I want to introduce a very simple but highly rewarding strategy.

This strategy requires patience, but it comes with good risk -reward.

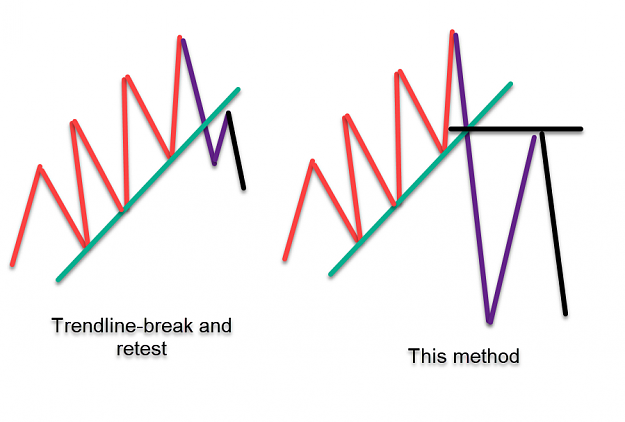

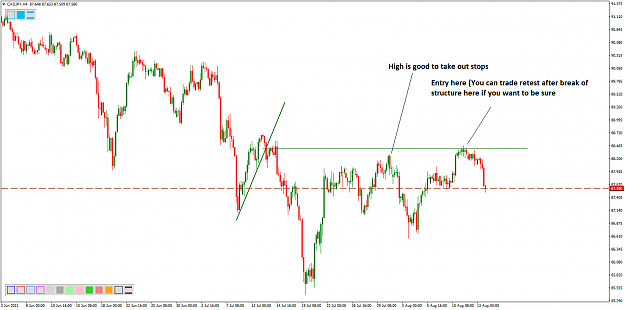

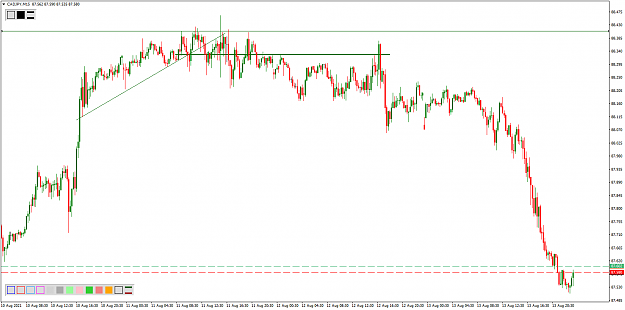

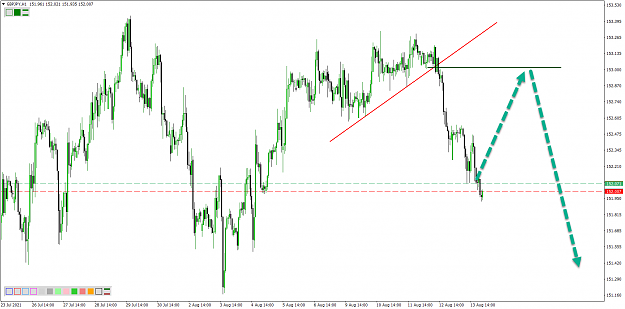

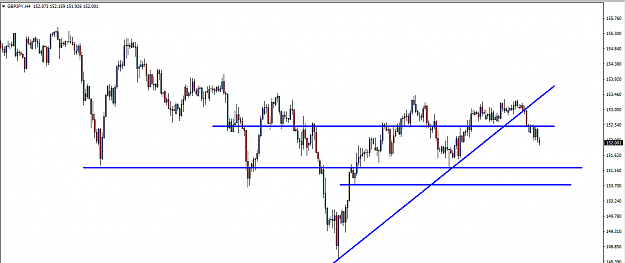

The basis of this strategy is the use of the Trendline tool and horizontal line.

Rules :

