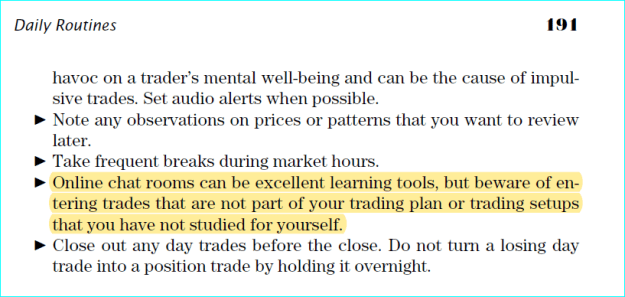

We don't give signal.

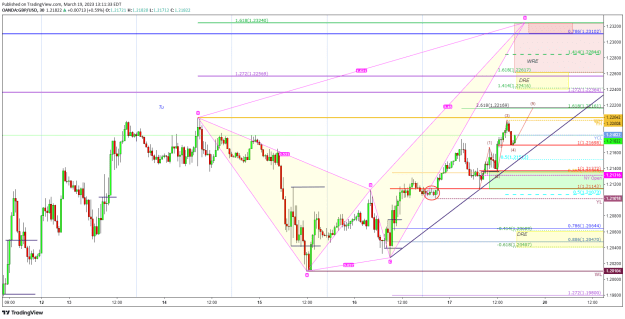

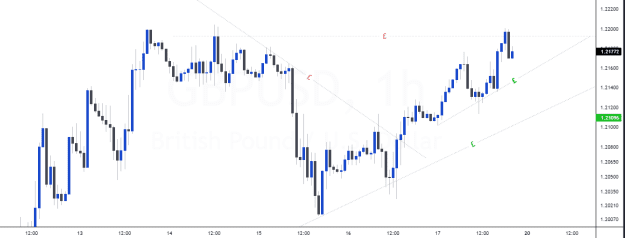

A good trader can never truly know where price want to go next., or when the market will shift between sideways and trending modes.

To make a simple analogy trading strategy in a non-stationary price chart is like trying to score a goal with moving goal posts by the time the ball reaches the goal the goal posts will be in a different position and you'll miss the goal completely

It is better for you to share analysis in this thread, rather than waititng for trade signal.

I come from the future.

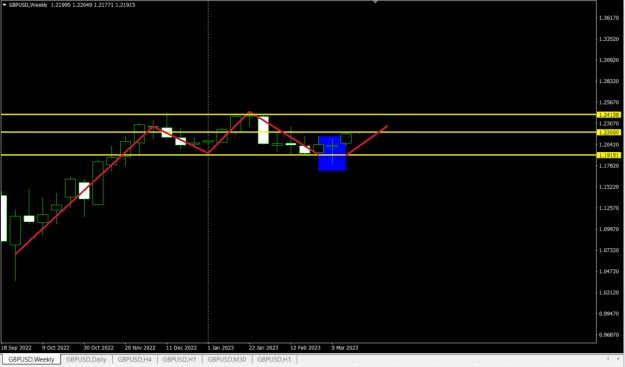

9