.forexfactory.com/thread/...5#post14641675.

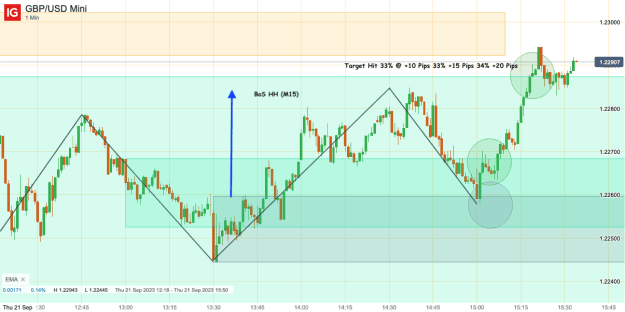

(3) Normally point 2 above for entry will suffice.

However If you find that the SL is too big and smaller SL is needed. ......

When price retraces to the h1 or m30 or m15 Engulf or Engulf Fail zone

Drop down to m5 or m1 and find Engulf or Engulf Fail set up.

It is advisable for lesser experienced trader not to use these small time frames as they carry a higher risk of SL being hit.

in these small time frames, it is better to wait for Engulf Fail pullback to an Engulf set up.

Entry upon retest of Engulf or Engulf Fail set up zone.

Zone as SL (40 pips maximum).

TP at opposite Engulf or support / resistant.

Down to earth expectation of a m5 or m1 scalper

https://www.forexfactory.com/thread/...2#post14808152

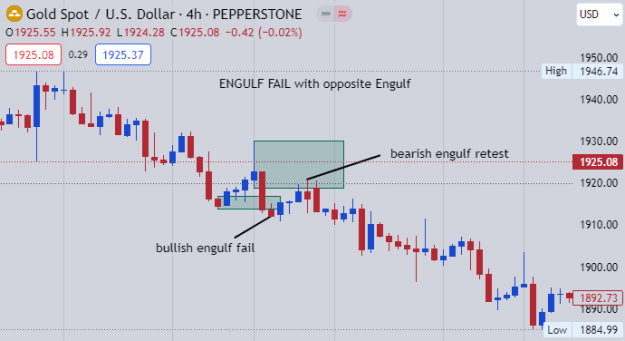

Implication of engulf fail

https://www.forexfactory.com/thread/...3#post14590243

https://www.forexfactory.com/thread/...1#post14591101

Monitoring of trades

https://www.forexfactory.com/thread/...7#post14734877

https://www.forexfactory.com/thread/...7#post14734947

https://www.forexfactory.com/thread/...3#post14737303

Most confident trades

https://www.forexfactory.com/thread/...6#post14635326

Overview videos

https://www.forexfactory.com/thread/...5#post14633045

https://www.forexfactory.com/thread/...5#post14710795

https://www.forexfactory.com/thread/...1#post14733931

Live trade example go through post 137, 139, 142, 143, 144

Even in m1 one can see how price dances using engulfing. https://www.forexfactory.com/thread/...0#post14593110

M1 scalping https://www.forexfactory.com/thread/...1#post14598231

Do not blame the methods, instead you should ask yourself how good are your eyes in spotting the setups?

https://www.forexfactory.com/thread/...1#post14635371

Creating your own Check List

https://www.forexfactory.com/thread/...8#post14837608

Breaking of Rules

Of course there will always be traders that ignore the rules and blow their accounts again and again.

As they themselves allowed it to form a habit which will be hard to break. Do not let it destroy your trading career.

https://www.forexfactory.com/thread/...8#post14607628

Always cultivate a daily habit to be disciplined, patient and consistent. They are keys to a successful outcome.

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.” — Aristotle

“Success is nothing more than a few simple disciplines, practiced every day.” — Jim Rohn

Only 2 things need to be in order before placing any trade.

Trading at the right time and at the right price level.

Many times direction bias and set ups were shown before a trade input was done.

There are also many scenarios in different situations shown and answering of traders' questions.