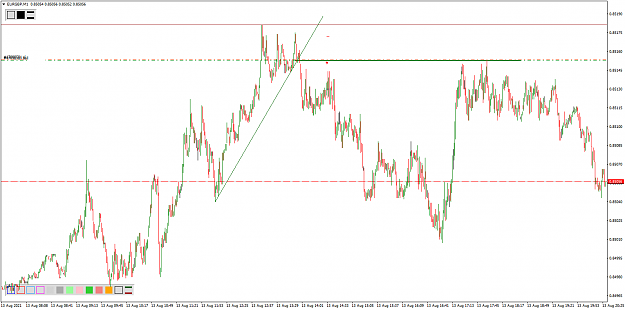

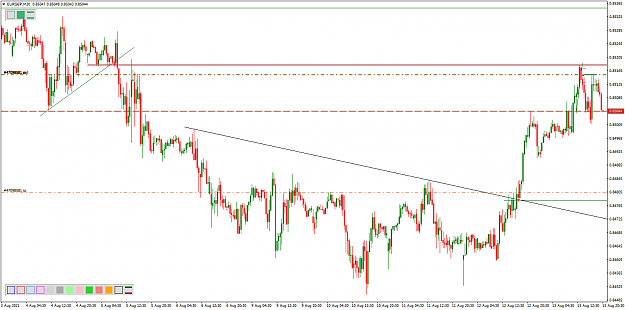

1. Identify a clear trendline break AROUND A COMPRESSED ZONE. Let price do its thing and break the trendline to the downside/upside depending on direction. Ideally we want to see price break swings up/down to/beyond the trendline, but it is sufficient to only break a couple of swings.

2. Draw a horizontal line to mark the price point at which the trendline was broken.

3. Watch as price returns to this price point.

4. Sell/Buy when price returns to the price level or wait for break of structure/ confirmation when price returns to price level before buying/selling.

For best results, trade in the direction of the trend. Also key to watch where price is coming from after the trendline is broken. For best results we want to see price coming from weak levels.

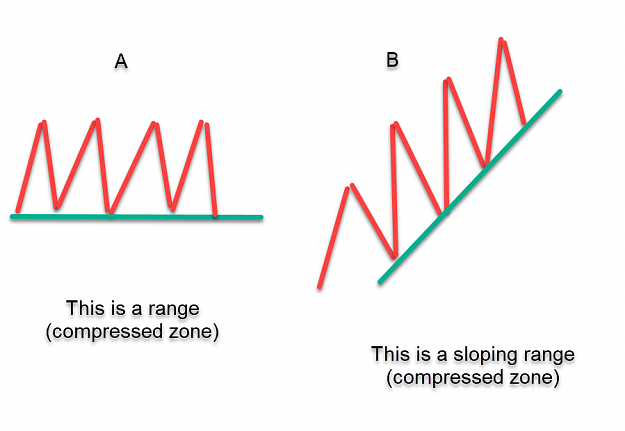

WHY DO WE NEED TO LOOK FOR COMPRESSED ZONES?

The basic idea is that in a compressed zone, buy or sell orders are being accumulated. When one set of orders are significantly more than the other set of orders, price moves impulsively from the compressed zone. The breakout level or zone then becomes important when price returns. Ideally we want to see a slowing down/weakening of price as it returns to the breakout level. We can expect to see a significant reaction of price upon return to the level/zone

THREAD RULES:

READ ATLEAST THE FIRST 110 POSTS BEFORE ASKING ANY QUESTIONS. IN MOST CASES THE ANSWER TO YOUR QUESTIONS ARE CONTAINED IN THE POSTS.

PLEASE REFRAIN FROM SHARING INDICATORS IN THIS THREAD.

Spammers and trolls will be blocked without any warnings.

Please keep your charts and posts central to the core of this strategy

This strategy requires patience, but it comes with good risk -reward.

The basis of this strategy is the use of the Trendline tool and horizontal line.

Rules :

1. Identify a clear trendline break AROUND A COMPRESSED ZONE. Let price do its thing and break the trendline to the downside/upside depending on direction. Ideally we want to see price break swings up/down to/beyond the trendline, but it is sufficient to only break a couple of swings.

2. Draw a horizontal line to mark the price point at which the trendline was broken.

3. Watch as price returns to this price point.

4. Sell/Buy when price returns to the price level or wait for break of structure/ confirmation when price returns to price level before buying/selling.

For best results, trade in the direction of the trend. Also key to watch where price is coming from after the trendline is broken. For best results we want to see price coming from weak levels.

WHY DO WE NEED TO LOOK FOR COMPRESSED ZONES?

The basic idea is that in a compressed zone, buy or sell orders are being accumulated. When one set of orders are significantly more than the other set of orders, price moves impulsively from the compressed zone. The breakout level or zone then becomes important when price returns. Ideally we want to see a slowing down/weakening of price as it returns to the breakout level. We can expect to see a significant reaction of price upon return to the level/zone

THREAD RULES:

READ ATLEAST THE FIRST 110 POSTS BEFORE ASKING ANY QUESTIONS. IN MOST CASES THE ANSWER TO YOUR QUESTIONS ARE CONTAINED IN THE POSTS.

PLEASE REFRAIN FROM SHARING INDICATORS IN THIS THREAD.

Spammers and trolls will be blocked without any warnings.

Please keep your charts and posts central to the core of this strategy

Trading should not be difficult