What others see as randomness, i see orderliness within the randomness.

i define engulf for 2 candles as follows:

https://www.forexfactory.com/thread/...0#post14742860

Engulf does not apply to 2 candles only, it can be in multiple candles..

for example the same 2 candles engulf in h4 appears as multiple candles in h1

i define engulf for multiple candles as per 1st image below but not limited to that.

Rules

(1) Direction Bias

Road Block and Current Market Price (CMP)

Time frames: w1, d1, h4 Engulfs/Engulfs Fail

video: https://www.forexfactory.com/thread/...7#post14593437

https://www.forexfactory.com/thread/...7#post14594927

https://www.forexfactory.com/thread/...0#post14606270

https://www.forexfactory.com/thread/...3#post14606923

concept:

https://www.forexfactory.com/thread/...7#post14608247

https://www.forexfactory.com/thread/...9#post14608979

https://www.forexfactory.com/thread/...3#post14610713

(2) Entry

Road Block and Current Market Price (CMP)

Time frames: h1, m30, m15 Engulfs/Engulfs Fail

When price retraces to the htf h4 Engulf zone (the lowest direction time frame).

Drop down to h1 or m30 or m15 and find Engulf or Engulf Fail set up.

Entry upon retest of Engulf or Engulf Fail set up zone.

Zone as SL (40 pips maximum).

TP at opposite Engulf or support / resistant.

video: https://www.forexfactory.com/thread/...1#post14623881

https://www.forexfactory.com/thread/...2#post14742022

https://www.forexfactory.com/thread/...4#post14633084

https://www.forexfactory.com/thread/...5#post14641675.

(3) Normally point 2 above for entry will suffice.

However If you find that the SL is too big and smaller SL is needed. ......

When price retraces to the h1 or m30 or m15 Engulf or Engulf Fail zone

Drop down to m5 or m1 and find Engulf or Engulf Fail set up.

It is advisable for lesser experienced trader not to use these small time frames as they carry a higher risk of SL being hit.

in these small time frames, it is better to wait for Engulf Fail pullback to an Engulf set up.

Entry upon retest of Engulf or Engulf Fail set up zone.

Zone as SL (40 pips maximum).

TP at opposite Engulf or support / resistant.

Down to earth expectation of a m5 or m1 scalper

https://www.forexfactory.com/thread/...2#post14808152

Implication of engulf fail

https://www.forexfactory.com/thread/...3#post14590243

https://www.forexfactory.com/thread/...1#post14591101

Monitoring of trades

https://www.forexfactory.com/thread/...7#post14734877

https://www.forexfactory.com/thread/...7#post14734947

https://www.forexfactory.com/thread/...3#post14737303

Most confident trades

https://www.forexfactory.com/thread/...6#post14635326

Overview videos

https://www.forexfactory.com/thread/...5#post14633045

https://www.forexfactory.com/thread/...5#post14710795

https://www.forexfactory.com/thread/...1#post14733931

Live trade example go through post 137, 139, 142, 143, 144

Even in m1 one can see how price dances using engulfing. https://www.forexfactory.com/thread/...0#post14593110

M1 scalping https://www.forexfactory.com/thread/...1#post14598231

Do not blame the methods, instead you should ask yourself how good are your eyes in spotting the setups?

https://www.forexfactory.com/thread/...1#post14635371

Creating your own Check List

https://www.forexfactory.com/thread/...8#post14837608

Breaking of Rules

Of course there will always be traders that ignore the rules and blow their accounts again and again.

As they themselves allowed it to form a habit which will be hard to break. Do not let it destroy your trading career.

https://www.forexfactory.com/thread/...8#post14607628

Always cultivate a daily habit to be disciplined, patient and consistent. They are keys to a successful outcome.

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.” — Aristotle

“Success is nothing more than a few simple disciplines, practiced every day.” — Jim Rohn

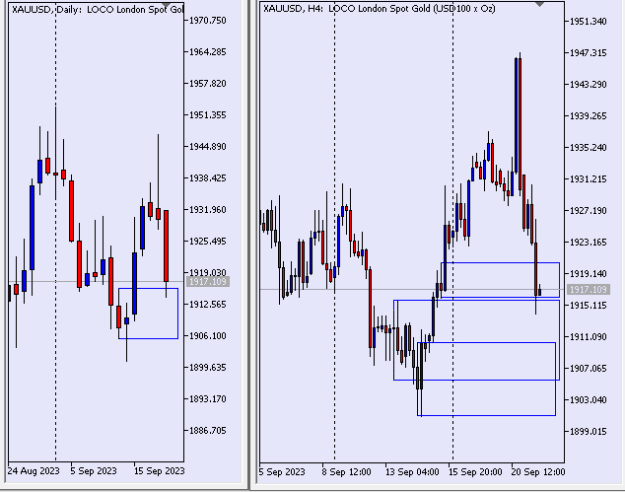

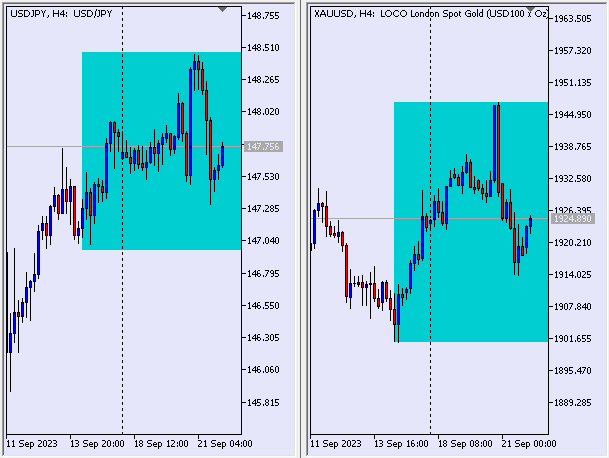

Only 2 things need to be in order before placing any trade.

Trading at the right time and at the right price level.

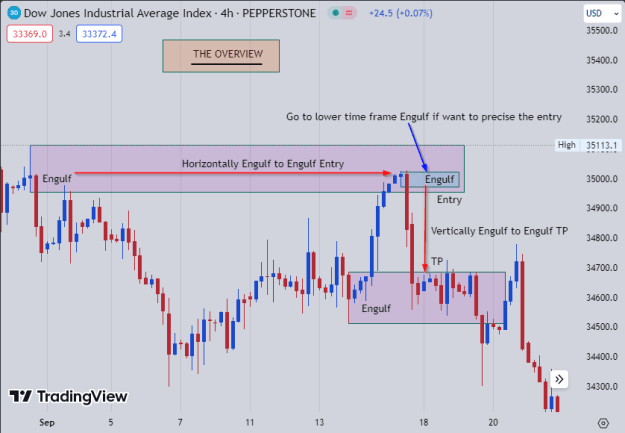

- Time of Day : Choose to trade in a high volume session – London, New York session, NYSE open.

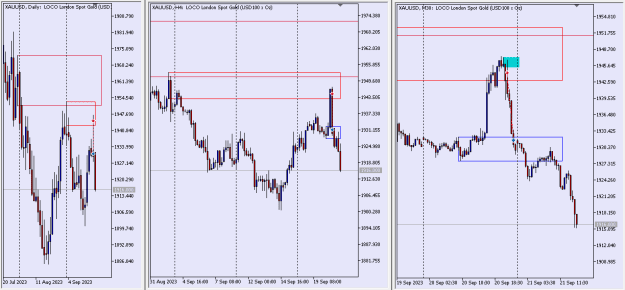

- Lower time frame Engulf/Engulf fail entry aligns with Higher time frame Engulf/Engulf fail direction.

Entry: Horizontally from HTF Engulf to same type LTF Engulf (bullish to bullish, bearish to bearish)

Take Profit: Vertically from Engulf to opposite Engulf (bullish to bearish, bearish to bullish)

https://www.forexfactory.com/thread/...6#post14621296

https://www.forexfactory.com/thread/...5#post14659695

https://www.forexfactory.com/thread/...7#post14635347

.

.

ITB - Seeing Orderliness amongst 'Randomness'